A prime example of a toxic asset during a financial crisis is mortgage-backed securities (MBS) tied to subprime loans. These assets lost significant value when borrowers defaulted at high rates, leading to massive losses for financial institutions. The deterioration of MBS triggered widespread insolvency concerns and eroded market confidence during the 2008 financial crisis. Another case of toxic assets includes collateralized debt obligations (CDOs) with poor-quality underlying loans. As defaults increased, the market for these CDOs collapsed, causing severe liquidity shortages and impairing bank balance sheets. Data from the crisis shows billions of dollars in write-downs related to these toxic assets, contributing to the global credit crunch.

Table of Comparison

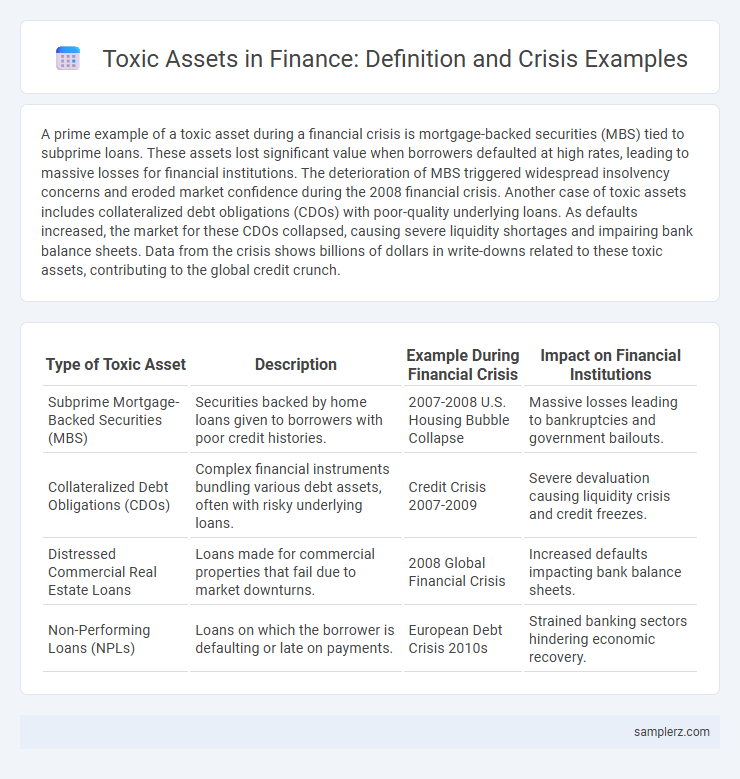

| Type of Toxic Asset | Description | Example During Financial Crisis | Impact on Financial Institutions |

|---|---|---|---|

| Subprime Mortgage-Backed Securities (MBS) | Securities backed by home loans given to borrowers with poor credit histories. | 2007-2008 U.S. Housing Bubble Collapse | Massive losses leading to bankruptcies and government bailouts. |

| Collateralized Debt Obligations (CDOs) | Complex financial instruments bundling various debt assets, often with risky underlying loans. | Credit Crisis 2007-2009 | Severe devaluation causing liquidity crisis and credit freezes. |

| Distressed Commercial Real Estate Loans | Loans made for commercial properties that fail due to market downturns. | 2008 Global Financial Crisis | Increased defaults impacting bank balance sheets. |

| Non-Performing Loans (NPLs) | Loans on which the borrower is defaulting or late on payments. | European Debt Crisis 2010s | Strained banking sectors hindering economic recovery. |

Understanding Toxic Assets: A Brief Overview

Toxic assets refer to financial assets that have significantly lost value and lack a market buyer, often causing substantial losses to holders during financial crises. Mortgage-backed securities (MBS) tied to subprime loans are prime examples, as they became illiquid and deeply devalued during the 2007-2008 financial crisis. Understanding these assets is crucial for risk management and regulatory practices to prevent systemic failures in the banking sector.

