Carry trade in finance involves borrowing funds in a currency with low interest rates and investing in assets denominated in a currency with higher yields. A common example is borrowing Japanese yen at near-zero interest rates and converting it to Australian dollars to invest in Australian government bonds offering higher returns. Investors profit from the interest rate differential while managing exchange rate risk. This strategy relies heavily on stable or predictable currency movements to lock in gains from the interest rate spread. Significant fluctuations in currency exchange rates can erode profits or cause losses despite favorable interest differentials. Central bank policies and global economic conditions play a crucial role in creating and sustaining carry trade opportunities.

Table of Comparison

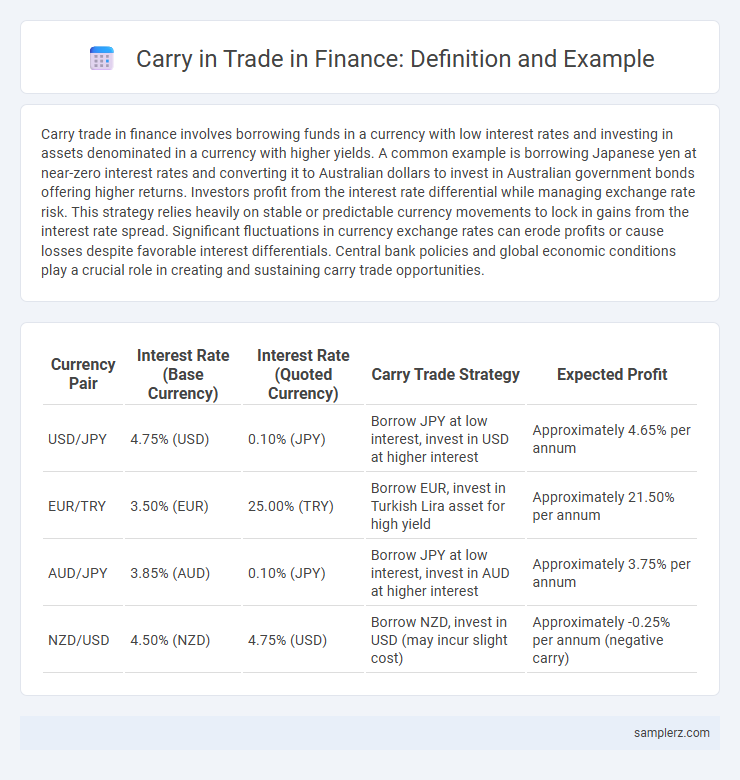

| Currency Pair | Interest Rate (Base Currency) | Interest Rate (Quoted Currency) | Carry Trade Strategy | Expected Profit |

|---|---|---|---|---|

| USD/JPY | 4.75% (USD) | 0.10% (JPY) | Borrow JPY at low interest, invest in USD at higher interest | Approximately 4.65% per annum |

| EUR/TRY | 3.50% (EUR) | 25.00% (TRY) | Borrow EUR, invest in Turkish Lira asset for high yield | Approximately 21.50% per annum |

| AUD/JPY | 3.85% (AUD) | 0.10% (JPY) | Borrow JPY at low interest, invest in AUD at higher interest | Approximately 3.75% per annum |

| NZD/USD | 4.50% (NZD) | 4.75% (USD) | Borrow NZD, invest in USD (may incur slight cost) | Approximately -0.25% per annum (negative carry) |

Understanding the Concept of Carry in Trade

Carry in trade involves borrowing funds in a low-interest-rate currency to invest in assets that yield higher returns, capitalizing on the interest rate differential. For example, a trader might borrow Japanese yen at near-zero rates and invest in high-yielding Australian government bonds, profiting from the spread after accounting for exchange rate fluctuations. This strategy depends on stable currency markets and interest rate differentials to generate consistent returns.

Historical Examples of Successful Carry Trades

The 1990s Japanese yen carry trade is a classic example, where investors borrowed low-yielding yen to invest in higher-yielding assets like Australian and New Zealand dollars, generating substantial returns. Another notable case occurred in the early 2000s with the U.S. dollar carry trade, as low Federal Reserve interest rates encouraged borrowing in dollars to fund investments in emerging markets with higher yields. These historical carry trades highlight how interest rate differentials and currency movements drive profitability in carry trade strategies.

