In finance, a green shoe option is an underwriting mechanism that allows underwriters to purchase up to an additional 15% of shares in an initial public offering (IPO) if demand exceeds expectations. This option helps stabilize the share price post-IPO by providing extra shares to meet investor demand, preventing price volatility. Companies like Google and Facebook have utilized green shoe options during their IPOs to ensure a smoother market debut. The green shoe option is named after the Green Shoe Manufacturing Company, the first to include this clause in its underwriting agreement. Underwriters exercise this option within 30 days of the IPO, using the extra shares to support price stability and investor confidence. Data shows that implementing a green shoe option can reduce post-offering price drops by providing liquidity and balancing supply and demand in the market.

Table of Comparison

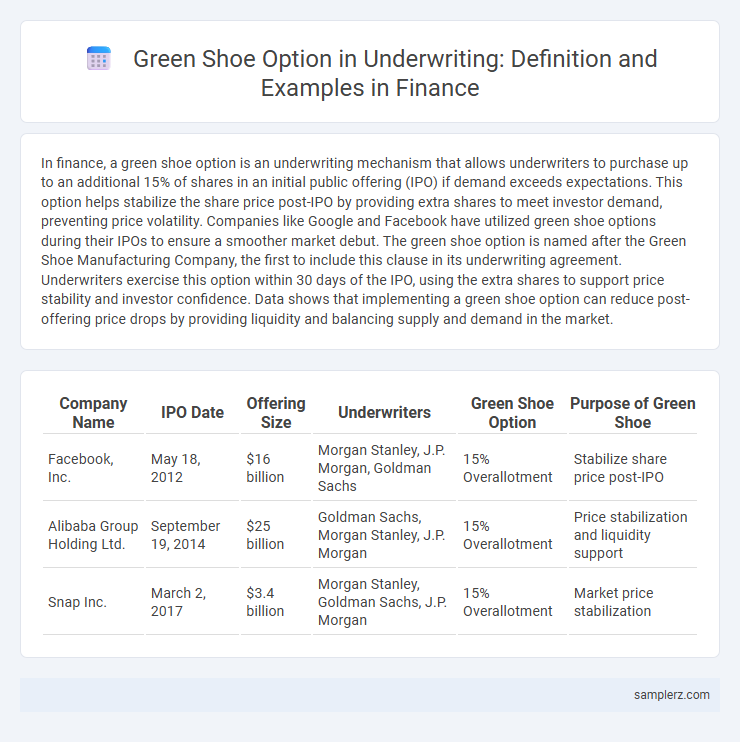

| Company Name | IPO Date | Offering Size | Underwriters | Green Shoe Option | Purpose of Green Shoe |

|---|---|---|---|---|---|

| Facebook, Inc. | May 18, 2012 | $16 billion | Morgan Stanley, J.P. Morgan, Goldman Sachs | 15% Overallotment | Stabilize share price post-IPO |

| Alibaba Group Holding Ltd. | September 19, 2014 | $25 billion | Goldman Sachs, Morgan Stanley, J.P. Morgan | 15% Overallotment | Price stabilization and liquidity support |

| Snap Inc. | March 2, 2017 | $3.4 billion | Morgan Stanley, Goldman Sachs, J.P. Morgan | 15% Overallotment | Market price stabilization |

Introduction to the Green Shoe Option in Underwriting

The Green Shoe option, also known as an overallotment option, allows underwriters to sell additional shares, typically up to 15% more than the original offering size, to stabilize the stock price post-IPO. This mechanism helps underwriters manage excess demand and reduce price volatility by enabling them to buy back shares if the market price falls below the offering price. The Green Shoe option is crucial in maintaining market confidence and ensuring successful capital raising during the underwriting process.