The Role of Toxic Assets in Financial Crises

Toxic assets, such as mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), played a central role in the 2008 financial crisis by losing substantial value and impairing financial institutions' balance sheets. These illiquid assets created cascading losses, leading to a credit crunch and necessitating massive government interventions like the Troubled Asset Relief Program (TARP). The opacity and complexity of toxic assets undermined market confidence and amplified systemic risk across global financial markets.

Notorious Toxic Assets from the 2008 Global Financial Crisis

Mortgage-backed securities (MBS) containing subprime loans became notorious toxic assets during the 2008 Global Financial Crisis, causing widespread losses for banks and investors. Collateralized debt obligations (CDOs) linked to these subprime mortgages amplified risk exposure and led to severe liquidity shortages in financial markets. The collapse of these assets triggered major bank failures and government bailouts, exemplifying systemic risk in the global financial system.

Subprime Mortgage-Backed Securities: A Prime Example

Subprime mortgage-backed securities (MBS) played a central role in the 2008 financial crisis by bundling high-risk home loans into complex financial products. These assets experienced massive defaults when borrowers with poor credit failed to meet mortgage payments, causing widespread losses. The collapse of these toxic assets triggered severe liquidity shortages and bank failures across the global financial system.

Collateralized Debt Obligations (CDOs) as Toxic Assets

Collateralized Debt Obligations (CDOs) exemplify toxic assets that played a pivotal role during the 2008 financial crisis by repackaging high-risk mortgage loans into complex securities with misleading credit ratings. These CDOs contained subprime mortgages that defaulted at unprecedented rates, causing massive losses for financial institutions and triggering widespread market instability. The opacity and complexity of CDO structures obscured their true risk, amplifying systemic vulnerabilities in global financial markets.

The Impact of Credit Default Swaps During a Crisis

Credit default swaps (CDS) played a critical role in amplifying the toxicity of mortgage-backed securities during the 2008 financial crisis by enabling excessive risk-taking and obfuscating true asset quality. The widespread use of CDS on subprime mortgage assets contributed to a cascade of defaults and massive losses for financial institutions, intensifying market instability and credit freezes. This loss of confidence in toxic assets backed by CDS contracts triggered severe liquidity shortages and widespread deleveraging across the global financial system.

Illiquid Commercial Real Estate Loans: A Crisis Case

Illiquid commercial real estate loans became a prime example of toxic assets during financial crises, as their complex structures and diminished market demand led to severe valuation challenges. These loans typically involved properties that were difficult to sell quickly without significant losses, causing banks to face substantial write-downs. The lack of liquidity in these assets exacerbated financial instability, contributing to broader market distress and credit freezes.

Structured Investment Vehicles (SIVs) and Toxic Risk

Structured Investment Vehicles (SIVs) were a prime example of toxic assets during the 2007-2008 financial crisis, as their reliance on short-term funding to finance long-term, illiquid securities created significant liquidity risk. These vehicles often held subprime mortgage-backed securities and other high-risk collateral, causing their asset values to plummet as market confidence eroded. The toxic risk associated with SIVs stemmed from their complex structure and hidden exposures, which amplified systemic instability and forced banks to absorb massive losses.

Toxic Sovereign Debt in Emerging Market Crises

Toxic sovereign debt in emerging market crises often includes defaulted bonds and excessively leveraged government securities that lose value during economic turmoil. These debts became prominent during the 1997 Asian Financial Crisis and the 2001 Argentine default, where sharp currency devaluations and fiscal mismanagement led to widespread investor losses. The persistent inability of these governments to service their obligations amplifies financial instability and restricts access to international capital markets.

Lessons Learned from Toxic Asset Meltdowns

During the 2008 financial crisis, mortgage-backed securities (MBS) exemplified toxic assets that triggered widespread market instability and collapse of major financial institutions. Lessons learned highlight the critical need for improved transparency, rigorous risk assessment, and stringent regulatory oversight to prevent excessive leverage and mispriced credit risk. Enhanced due diligence and proactive stress testing are essential to mitigating systemic vulnerabilities and fostering a resilient financial ecosystem.

example of toxic asset in crisis Infographic

samplerz.com

samplerz.com