A cross-currency swap is a financial derivative in which two parties exchange principal and interest payments in different currencies. For example, a U.S. company needing euros might swap its U.S. dollar debt payments with a European firm that requires dollars, agreeing to exchange principal amounts and fixed or floating interest payments over a specified period. This arrangement helps both parties hedge currency risk and secure capital at potentially lower costs compared to borrowing directly in the foreign market. Data from the Bank for International Settlements (BIS) indicates that cross-currency swaps constitute a significant portion of the global OTC derivatives market, with notional amounts exceeding trillions of dollars. Entities such as multinational corporations and financial institutions primarily utilize these swaps to manage currency exposure and interest rate fluctuations. Market participants often rely on daily settlement mechanics and agreed-upon exchange rates to maintain transparency and reduce counterparty risk in these swaps.

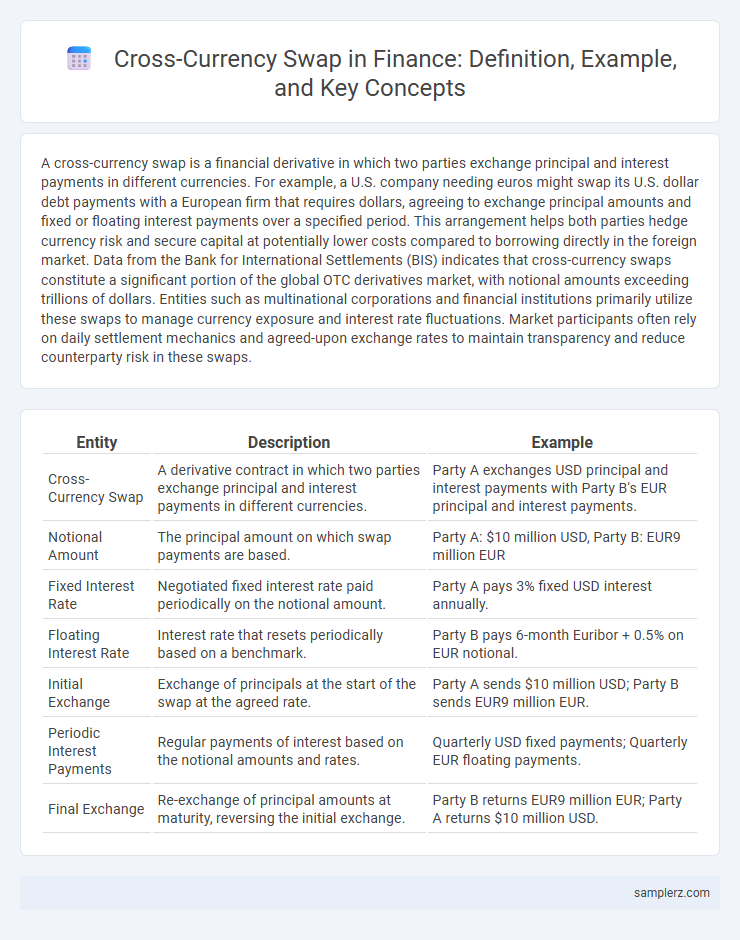

Table of Comparison

| Entity | Description | Example |

|---|---|---|

| Cross-Currency Swap | A derivative contract in which two parties exchange principal and interest payments in different currencies. | Party A exchanges USD principal and interest payments with Party B's EUR principal and interest payments. |

| Notional Amount | The principal amount on which swap payments are based. | Party A: $10 million USD, Party B: EUR9 million EUR |

| Fixed Interest Rate | Negotiated fixed interest rate paid periodically on the notional amount. | Party A pays 3% fixed USD interest annually. |

| Floating Interest Rate | Interest rate that resets periodically based on a benchmark. | Party B pays 6-month Euribor + 0.5% on EUR notional. |

| Initial Exchange | Exchange of principals at the start of the swap at the agreed rate. | Party A sends $10 million USD; Party B sends EUR9 million EUR. |

| Periodic Interest Payments | Regular payments of interest based on the notional amounts and rates. | Quarterly USD fixed payments; Quarterly EUR floating payments. |

| Final Exchange | Re-exchange of principal amounts at maturity, reversing the initial exchange. | Party B returns EUR9 million EUR; Party A returns $10 million USD. |

Introduction to Cross-Currency Swaps

Cross-currency swaps are derivative contracts that enable counterparties to exchange principal and interest payments in different currencies, mitigating foreign exchange risk and interest rate exposure. These swaps typically involve exchanging fixed interest payments in one currency for floating rates in another, allowing multinational corporations and financial institutions to manage currency mismatches on their balance sheets. Prominent examples include USD/EUR or USD/JPY swaps used to hedge cash flows from international investments or funding arrangements.

