A waterfall in private equity refers to the structured sequence of cash flow distributions between investors and fund managers. The distribution typically starts with returning capital contributions to limited partners, followed by the payment of a preferred return, often around 8%. After these hurdles are met, the remaining profits are split according to a predetermined carried interest percentage, commonly 20%, benefiting the general partners. This distribution mechanism ensures alignment of interests between investors and fund managers by prioritizing the return of capital and targeted returns before profit-sharing. Data from recent private equity funds reveal that waterfall models significantly impact investor internal rates of return (IRR) and overall fund performance metrics. Analyzing waterfall structures helps stakeholders understand risk and reward dynamics inherent in private equity investments.

Table of Comparison

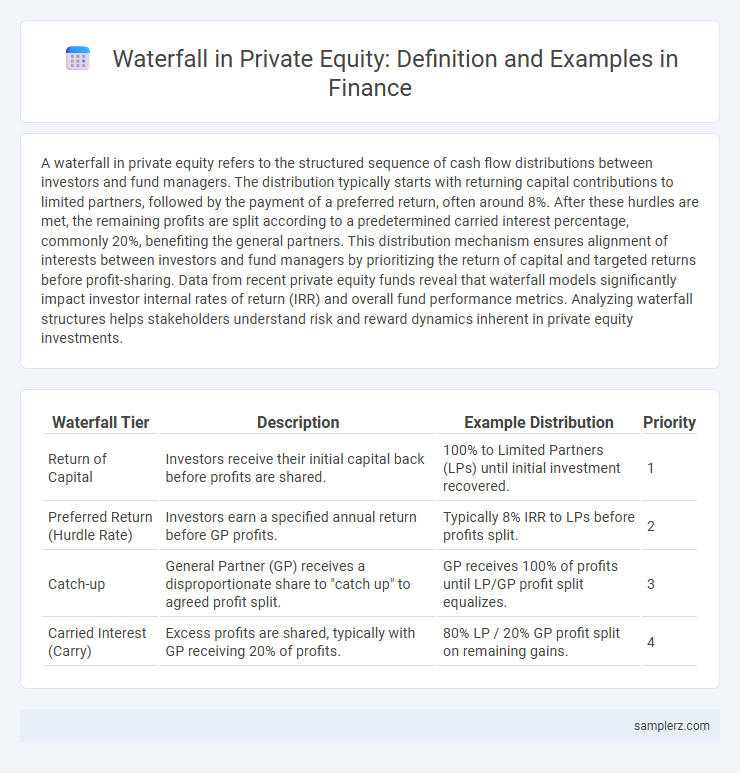

| Waterfall Tier | Description | Example Distribution | Priority |

|---|---|---|---|

| Return of Capital | Investors receive their initial capital back before profits are shared. | 100% to Limited Partners (LPs) until initial investment recovered. | 1 |

| Preferred Return (Hurdle Rate) | Investors earn a specified annual return before GP profits. | Typically 8% IRR to LPs before profits split. | 2 |

| Catch-up | General Partner (GP) receives a disproportionate share to "catch up" to agreed profit split. | GP receives 100% of profits until LP/GP profit split equalizes. | 3 |

| Carried Interest (Carry) | Excess profits are shared, typically with GP receiving 20% of profits. | 80% LP / 20% GP profit split on remaining gains. | 4 |

Understanding the Waterfall Structure in Private Equity

The waterfall structure in private equity dictates the sequence of profit distribution among investors and general partners, prioritizing the return of capital before profits are shared. Typically, the distribution follows tiers such as return of invested capital, preferred return (often around 8%), and carried interest, where general partners receive a percentage of profits exceeding the preferred return. Understanding this hierarchical payout ensures alignment of interests and incentivizes performance, crucial for successful private equity fund management.

