A repurchase agreement, commonly known as a repo, is a financial transaction used to provide short-term liquidity in the finance sector. In a typical repo, one party sells securities to another with an agreement to repurchase them at a later date and a predetermined price. This mechanism allows institutions like banks and hedge funds to temporarily borrow cash by leveraging their security holdings as collateral. Repos play a critical role in maintaining liquidity in financial markets by offering a low-risk method for borrowing and lending funds. Central banks often use repo operations to manage money supply and influence short-term interest rates. Market participants prefer repos because they provide quick access to cash without selling long-term assets, supporting efficient capital management.

Table of Comparison

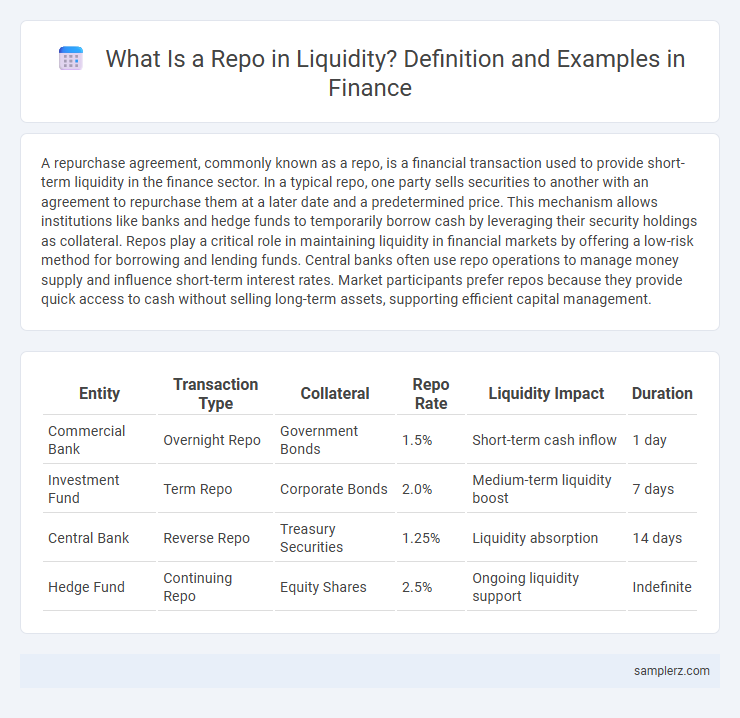

| Entity | Transaction Type | Collateral | Repo Rate | Liquidity Impact | Duration |

|---|---|---|---|---|---|

| Commercial Bank | Overnight Repo | Government Bonds | 1.5% | Short-term cash inflow | 1 day |

| Investment Fund | Term Repo | Corporate Bonds | 2.0% | Medium-term liquidity boost | 7 days |

| Central Bank | Reverse Repo | Treasury Securities | 1.25% | Liquidity absorption | 14 days |

| Hedge Fund | Continuing Repo | Equity Shares | 2.5% | Ongoing liquidity support | Indefinite |

Introduction to Repo Transactions in Liquidity Management

A repurchase agreement (repo) is a short-term borrowing mechanism widely used in liquidity management, where a seller agrees to repurchase securities at a later date for a higher price. This transaction effectively functions as a collateralized loan, enhancing cash flow and maintaining market liquidity. Central banks and financial institutions frequently engage in repo operations to stabilize interest rates and ensure adequate liquidity in the banking system.

How Repos Enhance Market Liquidity: An Overview

Repos, or repurchase agreements, enhance market liquidity by allowing financial institutions to quickly convert securities into cash, facilitating smoother day-to-day operations. By providing short-term funding secured by high-quality collateral, repos enable banks and traders to meet immediate liquidity needs without selling assets. This mechanism supports efficient price discovery and reduces funding costs, contributing to overall market stability.

Real-World Example: Repo Use by Central Banks

Central banks frequently use repurchase agreements (repos) to manage short-term liquidity and stabilize financial markets. For instance, the Federal Reserve employs repos to inject liquidity by purchasing securities with an agreement to sell them back, ensuring banks have sufficient funds to meet reserve requirements. During periods of market stress, this tool helps maintain smooth functioning of money markets and supports overall financial stability.

Commercial Banks' Repo Activities in Liquidity Operations

Commercial banks utilize repurchase agreements (repos) as a key tool in liquidity management, temporarily selling government securities to obtain short-term funding. These repo transactions enable banks to efficiently manage daily cash flow needs and comply with regulatory liquidity requirements. By engaging in both bilateral and tri-party repos, commercial banks ensure market stability and support monetary policy transmission.

Repo Agreements as Short-Term Funding Tools

Repo agreements serve as vital short-term funding tools in liquidity management by allowing financial institutions to sell securities with a commitment to repurchase them at a later date, typically overnight or within a few days. These agreements enhance market liquidity by providing immediate cash while enabling collateralized borrowing, thus reducing counterparty risk. Central banks and investment firms frequently utilize repos to stabilize financial markets and meet short-term funding needs efficiently.

Case Study: Repo Market During Financial Crises

During the 2008 financial crisis, the repo market experienced severe liquidity strains as counterparties hoarded cash, causing repo rates to spike dramatically. This disruption highlighted the repo market's critical role in providing short-term funding and maintaining liquidity for financial institutions. The Federal Reserve's interventions, including overnight and term repo operations, helped stabilize liquidity and restore confidence in the interbank lending market.

Impact of Repo Rates on Financial System Liquidity

Repo rates directly influence financial system liquidity by determining the cost of short-term borrowing for banks. A lower repo rate reduces borrowing costs, encouraging banks to increase lending and thus inject liquidity into the market. Conversely, higher repo rates tighten liquidity by making borrowing more expensive, leading to reduced credit availability and slower economic activity.

Securities Used in Repo Contracts: Practical Examples

In repo contracts, U.S. Treasury securities are the most commonly used collateral due to their high liquidity and credit quality, enabling efficient short-term borrowing. Corporate bonds with high credit ratings, such as those issued by investment-grade companies, also serve as acceptable securities in repo agreements, providing flexibility in liquidity management. Mortgage-backed securities (MBS) are frequently utilized in repo markets, offering diversified collateral options while maintaining adequate market liquidity.

Role of Repos in Interbank Liquidity Balancing

Repos facilitate interbank liquidity balancing by allowing banks to securely sell securities with an agreement to repurchase them, enabling short-term cash flow adjustments. This mechanism provides immediate liquidity to borrowing banks while supplying investing banks with low-risk, short-term investment opportunities. The efficient use of repos helps stabilize the interbank market, reducing liquidity mismatches and supporting overall financial stability.

Regulatory Considerations for Repo Transactions and Liquidity

Regulatory considerations for repo transactions are critical in managing liquidity risk and ensuring market stability. Under frameworks such as Basel III, financial institutions must maintain adequate capital and liquidity coverage ratios, influencing the volume and terms of repos they enter into. Compliance with regulations like the Securities Financing Transactions Regulation (SFTR) enhances transparency and mitigates counterparty risk, thereby supporting effective liquidity management in repo markets.

example of repo in liquidity Infographic

samplerz.com

samplerz.com