How the Green Shoe Mechanism Works

The Green Shoe mechanism allows underwriters to sell investors more shares than initially planned, typically up to 15% above the offering size, to stabilize the stock price after an IPO. If demand exceeds supply, underwriters exercise this option by purchasing additional shares from the issuer at the offering price, preventing volatile price swings. This method enhances price stability and investor confidence during the critical post-IPO trading period.

Historical Overview: Origin of the Green Shoe Option

The green shoe option originated from the 1963 initial public offering (IPO) of the Green Shoe Manufacturing Company, where underwriters were given the right to purchase additional shares to stabilize the stock price. This mechanism allowed underwriters to manage demand fluctuations and reduce volatility during the IPO process. Since then, the green shoe option has become a standard tool in equity underwriting to enhance market stability and investor confidence.

Real-World Example: Green Shoe Option in the Alibaba IPO

The Alibaba IPO in 2014 is a notable real-world example of a green shoe option, where underwriters were granted the right to sell an additional 15% of shares beyond the original offering. This mechanism helped stabilize the stock price amid high market volatility, allowing underwriters to efficiently manage excess investor demand. The green shoe option ultimately raised Alibaba's total capital to approximately $25 billion, reinforcing its status as the largest IPO in history.

Case Study: Reliance Industries and the Green Shoe in India

Reliance Industries utilized the green shoe option during its equity issue to stabilize share prices amid high market volatility, allowing underwriters to sell an additional 15% shares beyond the initial offering. This strategic move ensured liquidity and investor confidence by enabling the purchase of extra shares at the offering price if demand exceeded expectations. The green shoe mechanism contributed to successful price support and minimized post-IPO price fluctuations in the Indian capital market.

Impact of the Green Shoe on IPO Pricing Stability

The green shoe option in underwriting allows underwriters to purchase up to 15% additional shares at the offering price, enhancing IPO pricing stability by mitigating price volatility during the initial trading period. This mechanism supports demand absorption and prevents sharp price declines, thereby boosting investor confidence and market liquidity. Empirical data shows that IPOs with green shoe provisions experience narrower price fluctuations and more stable aftermarket performance compared to those without.

Advantages of Green Shoe for Issuers and Investors

The green shoe option allows issuers to stabilize their stock price by granting underwriters the ability to sell additional shares, preventing sharp declines after the initial offering. Investors benefit from increased market confidence and liquidity, as the price support mechanism reduces volatility in the early trading period. This underwriting strategy enhances capital raising efficiency while providing a safeguard against adverse market movements.

Steps Involved in Executing a Green Shoe Option

The execution of a green shoe option in underwriting begins with the underwriter securing an agreement to purchase additional shares, typically up to 15% of the original offering size, to stabilize the stock price post-IPO. Following the initial offering, the underwriter monitors market demand and stock performance, deciding within a predetermined period--usually 30 days--whether to exercise the green shoe option by buying the extra shares from the issuer. This process helps mitigate price volatility and provides liquidity, benefiting both the issuer and investors during the aftermarket phase.

Risks and Limitations of the Green Shoe Mechanism

The green shoe option, commonly used in underwriting to stabilize share prices post-IPO, carries risks such as potential market manipulation and increased volatility when exercised excessively. Limitations include the finite allocation of additional shares, which may not fully absorb selling pressure, exposing investors to price fluctuations. Moreover, reliance on the green shoe can obscure true market demand, potentially misleading underwriters and investors about the stock's performance.

Comparative Analysis: Green Shoe vs. Other Underwriting Stabilization Tools

The Green Shoe option allows underwriters to purchase up to 15% additional shares at the offering price to stabilize stock after an IPO, providing liquidity and price support more flexibly than traditional overallotment methods. Compared to other stabilization tools like price bands or lock-up agreements, the Green Shoe offers immediate market intervention, reducing volatility and enhancing investor confidence. This mechanism typically results in narrower price fluctuations post-listing, making it a preferred choice for managing aftermarket price stability in equity offerings.

example of green shoe in underwriting Infographic

samplerz.com

samplerz.com