In private equity, clawback provisions are designed to ensure fair distribution of profits between general partners (GPs) and limited partners (LPs). When the total returns from an investment fall below a certain threshold after initial distributions, GPs may be required to return previously received carried interest to the LPs. This mechanism protects LPs from overpayment and aligns the interests of both parties throughout the investment lifecycle. A common example of clawback occurs during the final liquidation of a fund when cumulative losses reduce earlier gains. Suppose a GP received carried interest based on preliminary profits, but subsequent asset devaluations cause the fund's overall returns to drop below the preferred return hurdle for LPs. The clawback clause mandates the GP to reimburse the excess carried interest, ensuring LPs achieve their minimum agreed-upon returns before GPs retain profit shares.

Table of Comparison

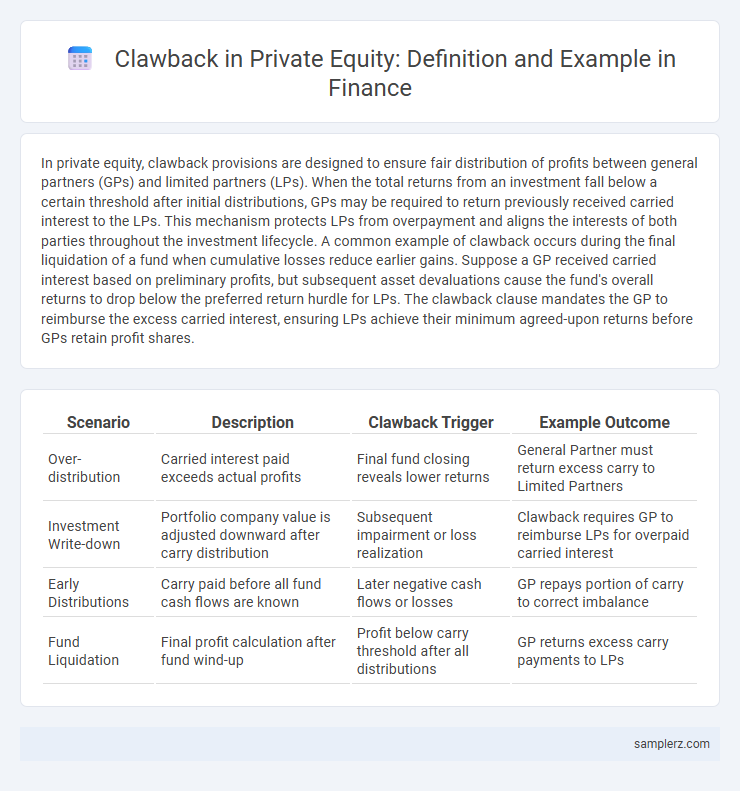

| Scenario | Description | Clawback Trigger | Example Outcome |

|---|---|---|---|

| Over-distribution | Carried interest paid exceeds actual profits | Final fund closing reveals lower returns | General Partner must return excess carry to Limited Partners |

| Investment Write-down | Portfolio company value is adjusted downward after carry distribution | Subsequent impairment or loss realization | Clawback requires GP to reimburse LPs for overpaid carried interest |

| Early Distributions | Carry paid before all fund cash flows are known | Later negative cash flows or losses | GP repays portion of carry to correct imbalance |

| Fund Liquidation | Final profit calculation after fund wind-up | Profit below carry threshold after all distributions | GP returns excess carry payments to LPs |

Understanding Clawbacks in Private Equity

Clawbacks in private equity occur when general partners must return excess carried interest to limited partners if distributions exceed the agreed profit-sharing terms. These provisions ensure fair return allocation by allowing limited partners to recover portions paid in advance when fund performance declines or assets are sold at lower-than-expected valuations. Understanding clawback mechanisms is crucial for aligning incentives and mitigating risks in private equity fund management.

