Negative convexity in bonds occurs when bond prices increase at a decreasing rate as yields fall, typically seen in mortgage-backed securities (MBS). These securities exhibit negative convexity because prepayment options allow borrowers to refinance when interest rates drop, limiting price appreciation. As a result, investors face increased price risk during declining interest rates since gains are capped while losses accelerate when yields rise. Callable bonds also demonstrate negative convexity, where issuers can redeem the bond before maturity when rates decline. The call option restricts the bond's price increase, causing it to behave less like a traditional bond with positive convexity. This results in asymmetric price movements, increasing interest rate risk for investors managing fixed income portfolios.

Table of Comparison

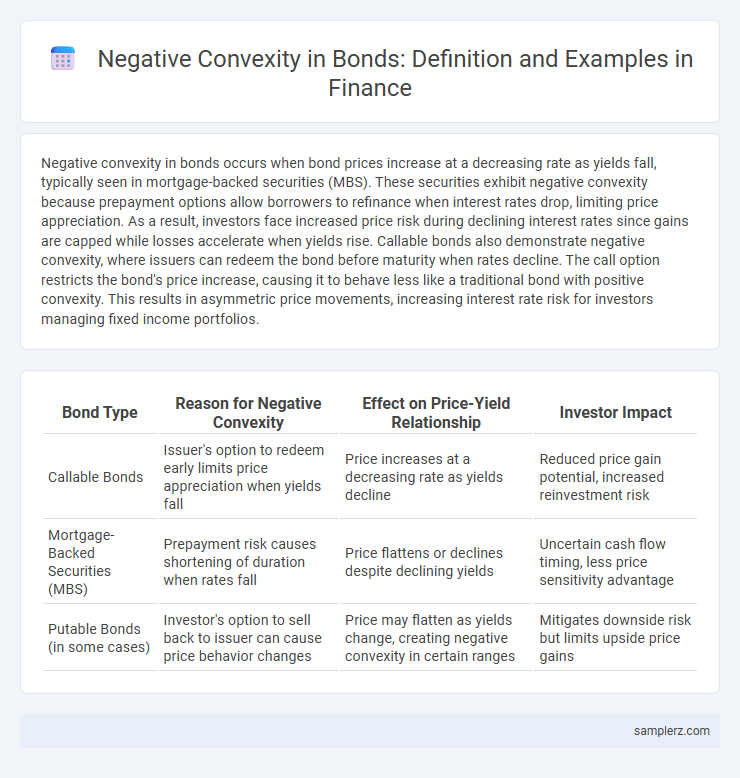

| Bond Type | Reason for Negative Convexity | Effect on Price-Yield Relationship | Investor Impact |

|---|---|---|---|

| Callable Bonds | Issuer's option to redeem early limits price appreciation when yields fall | Price increases at a decreasing rate as yields decline | Reduced price gain potential, increased reinvestment risk |

| Mortgage-Backed Securities (MBS) | Prepayment risk causes shortening of duration when rates fall | Price flattens or declines despite declining yields | Uncertain cash flow timing, less price sensitivity advantage |

| Putable Bonds (in some cases) | Investor's option to sell back to issuer can cause price behavior changes | Price may flatten as yields change, creating negative convexity in certain ranges | Mitigates downside risk but limits upside price gains |

Understanding Negative Convexity in Bonds

Negative convexity in bonds occurs when a bond's duration increases as interest rates rise, commonly seen in callable bonds or mortgage-backed securities. This phenomenon causes bond prices to decline more rapidly when yields increase, limiting price appreciation during rate declines and exposing investors to higher interest rate risk. Understanding negative convexity is crucial for managing portfolio risk and optimizing bond investment strategies.

Key Features of Negatively Convex Bonds

Negatively convex bonds, such as callable bonds, exhibit price behavior where their sensitivity to interest rate decreases increases as rates fall, causing price appreciation to slow down. These bonds often have embedded options allowing issuers to redeem the bond before maturity, limiting upside price gains when interest rates decline. Key features include higher yield spreads to compensate investors for call risk and the potential for price volatility that deviates from standard bond duration and convexity measures.

Negative Convexity and Callable Bonds Explained

Negative convexity occurs in callable bonds when rising interest rates reduce bond prices less than expected, but falling rates limit price appreciation due to the call option being exercised by the issuer. Callable bonds feature embedded options allowing issuers to redeem the bond early, creating uncertainty in cash flows and price behavior, which contributes to negative convexity. This risk impacts yield calculations and portfolio duration management, as callable bonds do not follow traditional convexity patterns of non-callable bonds.

Real-World Scenarios: Bonds Exhibiting Negative Convexity

Mortgage-backed securities (MBS) often display negative convexity due to prepayment risk, where rising interest rates reduce refinancing activity, causing bond prices to decline more sharply. Callable corporate bonds also exhibit negative convexity because issuers tend to call them when interest rates fall, limiting price appreciation for investors. These real-world examples highlight how negative convexity affects bond valuation and investment strategies in fluctuating interest rate environments.

Mortgage-Backed Securities as Negative Convexity Examples

Mortgage-Backed Securities (MBS) commonly exhibit negative convexity due to prepayment risk, where falling interest rates prompt borrowers to refinance, shortening the bond's duration unpredictably. This prepayment accelerates principal repayment, reducing potential gains when yields decline and limiting price appreciation. Investors in MBS face increased price volatility and reinvestment risk, distinguishing these securities from standard fixed-coupon bonds with positive convexity.

Impact of Interest Rate Changes on Negatively Convex Bonds

Negatively convex bonds, such as callable bonds, experience accelerated price declines when interest rates rise due to the embedded call option limiting price appreciation. Rising rates increase yield, but price drops more sharply compared to positively convex bonds, resulting in greater interest rate risk for investors. This negative convexity diminishes the bond's duration effectiveness, complicating interest rate risk management strategies.

Price Behavior of Bonds with Negative Convexity

Bonds with negative convexity, such as callable bonds or mortgage-backed securities, exhibit price behavior where their prices increase less when yields fall but decrease more when yields rise, compared to bonds with positive convexity. This asymmetric price response results from embedded options that limit price gains and amplify losses, causing investors to face higher interest rate risk. Negative convexity leads to diminished price appreciation during declining interest rates and greater price depreciation during rising rates, impacting portfolio duration and risk management strategies.

Risks Associated with Negative Convexity Bonds

Negative convexity bonds, such as callable bonds or mortgage-backed securities, exhibit price sensitivity where yields increase, causing prices to drop faster than standard bonds. The primary risk involves accelerated price declines during rising interest rates, reducing potential capital gains and increasing reinvestment risk. Investors may also face heightened uncertainty in cash flow timing due to embedded options, amplifying portfolio volatility.

Portfolio Strategies Involving Negatively Convex Bonds

Portfolio strategies involving negatively convex bonds often include callable bonds, which exhibit price declines that accelerate as interest rates fall, increasing reinvestment risk. Investors strategically incorporate these bonds to enhance yield but must manage potential price volatility through duration hedging and diversification. Employing interest rate derivatives and dynamic allocation helps mitigate negative convexity's impact while capturing income opportunities.

Comparing Negative and Positive Convexity in Bonds

Negative convexity in bonds, often observed in callable or mortgage-backed securities, causes price appreciation to be less sensitive to falling interest rates compared to positive convexity bonds like government treasuries. While positive convexity results in accelerated price gains when rates drop and smaller losses when rates rise, negative convexity traits lead to limited price increases and amplified price declines during the same interest rate movements. This contrast significantly impacts bond portfolio risk management and yield optimization strategies.

example of negative convexity in bond Infographic

samplerz.com

samplerz.com