Key Components of a Cross-Currency Swap

A cross-currency swap involves exchanging principal and interest payments in two different currencies, typically featuring fixed or floating interest rates tied to benchmarks such as LIBOR or SOFR. Key components include the initial principal exchange at the spot rate, periodic interest payments based on agreed-upon interest rate indices, and the final principal re-exchange at the predetermined forward exchange rate. Effective risk management in cross-currency swaps hinges on accurately identifying currency risk, interest rate risk, and counterparty credit risk embedded within these components.

How Cross-Currency Swaps Work in Practice

Cross-currency swaps involve exchanging principal and interest payments in different currencies between two parties, commonly used by multinational corporations to manage foreign exchange risk and interest rate exposure. At the initiation of the swap, the parties exchange principal amounts at the spot exchange rate, followed by periodic interest payments calculated on the swapped principal amounts, typically involving fixed-to-fixed, fixed-to-floating, or floating-to-floating interest rate exchanges. Upon maturity, the principal amounts are re-exchanged at the original spot rate, allowing both parties to hedge currency risk and achieve more favorable financing costs in their preferred currencies.

Real-World Example: USD-EUR Swap

A real-world example of a USD-EUR cross-currency swap involves two multinational corporations exchanging principal and interest payments to hedge currency risk and reduce borrowing costs. Company A borrows USD while Company B borrows EUR, then they swap the principal amounts at the prevailing exchange rate and agree to pay each other's interest obligations over the life of the swap. This arrangement helps both companies manage exposure to exchange rate fluctuations and optimize their capital structure across global markets.

Case Study: Corporate Hedging Using Cross-Currency Swaps

A multinational corporation hedged its foreign exchange risk by entering a cross-currency swap to exchange fixed interest payments in USD for floating-rate payments in EUR, aligning debt service obligations with euro revenue streams. This derivative effectively mitigated exposure to FX volatility and interest rate fluctuations, preserving cash flow stability. The swap's notional principal of $100 million demonstrated how tailored hedging strategies optimize multinational treasury management.

Cross-Currency Swap vs. Interest Rate Swap

A cross-currency swap involves exchanging principal and interest payments in different currencies, allowing parties to manage both currency risk and interest rate exposure. Unlike an interest rate swap, which only exchanges interest payments in the same currency, cross-currency swaps address fluctuations in foreign exchange rates alongside interest rates. This derivative is commonly used by multinational corporations and financial institutions to hedge currency risk while optimizing borrowing costs across markets.

Benefits of Cross-Currency Swaps for Multinational Firms

Cross-currency swaps enable multinational firms to hedge foreign exchange risk by exchanging principal and interest payments in different currencies, stabilizing cash flows and reducing exposure to currency volatility. These derivatives facilitate access to capital markets at potentially lower borrowing costs by leveraging comparative advantages in interest rates across countries. Effective use of cross-currency swaps enhances financial flexibility, supports currency diversification, and improves overall risk management strategies for global corporations.

Risks and Challenges in Cross-Currency Swaps

Cross-currency swaps involve exchanging principal and interest payments in different currencies, exposing parties to foreign exchange risk and interest rate risk simultaneously. Market liquidity can be limited, increasing pricing spreads and execution costs, while counterparty credit risk remains significant due to fluctuating currency values and interest rates over the contract term. Managing collateral and accounting for regulatory requirements add complexity and operational challenges in cross-currency swap transactions.

Regulatory Considerations in Cross-Currency Swap Transactions

Regulatory considerations in cross-currency swap transactions include adherence to capital and margin requirements imposed by frameworks such as Basel III and EMIR, ensuring adequate risk management and transparency. Entities must comply with reporting obligations to trade repositories and conduct frequent stress testing to monitor counterparty credit risk under evolving regulatory standards. Non-compliance can result in significant penalties, impacting liquidity and capital allocation in derivative portfolios.

Conclusion: Strategic Use of Cross-Currency Swaps in Finance

Cross-currency swaps serve as effective tools for managing currency risk and optimizing financing costs in multinational corporations and financial institutions. By exchanging principal and interest payments in different currencies, firms can secure favorable borrowing rates and hedge against currency fluctuations. Strategic deployment of cross-currency swaps enhances capital structure flexibility and supports global investment and funding strategies.

example of cross-currency swap in derivative Infographic

samplerz.com

samplerz.com