Alpha in hedge funds refers to the measure of an investment's performance relative to a benchmark index, representing the value a hedge fund manager adds beyond market returns. For example, if a hedge fund generates a 12% return while its benchmark index returns 8%, the alpha is 4%, indicating superior skill in selecting investments or timing the market. This metric is crucial for investors seeking funds that outperform passive benchmarks through active management. Hedge funds employ various strategies to achieve alpha, including long/short equity, event-driven, and global macro approaches. Data-driven analysis and alternative data sources often help managers identify mispriced securities or market inefficiencies. Tracking alpha allows investors to evaluate not only raw returns but also the effectiveness of the manager in generating excess returns adjusted for risk.

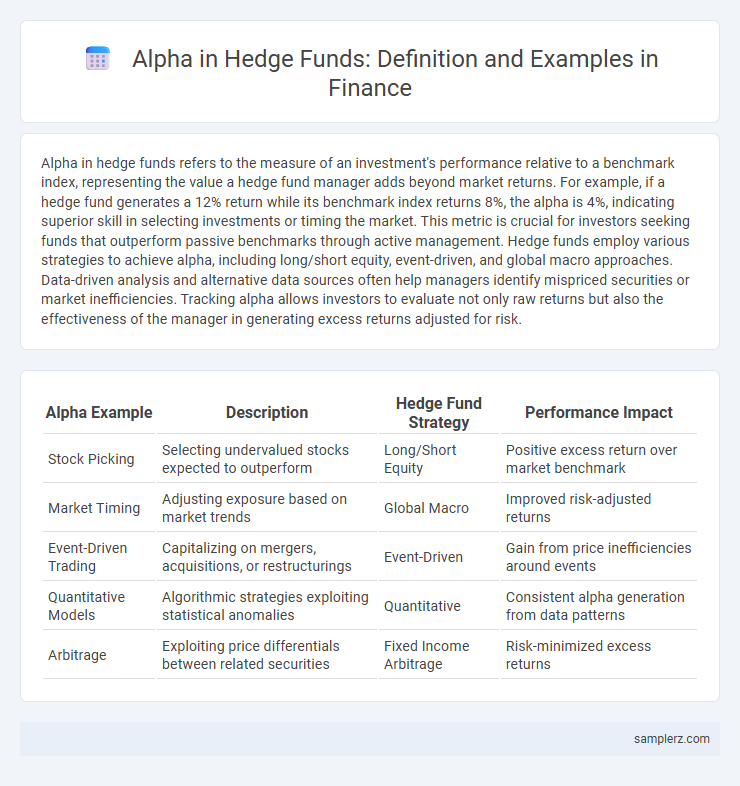

Table of Comparison

| Alpha Example | Description | Hedge Fund Strategy | Performance Impact |

|---|---|---|---|

| Stock Picking | Selecting undervalued stocks expected to outperform | Long/Short Equity | Positive excess return over market benchmark |

| Market Timing | Adjusting exposure based on market trends | Global Macro | Improved risk-adjusted returns |

| Event-Driven Trading | Capitalizing on mergers, acquisitions, or restructurings | Event-Driven | Gain from price inefficiencies around events |

| Quantitative Models | Algorithmic strategies exploiting statistical anomalies | Quantitative | Consistent alpha generation from data patterns |

| Arbitrage | Exploiting price differentials between related securities | Fixed Income Arbitrage | Risk-minimized excess returns |

Defining Alpha in Hedge Fund Strategies

Alpha in hedge fund strategies represents the excess return generated beyond the benchmark index, reflecting the manager's skill in security selection and market timing. For example, a hedge fund achieving a 12% return when the S&P 500 returns 8% has an alpha of 4%, indicating effective active management. This metric is crucial for investors to assess the value added by hedge fund managers in portfolio performance.

Key Drivers of Alpha Generation

Key drivers of alpha generation in hedge funds include skilled stock selection, market timing, and effective risk management strategies that outperform benchmarks. Employing advanced quantitative models and exploiting market inefficiencies also contribute significantly to consistent alpha production. Furthermore, leveraging expertise in alternative assets and dynamic portfolio allocation enhances the hedge fund's ability to generate positive excess returns.

Quantitative Alpha: Data-Driven Approaches

Quantitative alpha in hedge funds leverages advanced statistical models and machine learning algorithms to identify mispriced assets and market inefficiencies. By analyzing vast datasets, including price trends, macroeconomic indicators, and alternative data sources, these data-driven approaches generate predictive signals that outperform traditional investment strategies. Firms employing quantitative alpha often achieve superior risk-adjusted returns by systematically exploiting patterns invisible to human analysis.

Fundamental Analysis and Alpha Creation

Hedge funds generate alpha by leveraging fundamental analysis to identify undervalued securities through detailed evaluation of financial statements, market trends, and economic indicators. This rigorous approach enables portfolio managers to uncover mispriced assets and execute strategic trades that outperform benchmark indices. Consistent alpha creation hinges on deep sector expertise, comprehensive financial modeling, and disciplined risk management within the hedge fund's investment process.

Market Neutral Strategies: Achieving Pure Alpha

Market neutral strategies in hedge funds aim to generate pure alpha by simultaneously taking long and short positions to neutralize market risk and capture returns driven solely by security selection. By balancing equity exposure, these funds seek consistent positive alpha regardless of market direction. Empirical data shows market neutral funds typically achieve 4-6% annual alpha, outperforming traditional long-only benchmarks during volatile periods.

Case Study: Successful Alpha Generation in Hedge Funds

A notable example of alpha generation in hedge funds is Renaissance Technologies, which consistently delivered annualized returns exceeding 30% through quantitative strategies that exploit market inefficiencies. Their Medallion Fund's proprietary algorithms analyze massive datasets to identify subtle pricing anomalies, generating alpha that outperforms traditional benchmarks like the S&P 500 by substantial margins. This case study highlights how advanced data-driven models and machine learning can produce sustained alpha in highly competitive financial markets.

Measuring and Sustaining Alpha Performance

Alpha in hedge funds is measured by comparing the fund's returns to a benchmark index, isolating the value added by active management after adjusting for risk. Sustaining alpha requires rigorous risk management, continuous market analysis, and adaptive investment strategies to capitalize on shifting market inefficiencies. Consistent outperformance over benchmarks signals successful alpha generation and long-term value creation for investors.

Risk Management for Alpha Preservation

Effective risk management in hedge funds minimizes exposure to market volatility, preserving alpha by employing diversified asset allocation and hedging strategies. Techniques like stop-loss orders, leverage control, and scenario analysis help identify and mitigate potential drawdowns, sustaining consistent returns above benchmarks. By actively monitoring correlations and stress testing portfolios, hedge funds optimize risk-adjusted performance and protect generated alpha from adverse market movements.

Emerging Trends in Alpha Generation

Hedge funds generate alpha by leveraging emerging trends such as artificial intelligence-driven quantitative models and alternative data sources, including social media sentiment and satellite imagery analytics. Incorporating machine learning algorithms enhances predictive accuracy, enabling dynamic portfolio adjustments in volatile markets. These innovative strategies contribute to superior risk-adjusted returns, setting a new standard in alpha generation within the hedge fund industry.

Challenges in Maintaining Hedge Fund Alpha

Maintaining hedge fund alpha is challenged by market volatility, increased competition, and rising operational costs that erode returns. Quantitative models often struggle to adapt to rapid shifts in market dynamics, leading to alpha decay. Regulatory changes and investor redemptions further complicate consistent alpha generation, forcing hedge funds to continuously innovate risk management and investment strategies.

example of alpha in hedge fund Infographic

samplerz.com

samplerz.com