Ring-fencing in banking involves isolating a bank's critical operations or assets to protect them from financial risks faced by other parts of the institution. A common example is the separation of retail banking activities from investment banking services. This structured division ensures that customer deposits and essential banking functions remain secure, even if riskier investment operations experience losses. The UK's implementation of ring-fencing rules after the 2008 financial crisis illustrates this concept effectively. Major banks were required to create legally distinct entities to shield retail banking from volatile investment divisions. This measure protects depositors and maintains financial stability by minimizing the contagion risk during economic downturns or financial distress within investment arms.

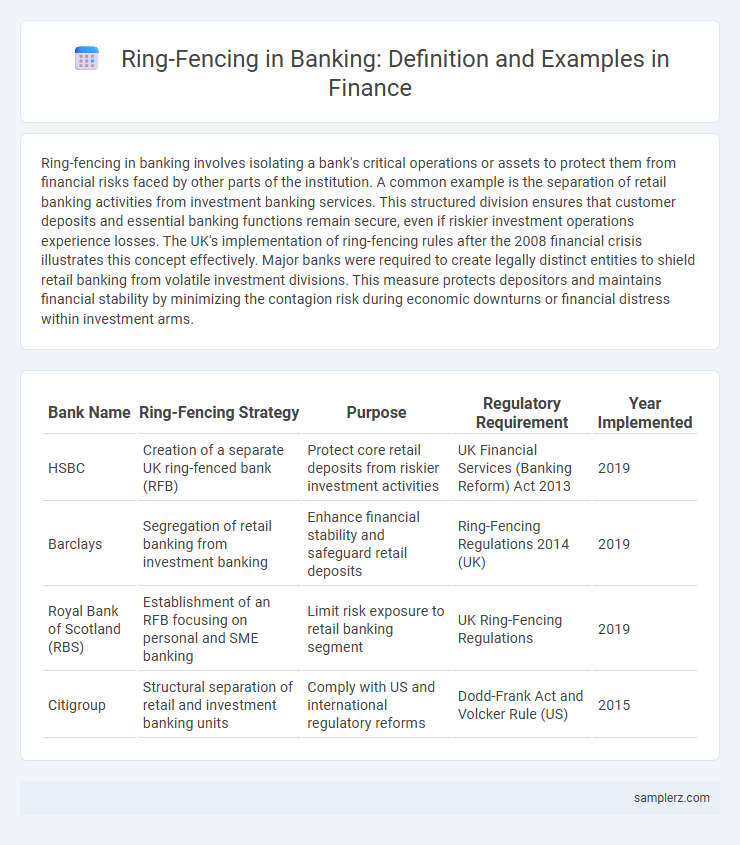

Table of Comparison

| Bank Name | Ring-Fencing Strategy | Purpose | Regulatory Requirement | Year Implemented |

|---|---|---|---|---|

| HSBC | Creation of a separate UK ring-fenced bank (RFB) | Protect core retail deposits from riskier investment activities | UK Financial Services (Banking Reform) Act 2013 | 2019 |

| Barclays | Segregation of retail banking from investment banking | Enhance financial stability and safeguard retail deposits | Ring-Fencing Regulations 2014 (UK) | 2019 |

| Royal Bank of Scotland (RBS) | Establishment of an RFB focusing on personal and SME banking | Limit risk exposure to retail banking segment | UK Ring-Fencing Regulations | 2019 |

| Citigroup | Structural separation of retail and investment banking units | Comply with US and international regulatory reforms | Dodd-Frank Act and Volcker Rule (US) | 2015 |

Understanding Ring-Fencing in Banking

Ring-fencing in banking refers to the practice of legally separating a bank's core retail banking activities from its investment and riskier operations to protect consumer deposits and maintain financial stability. An example is the UK's implementation of ring-fencing rules under the Financial Services (Banking Reform) Act 2013, requiring major banks like HSBC and Barclays to isolate their retail banking arms from investment banking units by 2019. This measure ensures that essential banking services remain insulated from potential losses arising from high-risk trading activities, safeguarding both customers and the broader financial system.

