In finance, a common example of a vanilla derivative is a plain vanilla interest rate swap. This type of swap involves exchanging fixed interest rate payments for floating rate payments based on a notional principal amount. Market participants use these instruments to manage interest rate risk or to speculate on changes in interest rates. Vanilla options also represent a straightforward example of vanilla derivatives. These options grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before or on a specified expiration date. Such derivatives are widely used for hedging purposes or to gain exposure to price movements in stocks, commodities, or currencies.

Table of Comparison

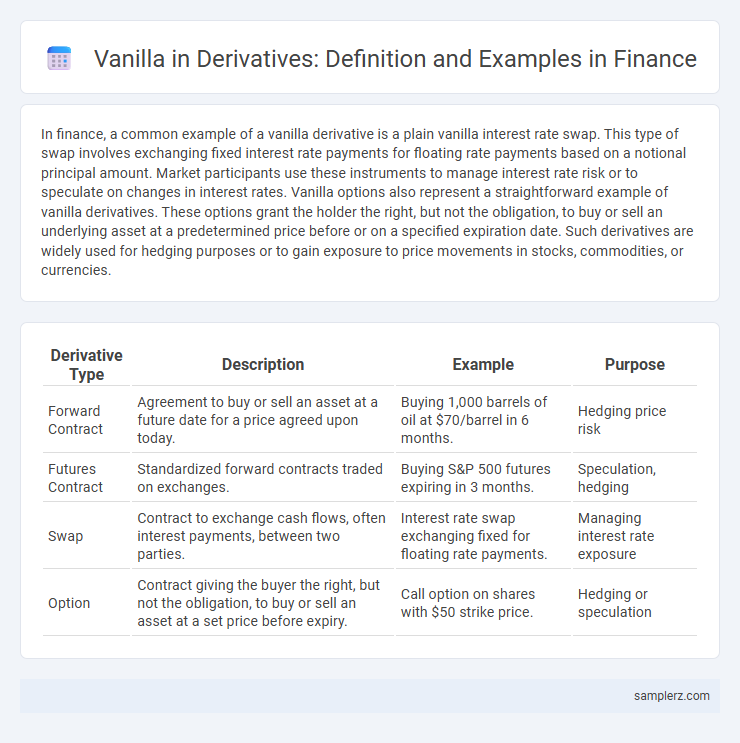

| Derivative Type | Description | Example | Purpose |

|---|---|---|---|

| Forward Contract | Agreement to buy or sell an asset at a future date for a price agreed upon today. | Buying 1,000 barrels of oil at $70/barrel in 6 months. | Hedging price risk |

| Futures Contract | Standardized forward contracts traded on exchanges. | Buying S&P 500 futures expiring in 3 months. | Speculation, hedging |

| Swap | Contract to exchange cash flows, often interest payments, between two parties. | Interest rate swap exchanging fixed for floating rate payments. | Managing interest rate exposure |

| Option | Contract giving the buyer the right, but not the obligation, to buy or sell an asset at a set price before expiry. | Call option on shares with $50 strike price. | Hedging or speculation |

Understanding Vanilla Derivatives in Finance

Vanilla derivatives in finance primarily include straightforward, standardized contracts like plain vanilla options and plain vanilla swaps that involve basic payoff structures without any exotic features. These financial instruments provide investors with tools to hedge risk or speculate on asset price movements, interest rates, or currencies using well-understood terms and limited complexity. Examples include European call and put options, as well as interest rate swaps with fixed-for-floating rate exchanges.

Key Features of Vanilla Derivatives

Vanilla derivatives, such as plain vanilla options and standard futures contracts, are characterized by straightforward terms and standardized structures that enhance liquidity and ease of valuation. Key features include fixed expiration dates, predetermined strike prices, and underlying assets that range from stocks and commodities to interest rates. These derivatives facilitate risk management by allowing investors to hedge exposure or speculate effectively without the complexity of exotic derivative structures.

Common Types of Vanilla Derivatives

Common types of vanilla derivatives include plain vanilla options, such as European and American call and put options, which grant the right but not the obligation to buy or sell an asset at a predetermined price before or at expiration. Interest rate swaps are another prevalent vanilla derivative, where counterparties exchange fixed and floating interest rate cash flows to manage exposure to interest rate fluctuations. Futures contracts on commodities or financial instruments represent standardized agreements to buy or sell an asset at a future date and price, widely used for hedging and speculation in vanilla derivative markets.

Vanilla Options: Structure and Function

Vanilla options are basic financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined strike price before or at expiration. Common types include call options, which allow buying, and put options, which allow selling, both standardized on exchanges for liquidity. Their straightforward structure makes vanilla options essential tools for hedging, speculation, and income strategies in financial markets.

Vanilla Swaps: A Practical Example

Vanilla swaps typically involve exchanging fixed interest rate payments for floating rate payments based on Libor, allowing participants to hedge interest rate risk efficiently. For example, a corporation paying a fixed 5% interest on a $10 million loan may enter a vanilla interest rate swap to receive fixed payments and pay floating payments tied to a 3-month Libor rate. This arrangement adjusts cash flows and mitigates exposure to rising interest rates without altering the original loan terms.

Use Cases of Vanilla Forwards in Financial Markets

Vanilla forwards serve as fundamental instruments in financial markets for hedging currency and interest rate risks by locking in prices or rates for future transactions. Corporations use vanilla forwards to manage exposure to foreign exchange fluctuations when planning cross-border payments, ensuring budget certainty. Investors and financial institutions employ vanilla forwards to minimize uncertainty in asset valuations, optimize cash flow management, and enhance risk-adjusted returns.

Benefits of Using Vanilla Derivatives

Vanilla derivatives, such as standard options and futures contracts, provide straightforward risk management tools for hedging against price fluctuations in financial markets. Their simplicity and transparency enable easier valuation and lower transaction costs, enhancing liquidity and market participation. Utilizing vanilla derivatives helps investors and corporations stabilize cash flows and optimize investment strategies while minimizing counterparty risk.

Comparing Vanilla and Exotic Derivatives

Vanilla derivatives, such as plain vanilla options and futures, offer standardized contract terms with predictable payoffs, making them simpler to price and hedge compared to exotic derivatives. Exotic derivatives include complex features like path dependency or multiple underlying assets, which introduce higher valuation complexity and risk profiles. While vanilla derivatives are widely used for hedging and speculative purposes, exotic derivatives cater to bespoke investment strategies requiring specific payoff structures.

Risk Management with Vanilla Derivatives

Vanilla derivatives, such as plain vanilla options and interest rate swaps, are fundamental tools in risk management for hedging against market volatility and interest rate fluctuations. These standardized financial instruments provide transparency and liquidity, enabling firms to effectively mitigate exposure to price risks and optimize their balance sheets. Utilizing vanilla derivatives allows firms to establish clear risk profiles and implement cost-effective strategies for managing credit and market risks.

Real-World Examples of Vanilla Derivative Transactions

A plain vanilla interest rate swap between two corporations, one paying fixed interest while receiving a floating rate tied to LIBOR, demonstrates a common vanilla derivative transaction used to hedge interest rate risk. Another example is a vanilla call option on a commodity like crude oil, where an energy firm secures the right to purchase oil at a predetermined price to manage cost volatility. Currency forwards between multinational firms locking in exchange rates for future purchases illustrate vanilla derivatives applied in foreign exchange risk management.

example of vanilla in derivative Infographic

samplerz.com

samplerz.com