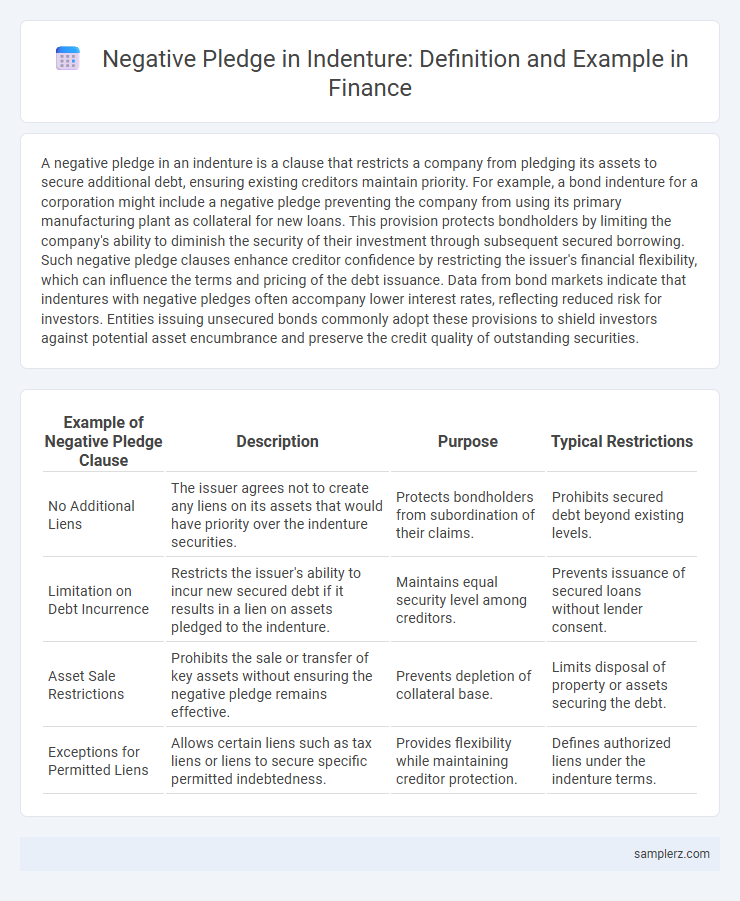

A negative pledge in an indenture is a clause that restricts a company from pledging its assets to secure additional debt, ensuring existing creditors maintain priority. For example, a bond indenture for a corporation might include a negative pledge preventing the company from using its primary manufacturing plant as collateral for new loans. This provision protects bondholders by limiting the company's ability to diminish the security of their investment through subsequent secured borrowing. Such negative pledge clauses enhance creditor confidence by restricting the issuer's financial flexibility, which can influence the terms and pricing of the debt issuance. Data from bond markets indicate that indentures with negative pledges often accompany lower interest rates, reflecting reduced risk for investors. Entities issuing unsecured bonds commonly adopt these provisions to shield investors against potential asset encumbrance and preserve the credit quality of outstanding securities.

Table of Comparison

| Example of Negative Pledge Clause | Description | Purpose | Typical Restrictions |

|---|---|---|---|

| No Additional Liens | The issuer agrees not to create any liens on its assets that would have priority over the indenture securities. | Protects bondholders from subordination of their claims. | Prohibits secured debt beyond existing levels. |

| Limitation on Debt Incurrence | Restricts the issuer's ability to incur new secured debt if it results in a lien on assets pledged to the indenture. | Maintains equal security level among creditors. | Prevents issuance of secured loans without lender consent. |

| Asset Sale Restrictions | Prohibits the sale or transfer of key assets without ensuring the negative pledge remains effective. | Prevents depletion of collateral base. | Limits disposal of property or assets securing the debt. |

| Exceptions for Permitted Liens | Allows certain liens such as tax liens or liens to secure specific permitted indebtedness. | Provides flexibility while maintaining creditor protection. | Defines authorized liens under the indenture terms. |

Understanding Negative Pledge Clauses in Indentures

Negative pledge clauses in indentures restrict issuers from pledging assets as collateral to other creditors, protecting bondholders' interests by maintaining asset availability. These clauses prevent dilution of security without explicit consent, ensuring priority in debt repayment. For example, a company issuing bonds may agree in the indenture not to encumber its key assets, preserving unsecured bondholder protections and maintaining creditworthiness.

