HIFO, or Highest In, First Out, is an inventory accounting method where the most expensive inventory items are sold first. In finance, this approach helps companies manage their cost of goods sold (COGS) by prioritizing the disposal of higher-valued inventory. For example, a retailer purchasing three batches of goods at $10, $12, and $15 per unit will allocate the $15 batch as the first sold under HIFO, optimizing tax benefits when prices fluctuate. This method contrasts with FIFO or LIFO by targeting the highest acquisition cost items, impacting profit margins and tax calculations. Using HIFO, businesses can reduce taxable income during inflationary periods by reporting higher COGS. Financial analysts often review HIFO inventory data to assess company strategies in managing inventory costs and revenue recognition.

Table of Comparison

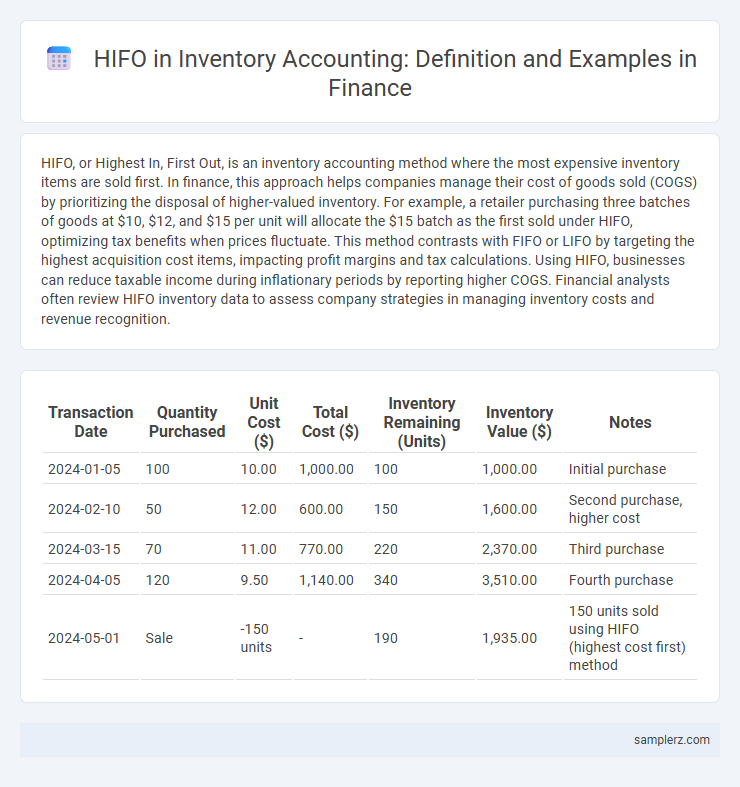

| Transaction Date | Quantity Purchased | Unit Cost ($) | Total Cost ($) | Inventory Remaining (Units) | Inventory Value ($) | Notes |

|---|---|---|---|---|---|---|

| 2024-01-05 | 100 | 10.00 | 1,000.00 | 100 | 1,000.00 | Initial purchase |

| 2024-02-10 | 50 | 12.00 | 600.00 | 150 | 1,600.00 | Second purchase, higher cost |

| 2024-03-15 | 70 | 11.00 | 770.00 | 220 | 2,370.00 | Third purchase |

| 2024-04-05 | 120 | 9.50 | 1,140.00 | 340 | 3,510.00 | Fourth purchase |

| 2024-05-01 | Sale | -150 units | - | 190 | 1,935.00 | 150 units sold using HIFO (highest cost first) method |

Understanding HIFO Inventory Accounting

HIFO (Highest In, First Out) inventory accounting involves selling the most expensive inventory items first, which can lead to higher cost of goods sold (COGS) and lower taxable income during periods of rising prices. For example, when a company purchases inventory at different prices, HIFO assigns costs based on the highest purchase price first, optimizing tax savings by maximizing COGS. Understanding HIFO helps businesses manage profitability and tax liabilities effectively through strategic inventory cost allocation.

