The Troubled Asset Relief Program (TARP) was a significant financial bailout initiated by the U.S. government in 2008 during the global financial crisis. This program enabled the U.S. Treasury to purchase or insure up to $700 billion of troubled assets from financial institutions. One prominent example of TARP in action was the bailout of the American International Group (AIG), where the government provided an $85 billion rescue package to prevent the insurer's collapse. TARP also supported major banks like Citigroup and Bank of America by injecting capital through preferred stock purchases, stabilizing their balance sheets. Data from the U.S. Treasury shows that these interventions helped restore market confidence and liquidity in the financial system. By 2014, the Treasury had recovered most of the funds invested under TARP, demonstrating the program's role in crisis mitigation through strategic asset acquisition and capital injection.

Table of Comparison

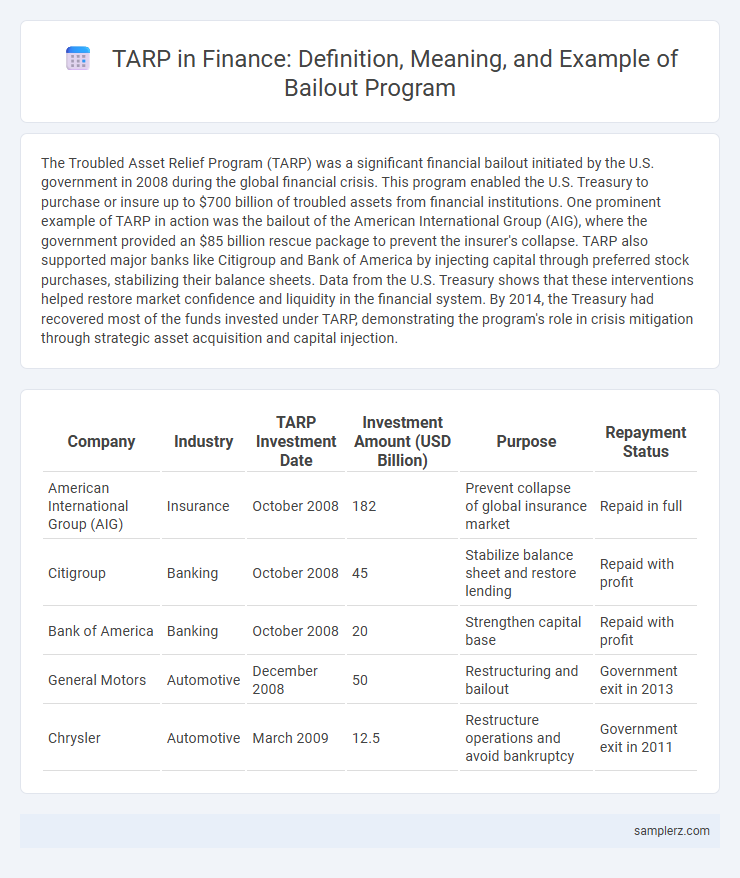

| Company | Industry | TARP Investment Date | Investment Amount (USD Billion) | Purpose | Repayment Status |

|---|---|---|---|---|---|

| American International Group (AIG) | Insurance | October 2008 | 182 | Prevent collapse of global insurance market | Repaid in full |

| Citigroup | Banking | October 2008 | 45 | Stabilize balance sheet and restore lending | Repaid with profit |

| Bank of America | Banking | October 2008 | 20 | Strengthen capital base | Repaid with profit |

| General Motors | Automotive | December 2008 | 50 | Restructuring and bailout | Government exit in 2013 |

| Chrysler | Automotive | March 2009 | 12.5 | Restructure operations and avoid bankruptcy | Government exit in 2011 |

Overview of TARP in Financial Bailouts

The Troubled Asset Relief Program (TARP) was established in 2008 to stabilize the U.S. financial system during the global financial crisis by purchasing toxic assets and injecting capital into banks. It authorized up to $700 billion to restore liquidity, support lending, and instill confidence in distressed institutions. TARP's interventions, including capital purchases and guarantees, played a crucial role in preventing further economic collapse and facilitating recovery.

