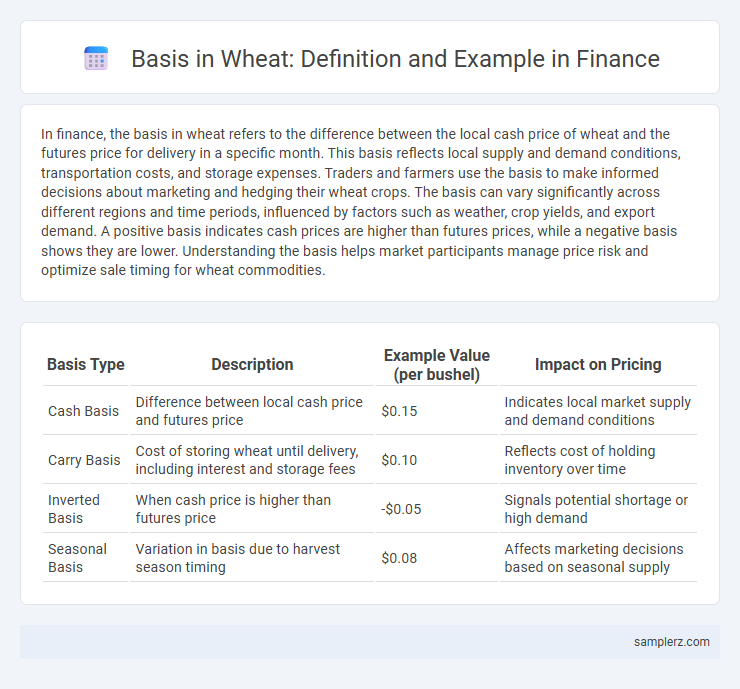

In finance, the basis in wheat refers to the difference between the local cash price of wheat and the futures price for delivery in a specific month. This basis reflects local supply and demand conditions, transportation costs, and storage expenses. Traders and farmers use the basis to make informed decisions about marketing and hedging their wheat crops. The basis can vary significantly across different regions and time periods, influenced by factors such as weather, crop yields, and export demand. A positive basis indicates cash prices are higher than futures prices, while a negative basis shows they are lower. Understanding the basis helps market participants manage price risk and optimize sale timing for wheat commodities.

Table of Comparison

| Basis Type | Description | Example Value (per bushel) | Impact on Pricing |

|---|---|---|---|

| Cash Basis | Difference between local cash price and futures price | $0.15 | Indicates local market supply and demand conditions |

| Carry Basis | Cost of storing wheat until delivery, including interest and storage fees | $0.10 | Reflects cost of holding inventory over time |

| Inverted Basis | When cash price is higher than futures price | -$0.05 | Signals potential shortage or high demand |

| Seasonal Basis | Variation in basis due to harvest season timing | $0.08 | Affects marketing decisions based on seasonal supply |

Understanding Basis in Wheat Markets

Basis in wheat markets represents the difference between the local cash price of wheat and the futures price for a specific delivery month, reflecting supply-demand dynamics at a given location. Farmers and traders use the basis to assess local market conditions, transportation costs, and storage expenses, which influence their pricing and hedging strategies. A narrowing basis often signals increased local supply or reduced demand, while a widening basis indicates tighter supply or stronger demand in the region.

Key Factors Influencing Wheat Basis

Wheat basis is influenced by factors such as local supply and demand conditions, transportation costs, and quality differentials compared to the futures contract grade. Seasonal harvest cycles and regional storage capacity also play crucial roles in basis fluctuations. Understanding these drivers helps traders and producers manage price risk effectively in the wheat market.

How Basis Is Calculated for Wheat

Basis for wheat is calculated as the difference between the local cash price and the futures price for wheat contracts, reflecting regional supply and demand conditions. This value fluctuates daily and is crucial for farmers and traders to make informed marketing decisions. Understanding the basis helps assess price risk and optimize timing for selling or purchasing wheat.

Seasonal Patterns in Wheat Basis

Seasonal patterns in wheat basis exhibit fluctuations due to variations in local supply and demand, transportation costs, and harvest timing. Basis for wheat typically strengthens during harvest months as on-farm storage fills and cash sales increase, while narrowing post-harvest due to increased market availability. Understanding these seasonal trends allows traders and farmers to optimize pricing and hedging strategies effectively.

Example: Positive Basis in Wheat Transactions

A positive basis in wheat occurs when the local cash price exceeds the futures price, indicating strong demand or supply shortages in the cash market. For example, if the futures price for wheat is $5.00 per bushel and the nearby elevator offers $5.20 per bushel, the basis is +$0.20, signaling a premium for immediate delivery. This positive basis often reflects tight local supplies or transportation constraints that elevate cash prices above futures.

Example: Negative Basis in Wheat Transactions

A negative basis in wheat transactions occurs when the local cash price of wheat is lower than the futures price, often due to oversupply or weak demand in the cash market. For example, if the futures price for wheat is $6.00 per bushel and the cash market price is $5.80, the basis is -$0.20, indicating a negative basis. This situation signals traders to consider storage or hedging strategies as the local market conditions diverge from futures market expectations.

Basis and Its Role in Wheat Futures Hedging

Basis in wheat futures hedging represents the difference between the local cash price of wheat and the futures price recorded on a commodities exchange, such as the Chicago Board of Trade (CBOT). This price differential plays a crucial role in risk management by allowing farmers and traders to hedge against price fluctuations before harvest, ensuring more predictable revenue. Precise monitoring of basis trends helps optimize contract timing and improves the effectiveness of hedging strategies in volatile wheat markets.

Real-World Basis Arbitrage in Wheat Trading

Basis in wheat trading represents the difference between the local cash price and the futures price of wheat at a specific time. Real-world basis arbitrage occurs when traders exploit pricing discrepancies across geographical markets or between spot and futures markets to lock in risk-free profits. For example, if the cash price of wheat in Kansas is significantly lower than the futures price on the Chicago Board of Trade, a trader might buy wheat locally and simultaneously sell futures contracts, profiting from the convergence of prices at contract expiration.

Impact of Transportation Costs on Wheat Basis

Transportation costs significantly influence the wheat basis, defined as the difference between local cash prices and futures prices. Higher freight expenses increase the basis by raising the local price relative to futures, reflecting the added cost to move wheat from production areas to market centers. Efficient logistics and lower transportation costs help narrow the basis, enhancing profitability for grain producers and traders.

Strategies for Managing Basis Risk in Wheat

Basis risk in wheat, defined as the difference between local cash prices and futures prices, can significantly impact profitability for producers and traders. Strategies such as utilizing cash-futures hedging, selecting contract delivery locations aligned with the basis, and monitoring historical basis patterns help mitigate exposure. Employing forward contracting combined with regular basis analysis ensures more stable revenue against fluctuating market conditions.

example of basis in wheat Infographic

samplerz.com

samplerz.com