Historical Background of Ring-Fencing

Ring-fencing in banking emerged prominently after the 2008 global financial crisis to protect retail banking operations from risky investment activities. The UK's implementation of the Banking Reform Act 2013 mandated major banks to separate core retail banking from investment banking to reduce systemic risk and safeguard consumer deposits. This structural reform aimed to enhance financial stability by isolating essential banking services from volatile market activities.

Regulatory Drivers Behind Ring-Fencing

Regulatory drivers behind ring-fencing in banking primarily aim to protect core retail banking services from risks associated with investment banking activities, enhancing financial stability. The UK's Financial Services (Banking Reform) Act 2013 mandates ring-fencing to ensure retail deposits remain secure and accessible during market turbulence. Basel III regulations further reinforce capital and liquidity requirements, compelling banks to separate critical infrastructure and reduce systemic risk exposure.

Key Objectives of Banking Ring-Fencing

Banking ring-fencing aims to protect retail deposits by isolating consumer banking operations from high-risk investment activities, thereby ensuring financial stability during market volatility. Key objectives include safeguarding essential banking services, minimizing contagion risk in systemic crises, and enhancing overall confidence in the banking sector. This regulatory mechanism helps maintain liquidity and operational continuity for critical retail functions amidst potential investment banking losses.

Real-World Examples of Ring-Fencing

Ring-fencing in banking is exemplified by the UK's Financial Services (Banking Reform) Act 2013, which mandates the separation of retail banking from investment banking activities to protect consumer deposits. Barclays Group implemented ring-fencing by isolating its retail division to ensure stability and minimize risk exposure from trading operations. This approach enhances financial resilience, limiting contagion effects during market upheavals and safeguarding critical banking services.

Case Study: UK’s Banking Ring-Fence

The UK's Banking Ring-Fence, introduced under the Financial Services (Banking Reform) Act 2013, mandates the separation of retail banking services from investment banking to protect consumers and maintain financial stability. Major banks like HSBC and Barclays established distinct subsidiaries for everyday banking activities, isolating them from riskier trading operations. This regulatory framework enhances transparency, reduces systemic risk, and ensures that retail banking services remain operational during market turbulence.

Ring-Fencing in the European Banking Sector

Ring-fencing in the European banking sector involves legally separating retail banking operations from investment banking activities to protect consumer deposits and maintain financial stability. The UK's implementation of the ring-fencing rule under the Financial Services (Banking Reform) Act 2013 requires major banks to isolate core domestic retail services from riskier trading operations. This regulatory measure aims to prevent the contagion of financial shocks within banking groups and ensure that essential banking services remain resilient during market stress.

Impact of Ring-Fencing on Financial Stability

Ring-fencing in banking involves separating core retail banking activities from riskier investment banking operations to protect consumer deposits and ensure the continuity of essential services. This structural separation enhances financial stability by reducing the risk of contagion during market stress and limiting the likelihood of taxpayer-funded bailouts. Empirical studies show that ring-fencing strengthens capital buffers and improves risk management frameworks, contributing to a more resilient banking sector.

Challenges Faced During Implementation

Ring-fencing in banking, which involves separating retail banking from investment activities to protect consumer deposits, faces significant challenges such as increased operational complexity and high compliance costs. Banks must redesign internal systems and processes to ensure legal and financial segregation, often leading to inefficiencies and reduced profitability. Regulatory ambiguity and varying jurisdictional requirements further complicate implementation, risking delays and inconsistent enforcement.

Future Outlook for Ring-Fencing in Banking

The future outlook for ring-fencing in banking emphasizes enhanced regulatory frameworks aimed at protecting retail deposits and critical payment systems from investment banking risks. Major financial hubs like the UK and EU are expected to refine ring-fencing rules to balance financial stability with market efficiency. Technological advancements and increased data transparency will support regulators in monitoring compliance and adapting policies to evolving market dynamics.

example of ring-fencing in banking Infographic

samplerz.com

samplerz.com