Key Principles of HIFO Method

The HIFO (Highest-In, First-Out) inventory accounting method prioritizes the sale of inventory items with the highest purchase cost first, maximizing cost of goods sold and minimizing taxable income during inflationary periods. This approach ensures more accurate matching of current costs with current revenues, reflecting realistic inventory valuation on the balance sheet. By consistently applying HIFO, companies can optimize tax liabilities and maintain precise financial reporting aligned with market cost fluctuations.

HIFO vs FIFO: A Comparative Overview

HIFO (Highest In, First Out) inventory accounting method values the cost of goods sold using the highest purchase prices, resulting in lower taxable income during inflation periods compared to FIFO (First In, First Out), which assumes the oldest inventory is sold first. While FIFO matches older, potentially cheaper inventory costs against current revenues, HIFO reflects more recent, higher costs, providing a conservative profit estimate and reducing tax liabilities. Companies facing rising prices may prefer HIFO for aggressive tax management, whereas FIFO offers more accurate inventory valuation aligned with physical stock flow.

Real-World Example of HIFO in Action

A real-world example of HIFO (Highest In, First Out) in inventory accounting occurs when a technology retailer sells the newest, most expensive smartphones first to maximize cost of goods sold and reduce taxable income. By allocating the highest purchase costs to inventory outflows, HIFO allows companies to better match expenses with current revenues during periods of rising prices. This method results in lower reported profits and tax liabilities compared to FIFO or LIFO, especially in volatile markets.

Step-by-Step HIFO Calculation Example

HIFO (Highest In, First Out) inventory accounting assigns the cost of the highest-priced inventory items sold first, maximizing the cost of goods sold in inflationary markets. For example, assume a company purchases 100 units at $10 each and later 100 units at $15 each; selling 150 units would first allocate 100 units at $15 and 50 units at $10, resulting in a total cost of goods sold of $2,250 (100 x $15 + 50 x $10). This step-by-step HIFO method effectively reduces taxable income by recognizing higher inventory costs during sales.

HIFO Application in Retail Inventory

HIFO (Highest In, First Out) method in retail inventory accounting prioritizes selling the highest cost items first, maximizing cost of goods sold during inflationary periods. This approach strategically reduces taxable income by matching higher inventory costs against revenue, improving cash flow management for retailers. Implementing HIFO requires detailed inventory tracking and cost allocation systems to ensure accurate financial reporting and compliance.

Impact of HIFO on Financial Statements

HIFO (Highest In, First Out) inventory accounting method values the cost of goods sold using the highest purchase prices, resulting in lower reported net income during periods of rising prices. This approach increases inventory valuation on the balance sheet when lower-cost items remain, enhancing current asset figures. Consequently, HIFO can lead to reduced taxable income and altered financial ratios, affecting decision-making for investors and creditors.

HIFO Example: Tax Implications and Strategies

In inventory accounting, the Highest In, First Out (HIFO) method sells the most expensive inventory first, which can lead to lower taxable income during periods of rising prices by maximizing cost of goods sold. For tax planning, businesses using HIFO may defer tax liabilities and improve cash flow, though it requires detailed tracking of purchase costs. Strategically applying HIFO can optimize tax outcomes, especially in industries with volatile input prices, by minimizing reported profits and thereby reducing current tax burdens.

HIFO Use Case: Manufacturing Sector

In the manufacturing sector, HIFO (Highest In, First Out) inventory accounting is employed to minimize tax liabilities by allocating the highest cost inventory items to the cost of goods sold, thereby reducing taxable income during periods of rising material costs. For example, a car manufacturer using HIFO may record the most expensive steel purchases as sold first, which reflects current market price fluctuations more accurately than FIFO or LIFO methods. This approach helps companies manage profit margins and cash flows effectively while maintaining compliance with accounting standards.

Common Pitfalls When Applying HIFO

Common pitfalls when applying HIFO (Highest In, First Out) in inventory accounting include misidentifying the highest cost items during periods of significant price fluctuations, leading to inaccurate cost of goods sold calculations. Failing to maintain detailed and accurate records of purchase prices can result in improper inventory valuation and financial statement misrepresentation. Ignoring the impact of HIFO on tax liabilities and cash flow can cause unexpected financial outcomes and compliance issues.

example of HIFO in inventory accounting Infographic

samplerz.com

samplerz.com