Key Scenarios Triggering Clawbacks

In private equity, key scenarios triggering clawbacks often include underperformance of portfolio companies resulting in lower-than-expected returns, enabling limited partners (LPs) to reclaim excess carried interest paid to general partners (GPs). Another common trigger arises from accounting adjustments or restatements that reveal prior overpayments linked to distributable profits. Fraudulent activities or mismanagement can also activate clawback provisions, ensuring LPs are compensated for breaches of fiduciary duty or unethical conduct.

Real-World Clawback Provisions Explained

In private equity, clawback provisions ensure that general partners return excess carried interest if fund performance declines after initial distributions, maintaining fairness between limited and general partners. A typical example occurs when early fund exits generate significant profits leading to advance carried interest payments, but subsequent investments underperform, triggering the clawback mechanism. These provisions align interests by requiring repayment to limited partners, safeguarding their capital against disproportionate earnings by general partners over the fund's lifespan.

How Clawbacks Protect Limited Partners

Clawbacks in private equity protect limited partners by ensuring the general partners return excess carried interest if total profits fall below a predetermined hurdle rate, maintaining a fair profit distribution. This mechanism aligns the interests of both parties by preventing general partners from retaining disproportionate gains during early profitable exits. By enforcing clawbacks, limited partners are safeguarded from overpayment, promoting transparency and trust in fund performance.

High-Profile Clawback Cases in Private Equity

High-profile clawback cases in private equity often involve fund managers returning previously distributed carried interest after underperformance or fraud is uncovered, such as the KKR case where $30 million was reclaimed due to missed return hurdles. Another notable example is the Apollo Global Management incident where clawbacks amounted to $100 million after the fund failed to meet its internal rate of return targets. These cases highlight the critical role clawbacks play in aligning fund managers' incentives with investor interests and maintaining fiduciary accountability.

Steps in Enforcing Private Equity Clawbacks

Private equity clawbacks are enforced by first conducting a thorough audit to identify excess distributions to general partners exceeding their agreed-upon carried interest. Next, fund administrators calculate the precise amount to be returned, ensuring alignment with the limited partnership agreement's terms. Finally, the general partner is required to repay the excess proceeds, restoring equitable distribution between limited partners and general partners.

Impact of Clawback Clauses on GP Compensation

Clawback clauses in private equity ensure that general partners (GPs) return excess carried interest if fund performance declines or limited partners (LPs) experience losses, aligning GP compensation with long-term fund success. These provisions impact GP earnings by potentially reducing carried interest payouts when early profits are reversed, promoting prudent investment decisions. As a result, clawbacks protect LPs and incentivize GPs to maintain consistent fund performance across the investment horizon.

Legal Considerations of Clawback Enforcement

Clawback provisions in private equity agreements are legally enforceable mechanisms that require fund managers to return previously distributed carried interest if certain performance thresholds are not met. Enforcement often involves complex contractual interpretations and jurisdiction-specific securities laws, making legal counsel essential for navigating disputes. Courts typically evaluate the clarity of the clawback clause, timing of distributions, and the fund's compliance with fiduciary duties during enforcement proceedings.

Structuring Effective Clawback Agreements

Structuring effective clawback agreements in private equity involves clearly defining the conditions under which fund managers must return previously earned carried interest if subsequent losses occur. Key components include specifying performance hurdles, timeframes for clawback triggers, and mechanisms for calculating refunds to ensure alignment of interests between investors and general partners. Precise legal language and transparent reporting protocols enhance enforceability and protect limited partners' capital.

Lessons Learned from Clawback Disputes

Clawback disputes in private equity commonly arise when limited partners demand the return of previously distributed profits due to underperformance or misalignment of carried interest calculations. Key lessons learned include the necessity of transparent waterfall provisions and clear definitions of carried interest to prevent misunderstandings and costly legal battles. Implementing robust audit rights and regular financial reconciliations can mitigate risks and ensure timely resolution of potential clawback claims.

example of clawback in private equity Infographic

samplerz.com

samplerz.com