A silent partner in a finance partnership is an investor who contributes capital but does not participate in daily business operations or management decisions. This entity typically provides financial backing while remaining anonymous to clients and the public, often limiting their involvement to receiving a share of the profits. Data shows that silent partners are common in sectors such as real estate, private equity, and small business ventures. In financial terms, a notable example of a silent partner is Carlyle Group's limited partners, who invest large sums without direct influence on fund management. These investors supply critical capital, enabling the general partners to execute investment strategies and manage assets. Reports indicate that silent partners frequently seek to diversify their portfolio risk while benefiting from the expertise of active managers.

Table of Comparison

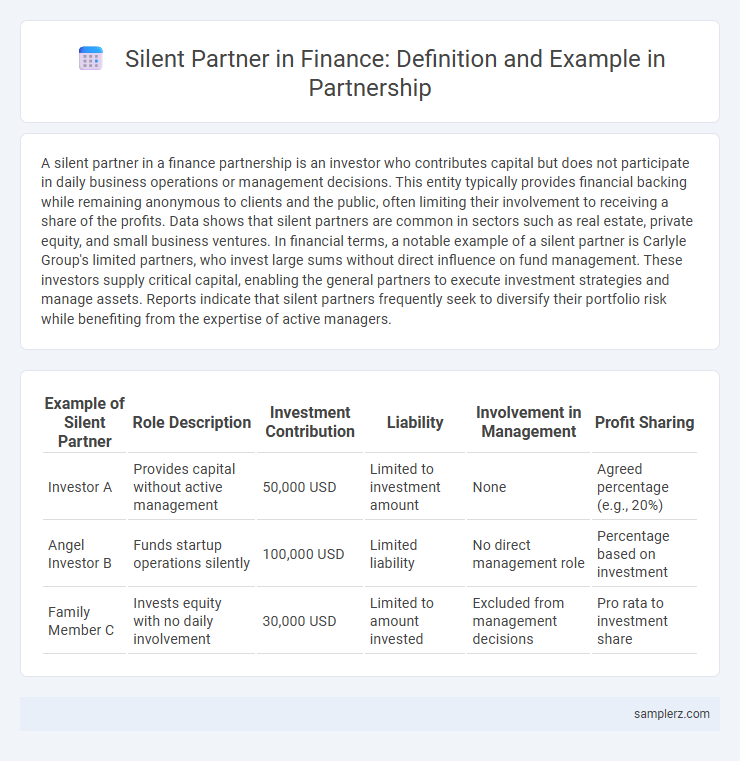

| Example of Silent Partner | Role Description | Investment Contribution | Liability | Involvement in Management | Profit Sharing |

|---|---|---|---|---|---|

| Investor A | Provides capital without active management | 50,000 USD | Limited to investment amount | None | Agreed percentage (e.g., 20%) |

| Angel Investor B | Funds startup operations silently | 100,000 USD | Limited liability | No direct management role | Percentage based on investment |

| Family Member C | Invests equity with no daily involvement | 30,000 USD | Limited to amount invested | Excluded from management decisions | Pro rata to investment share |

Introduction to Silent Partnerships in Finance

Silent partners in finance contribute capital to a business partnership without participating in daily management or decision-making processes. An example is an investor who provides funds to a startup while allowing the active partners to handle operations and strategy. This structure limits the silent partner's liability to their investment, making it a strategic option for risk management in business ventures.

Definition and Role of a Silent Partner

A silent partner in a financial partnership is an investor who contributes capital without participating in the day-to-day management or decision-making processes of the business. Their role primarily involves providing financial support and sharing in the profits or losses, while remaining anonymous to customers and employees. This type of partnership structure allows operational partners to run the business independently while leveraging the silent partner's investment.

Key Characteristics of Silent Partners

Silent partners in finance contribute capital to a business partnership without participating in daily management or decision-making processes. They maintain limited liability, protecting personal assets beyond their investment, while benefiting from profit sharing based on their equity stake. These partners prioritize anonymity and minimal operational involvement, which distinguishes them from general partners actively managing the business.

Real-Life Example: Silent Partner in a Restaurant Venture

In a successful restaurant partnership, a silent partner might invest capital without participating in daily operations or decision-making, allowing the active partner to manage the business. For instance, in the case of Joe's Grill, the silent partner provided $100,000 to fund kitchen renovations and marketing efforts while remaining uninvolved in management tasks. This model enables the silent partner to earn a share of the profits based on investment, typically outlined in the partnership agreement, without exposure to operational risks or liabilities.

Silent Partner Scenario: Investment Firm Case Study

A silent partner in the investment firm scenario contributes capital without influencing daily management, allowing the active partners to make strategic decisions while sharing profits. This passive involvement enables the silent partner to benefit from returns on investment without exposure to operational risks. Such arrangements are common in private equity firms where limited partners provide funding but defer control to general partners.

Silent Partner in Family-Owned Businesses

Silent partners in family-owned businesses typically invest capital without participating in daily operations, providing financial support while limiting liability. For example, a family member who contributes funds but refrains from management decisions acts as a silent partner, preserving family harmony and allowing active members to run the business. This structure helps balance investment roles and operational control within family partnerships.

Silent Partner Agreement: Legal Essentials

A silent partner in a partnership typically contributes capital without participating in daily management, as defined in a silent partner agreement outlining roles, profit shares, and liability limits. Legal essentials of such agreements include clear clauses on confidentiality, financial obligations, and dispute resolution to protect both active and silent partners. Proper documentation ensures the silent partner's limited liability status and prevents unauthorized decision-making interference.

Silent Partner vs. Active Partner: Financial Implications

A silent partner typically invests capital in a partnership but does not participate in daily management or decision-making, limiting their financial liability to their investment amount. In contrast, an active partner engages in running the business and assumes full responsibility for debts and operational risks, potentially increasing both profit share and financial exposure. Understanding these roles is essential for structuring partnerships, tax obligations, and liability distribution in finance.

Benefits and Risks for Silent Partners

A silent partner in finance contributes capital without involved management, enabling wealth growth while maintaining privacy and limited liability. Benefits include passive income and reduced exposure to operational risks, as the active partner manages daily business activities. Risks encompass potential loss of investment if the business fails and limited control over decisions affecting the partnership's performance.

Famous Silent Partnership Examples in Finance Industry

Silent partners in the finance industry often include wealthy investors like Warren Buffett, who provides capital without engaging in daily operations. The private equity firm KKR frequently involves silent partners who supply funding while management handles the investment decisions. Another example is Berkshire Hathaway's acquisition model, where silent partners back subsidiary companies but allow original management teams to retain operational control.

example of silent partner in partnership Infographic

samplerz.com

samplerz.com