Popular Currency Pairs Used in Carry Trades

Popular currency pairs used in carry trades often include the AUD/JPY, NZD/JPY, and USD/TRY due to their interest rate differentials. Traders borrow in low-yielding currencies like the Japanese yen while investing in high-yielding currencies such as the Australian dollar or Turkish lira to profit from the rate spread. These pairs are favored for their liquidity and relatively stable economic environments that support consistent carry trade strategies.

How Interest Rate Differentials Drive Carry Trades

Interest rate differentials between countries create opportunities for carry trades by allowing investors to borrow funds in low-interest-rate currencies and invest in higher-yielding assets abroad. For example, traders may borrow Japanese yen at near-zero rates and convert them into Australian dollars to invest in high-yield Australian government bonds, profiting from the interest rate gap. Exchange rate stability and central bank policies significantly influence the risk and return dynamics of these carry trade strategies.

Real-World Carry Trade Strategies

Real-world carry trade strategies often involve borrowing in low-interest-rate currencies, such as the Japanese yen, and investing in higher-yielding assets like emerging market bonds or Australian dollar-denominated securities. These trades capitalize on the interest rate differentials while managing risks associated with currency fluctuations through hedging techniques or dynamic currency exposure adjustments. Successful execution relies on macroeconomic analysis, interest rate forecasts, and liquidity considerations to optimize carry returns and mitigate potential losses.

Risks Illustrated by Famous Carry Trade Failures

The 1994 Mexican Peso Crisis exemplifies carry trade risks, where investors borrowed in low-yield U.S. dollars and invested in high-yield Mexican bonds before a sudden peso devaluation caused massive losses. Similarly, the 1997 Asian Financial Crisis highlighted the danger of carry trades funded by short-term borrowing in stable currencies and invested in vulnerable emerging markets, leading to rapid capital flight. The 2008 Global Financial Crisis further exposed carry trade vulnerabilities as funding liquidity evaporated, forcing unwinding of positions and severe asset price drops.

The Role of Leverage in Carry Trading

Leverage amplifies the potential returns in carry trading by allowing investors to borrow funds at low interest rates and invest in higher-yielding assets, such as foreign currencies or bonds. For example, a trader might borrow Japanese yen at near-zero interest and convert it into Australian dollars, which offer higher interest rates, profiting from the interest rate differential. However, the use of leverage also increases exposure to currency risk, making risk management critical in carry trade strategies.

Regulatory Impact on Carry Trade Activities

Carry trade strategies often involve borrowing in low-interest-rate currencies such as the Japanese yen and investing in higher-yield assets like Australian government bonds. Regulatory developments, including stricter capital requirements and enhanced reporting standards by the Basel III framework, have increased compliance costs and reduced leverage opportunities for carry traders. Central bank interventions and currency controls further impact the profitability and risk management of carry trade portfolios.

Case Study: The Yen Carry Trade Phenomenon

The Yen Carry Trade involves borrowing Japanese yen at its historically low-interest rates and converting the proceeds into higher-yielding currencies, such as the Australian dollar or Brazilian real, to profit from interest rate differentials. During the early 2000s, investors capitalized on Japan's near-zero interest rates, leveraging carry trades to boost returns, although the strategy faced significant risks when currency volatility surged during the 2008 financial crisis. This case study highlights how interest rate policies and exchange rate dynamics play critical roles in the profitability and risks associated with carry trade strategies.

Key Lessons Learned from Carry Trade Examples

Carry trade examples reveal the critical lesson of managing exchange rate risk, as currency fluctuations can quickly erode potential profits. Successful carry trades emphasize the importance of leveraging interest rate differentials while maintaining strict risk controls to protect against sudden market reversals. Understanding macroeconomic indicators and central bank policies is essential for timing entry and exit points in carry trades effectively.

example of carry in trade Infographic

samplerz.com

samplerz.com