Market tightness in finance is characterized by limited liquidity and fewer available assets for trading, leading to heightened competition among buyers and sellers. This condition often results in narrow bid-ask spreads and rapid price adjustments due to the scarcity of supply relative to demand. An example of tightness appears in the bond market when a sudden surge in demand for government securities causes yields to drop and trading volumes to concentrate among a few active participants. Equity markets also exhibit tightness during periods of low trading volumes, where stock prices can become more volatile due to reduced market depth. Corporate bond issuance often experiences tightness when investors demand higher premiums for riskier debt, limiting the ability of companies to raise capital efficiently. Data indicates that market tightness correlates with increased transaction costs and can reflect broader economic uncertainty or regulatory constraints affecting market behavior.

Table of Comparison

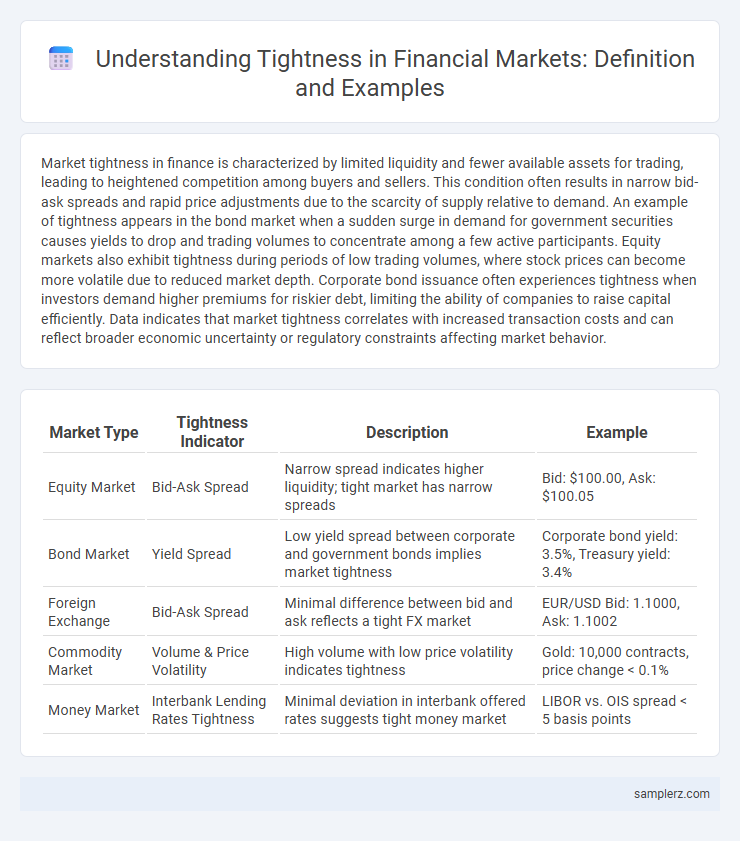

| Market Type | Tightness Indicator | Description | Example |

|---|---|---|---|

| Equity Market | Bid-Ask Spread | Narrow spread indicates higher liquidity; tight market has narrow spreads | Bid: $100.00, Ask: $100.05 |

| Bond Market | Yield Spread | Low yield spread between corporate and government bonds implies market tightness | Corporate bond yield: 3.5%, Treasury yield: 3.4% |

| Foreign Exchange | Bid-Ask Spread | Minimal difference between bid and ask reflects a tight FX market | EUR/USD Bid: 1.1000, Ask: 1.1002 |

| Commodity Market | Volume & Price Volatility | High volume with low price volatility indicates tightness | Gold: 10,000 contracts, price change < 0.1% |

| Money Market | Interbank Lending Rates Tightness | Minimal deviation in interbank offered rates suggests tight money market | LIBOR vs. OIS spread < 5 basis points |

Understanding Market Tightness in Finance

Market tightness in finance occurs when there is a significant imbalance between supply and demand, such as in the labor market where job openings exceed available workers, driving up wages. In credit markets, tightness is evident when lending standards become more stringent, reducing the availability of loans despite strong demand. Understanding these conditions helps investors and policymakers anticipate potential risks and adjust strategies accordingly.