Key Components of a Private Equity Waterfall

A private equity waterfall typically includes key components such as the return of capital, preferred return (hurdle rate), catch-up mechanism, and carried interest. The return of capital ensures limited partners receive their invested capital back before profits are shared, while the preferred return guarantees a minimum return on their investment. The catch-up mechanism allows the general partner to receive a greater share of profits after the preferred return is met, followed by the carried interest, which represents the general partner's profit participation above the preferred return threshold.

Preferred Return and Hurdle Rate Explained

In private equity, the waterfall structure dictates the order of profit distribution, where the Preferred Return ensures limited partners receive a minimum annual return, commonly around 8%, before general partners share in the profits. The Hurdle Rate represents this minimum return threshold that must be achieved to trigger carried interest payments to the fund managers. Once the Preferred Return and Hurdle Rate are met, excess profits are typically split according to a predetermined carried interest arrangement, aligning incentives between investors and managers.

How Catch-Up Mechanisms Work in Waterfalls

Catch-up mechanisms in private equity waterfalls allow the general partner (GP) to receive a larger share of profits after limited partners (LPs) achieve their preferred return, typically 8%. Once the LPs are paid their hurdle rate, the catch-up clause enables the GP to receive most or all of the subsequent distributions until the agreed-upon profit split is reached, commonly 80/20. This structure aligns incentives by accelerating GP compensation after LP return thresholds are satisfied, promoting performance-driven fund management.

Step-by-Step Example of a Waterfall Distribution

In private equity, a typical waterfall distribution begins with returning capital to limited partners (LPs) to ensure they recover their initial investment. Next, preferred returns are allocated to LPs, usually around 8%, before the general partners (GPs) receive any profits. Finally, remaining profits are split according to the carried interest arrangement, commonly 80% to LPs and 20% to GPs, incentivizing performance while protecting LPs' capital.

Calculations of Carried Interest in Private Equity

Carried interest in private equity is commonly calculated using a waterfall structure that prioritizes return of capital to investors before general partners receive profits. For example, after limited partners receive their preferred return, typically 8%, the general partner earns a carried interest, often 20%, on remaining profits. This calculation involves sequential tiers where distributions ensure investors' capital and preferred returns are met before the general partner's carried interest is applied to residual gains.

Real-World Waterfall Scenario: Sample Case Study

In a real-world waterfall scenario in private equity, profits are distributed sequentially: first, limited partners receive their preferred return, typically around 8%, before general partners earn any carry. Once the preferred return is met, remaining profits are split, often 80% to limited partners and 20% to general partners, reflecting the carried interest arrangement. This structure aligns incentives and ensures limited partners recover their capital and a hurdle rate prior to general partners benefiting from performance fees.

Common Waterfall Variations in Private Equity Deals

Common waterfall variations in private equity deals include the European waterfall, which requires limited partners to receive their entire capital back before general partners earn carried interest, and the American waterfall, allowing general partners to receive carried interest on a deal-by-deal basis once limited partners are repaid for that specific investment. Another variation, the modified American waterfall, combines features of both, enabling earlier carried interest distributions while ensuring limited partners achieve a preferred return overall. These structures impact profit distribution, risk allocation, and investor incentives, making their understanding crucial for private equity participants.

Potential Pitfalls and Challenges in Waterfall Structures

Waterfall structures in private equity can present potential pitfalls such as misaligned interests between general partners and limited partners due to complex hurdle rates and catch-up provisions. Challenges often arise from unclear distribution priorities, leading to disputes over carried interest calculations and delayed investor returns. Understanding these intricate mechanisms is crucial for accurately modeling returns and avoiding unintended financial consequences.

Best Practices for Structuring Private Equity Waterfalls

Private equity waterfalls should be structured with clear tiers, such as return of capital, preferred return, catch-up, and carried interest, to align incentives between limited partners and general partners. Including hurdle rates that accurately reflect investment risk and market conditions ensures fair distribution of proceeds and motivates performance. Transparent communication of waterfall terms and regular performance reporting foster trust and optimize fund governance.

example of waterfall in private equity Infographic

samplerz.com

samplerz.com