Key Objectives of the TARP Program

The Troubled Asset Relief Program (TARP) aimed to stabilize the financial system by purchasing toxic assets and injecting capital into banks to restore liquidity and confidence. Key objectives included preventing further collapse of financial institutions, promoting the resumption of lending to businesses and consumers, and preserving homeownership by assisting struggling borrowers. Through these targeted interventions, TARP sought to mitigate systemic risks and support economic recovery during the 2008 financial crisis.

Timeline of TARP Implementation

The Troubled Asset Relief Program (TARP) was authorized by the Emergency Economic Stabilization Act on October 3, 2008, with $700 billion allocated to stabilize the financial system. Initial disbursements began in October 2008, targeting banks and financial institutions to restore liquidity and confidence during the 2008 financial crisis. By 2010, key TARP programs like the Capital Purchase Program had disbursed over $200 billion, while repayments and recoveries gradually reduced the outstanding balance.

Major Banks Benefiting from TARP

Major banks benefiting from TARP included JPMorgan Chase, Bank of America, and Citigroup, which received substantial capital injections to stabilize their operations during the 2008 financial crisis. The Troubled Asset Relief Program allocated approximately $205 billion to these institutions to restore liquidity and encourage lending. This government intervention played a crucial role in preventing the collapse of the U.S. financial system by reinforcing the balance sheets of these major banks.

Case Study: Citigroup’s TARP Bailout

Citigroup received $45 billion from the Troubled Asset Relief Program (TARP) during the 2008 financial crisis to stabilize its operations and restore investor confidence. The bailout enabled Citigroup to shore up its balance sheet by purchasing toxic assets and replenishing capital reserves. Post-TARP, Citigroup gradually repaid the loan by 2010, avoiding bankruptcy and maintaining its status as a major global financial institution.

Impact of TARP on the US Economy

The Troubled Asset Relief Program (TARP) played a critical role in stabilizing the US financial system during the 2008 crisis by injecting over $700 billion into banks and financial institutions. TARP's capital injections helped restore investor confidence, prevent a deeper recession, and promote credit flow to businesses and consumers. Studies estimate that TARP contributed to saving millions of jobs and accelerating economic recovery by supporting key sectors such as housing and automotive industries.

Repayment and Exit Strategies under TARP

The Troubled Asset Relief Program (TARP) included structured repayment and exit strategies to ensure taxpayer funds were recovered efficiently. Financial institutions repaid TARP investments through capital injections, dividends, and debt repayments, often exceeding initial disbursements to generate positive returns. Exit strategies involved gradual stock sales, warrant exercises, and debt maturities, allowing the Treasury to minimize market disruption and maximize recovery.

Criticisms and Controversies of TARP

TARP, the Troubled Asset Relief Program, faced significant criticism for its perceived favoritism towards large financial institutions while offering limited direct relief to struggling homeowners. Critics argued that TARP's implementation lacked transparency, leading to concerns about accountability and the proper use of taxpayer funds. Controversies also arose over the scope of executive compensation and bonuses paid to bank executives despite receiving bailout money.

Lessons Learned from the TARP Example

The Troubled Asset Relief Program (TARP) demonstrated the importance of swift government intervention in stabilizing financial markets during crises. Key lessons include the necessity for transparent communication and mechanisms that balance risk mitigation with accountability to taxpayers. The experience highlighted that well-structured bailouts can restore confidence without encouraging reckless behavior, reinforcing the need for clear exit strategies and regulatory reforms.

TARP’s Influence on Future Bailout Policies

The Troubled Asset Relief Program (TARP) set a precedent by demonstrating government intervention through capital injections to stabilize major financial institutions during the 2008 crisis, impacting regulatory frameworks for risk management. Its structured approach influenced subsequent bailout policies by emphasizing accountability measures such as executive compensation limits and strict oversight requirements. TARP's legacy persists in shaping contingency planning, promoting transparency, and balancing systemic risk mitigation with market discipline in future financial rescue operations.

example of TARP in bailout Infographic

samplerz.com

samplerz.com