Key Features of Negative Pledge Provisions

Negative pledge provisions in indentures prohibit issuers from creating security interests on specified assets, ensuring equal treatment of unsecured bondholders and preventing preferential creditor claims. Key features include restrictions on incurring secured debt beyond a defined threshold, requirements to maintain asset coverage ratios, and clauses allowing exceptions for certain permitted liens. These covenants enhance creditor confidence by limiting issuer leverage and preserving asset value throughout the debt term.

Real-World Example of Negative Pledge in Bond Indentures

A notable real-world example of a negative pledge clause can be found in the indenture for Tesla's 2024 Convertible Senior Notes, which prohibits the company from creating liens on its assets that would senior or equal the notes without extending the same security to the noteholders. This clause protects bondholders by ensuring Tesla cannot prioritize other creditors through secured debt, maintaining the notes' relative safety despite the company's ongoing capital investments. Similar negative pledge provisions are common in high-yield bond indentures to prevent asset encumbrance and safeguard investor interests during expansion or refinancing.

Negative Pledge Clause: Sample Wording and Structure

The Negative Pledge Clause in an indenture typically prohibits the issuer from creating any security interest over specified assets that would rank senior to or pari passu with the bonds, ensuring creditor protection. A sample wording might state, "The Company shall not, without the prior consent of the Trustee, create or permit to exist any mortgage, lien, or charge upon any of its property, present or future, to secure any Debt unless the same Security is extended equally and ratably to the Bonds." Structurally, this clause is often positioned alongside covenants related to debt incurrence and asset disposition, forming a critical part of credit enhancement in bond agreements.

How Negative Pledge Protects Unsecured Creditors

A negative pledge clause in an indenture restricts the issuer from creating secured debt that would have priority over existing unsecured creditors, thereby preserving their claim on the issuer's assets. This protection ensures that unsecured creditors retain equitable treatment by preventing the issuer from subordinating their interests through collateralization. By maintaining a level playing field, the negative pledge clause mitigates the risk of unsecured creditors receiving diminished recoveries in the event of default or bankruptcy.

Negative Pledge Case Study: Corporate Debt Scenario

In a corporate debt scenario, a negative pledge clause in the indenture specifically prohibits the borrower from granting any security interest on its assets to other creditors, ensuring that existing bondholders maintain priority. This restriction protects bondholders by limiting the issuer's ability to secure additional debt that could dilute their claims or increase credit risk. A notable case involved a corporation attempting to pledge assets for new bank loans, which was challenged due to the enforceable negative pledge covenant, preserving the original bondholders' unsecured status.

Comparing Negative Pledge vs. Affirmative Covenants

Negative pledge clauses in indentures restrict borrowers from securing additional debt with assets, thereby protecting existing bondholders from dilution of collateral value. Unlike affirmative covenants, which require borrowers to take specific actions such as maintaining financial ratios or providing regular reports, negative pledges impose limitations without mandating proactive steps. This distinction ensures negative pledges primarily serve as protective, preventive tools, while affirmative covenants actively guide borrower behavior.

Common Exceptions to Negative Pledge in Indentures

Common exceptions to negative pledge clauses in indentures often include permitted liens for securing purchase money obligations, liens arising from judgments that are not material to the borrower's financial condition, and liens related to refinancing existing indebtedness. These exceptions allow issuers to maintain operational flexibility without violating covenant restrictions while protecting bondholders from excessive secured debt that could subordinate their claims. Specific carve-outs typically address liens on inventory, equipment, or real property essential to business operations, ensuring seamless asset management within covenant limits.

Legal Implications of Violating Negative Pledge Clauses

Violating negative pledge clauses in an indenture can trigger cross-default provisions, accelerating debt repayment and increasing legal liability for the issuer. Courts may enforce injunctions to prevent further breaches, potentially leading to costly litigation and reputational damage. These legal implications emphasize strict compliance with covenant terms to avoid adverse financial and operational consequences.

Negative Pledge Example: Impact on Borrower's Flexibility

A negative pledge clause in an indenture restricts the borrower from creating secured liens on assets, preserving unsecured creditors' priority but limiting the borrower's ability to secure additional financing. This constraint can reduce the borrower's flexibility by preventing collateralized borrowing, potentially affecting liquidity and expansion capabilities. Lenders benefit by maintaining a higher claim priority, enhancing their protection against asset redistribution.

example of negative pledge in indenture Infographic

samplerz.com

samplerz.com