Key Indicators of Market Tightness

Key indicators of market tightness include narrowing bid-ask spreads, increased trading volume, and reduced market liquidity. Elevated price volatility coupled with limited order book depth signals constrained market conditions. Monitoring these metrics helps investors identify periods of heightened competition and potential price inefficiencies.

Example: Treasury Bond Market Tightness

The Treasury bond market exhibits tightness when bid-ask spreads narrow significantly, indicating high liquidity and strong investor demand for government securities. This tightness often occurs during periods of economic stability or heightened risk aversion, as investors flock to safe-haven assets like U.S. Treasury bonds. Reduced market depth and lower volatility in Treasury yields further exemplify this phenomenon, reflecting efficient price discovery and minimal transaction costs.

Tightness in the Foreign Exchange Market

Tightness in the foreign exchange market is characterized by narrow bid-ask spreads and limited liquidity, often caused by reduced trading volumes during geopolitical uncertainty or central bank interventions. For instance, during unexpected interest rate hikes by the Federal Reserve, currency pairs like USD/EUR may experience tighter spreads as market participants rapidly adjust positions. This constrained market environment can lead to increased volatility despite apparent tightness, impacting hedging and speculative strategies.

Shortage of Liquidity in Money Markets

Shortage of liquidity in money markets often occurs during periods of financial stress, leading to increased borrowing costs and reduced market efficiency. Banks and financial institutions experience difficulties in accessing short-term funds, causing a sharp rise in interbank lending rates such as the LIBOR or SOFR spreads. This tightness hinders the smooth functioning of payment systems and credit availability, impacting overall economic stability.

Equity Market Tightness During Volatility

Equity market tightness during volatility is characterized by narrowed bid-ask spreads and reduced trading volumes, reflecting cautious investor behavior amid uncertainty. Heightened market tightness often signals decreased liquidity, increasing transaction costs and price impact for traders executing large orders. Empirical studies identify tightness spikes during events such as geopolitical crises and economic announcements, underscoring the link between volatility shocks and market microstructure dynamics.

Impact of Tight Credit Markets on Lending

Tight credit markets significantly restrict the availability of loans, forcing financial institutions to raise lending standards and increase interest rates. This contraction in credit supply leads to reduced borrowing by businesses and consumers, slowing economic growth and investment. Small and medium-sized enterprises often face the greatest challenges securing funding, which hampers expansion and operational activities.

Real Estate Market Tightness: Causes and Effects

The real estate market tightness often stems from limited housing inventory combined with high buyer demand, driven by factors such as low mortgage rates and population growth. This market constraint causes rapid price escalations and bidding wars, reducing affordability for many buyers. Consequently, tight market conditions may slow transaction volumes and increase rental prices, impacting overall economic stability.

Commodity Markets: Signs of Tightness

Commodity markets exhibit signs of tightness when inventory levels decline sharply, leading to reduced availability of key resources like crude oil, copper, or wheat. Elevated futures prices with a steep contango or backwardation curve indicate supply constraints and heightened demand pressures. Low storage capacity combined with increased consumption rates often results in price volatility and supply chain disruptions.

Strategies for Navigating Tight Financial Markets

Navigating tight financial markets requires strategic asset allocation focused on liquidity and low-risk investments such as Treasury bills and high-quality corporate bonds to preserve capital. Employing disciplined cash flow management and maintaining a robust reserve fund helps mitigate volatility and ensures operational stability during restricted credit conditions. Leveraging alternative financing options like invoice factoring or peer-to-peer lending can also provide critical access to capital when traditional lending tightens.

example of tightness in market Infographic

samplerz.com

samplerz.com