Mezzanine financing is a hybrid form of capital that combines debt and equity features, often used by companies to fund expansions or acquisitions. This type of financing typically involves subordinated debt that ranks below senior loans but above common equity in the capital structure. Investors in mezzanine financing receive interest payments and may also obtain equity warrants, providing an opportunity for higher returns. An example of mezzanine financing occurs when a mid-sized company seeks $10 million to acquire a competitor. The company obtains $6 million through senior bank loans and raises the remaining $4 million via mezzanine debt from private equity firms. This mezzanine capital fills the funding gap, supports the acquisition, and allows the company to maintain control without issuing new common stock.

Table of Comparison

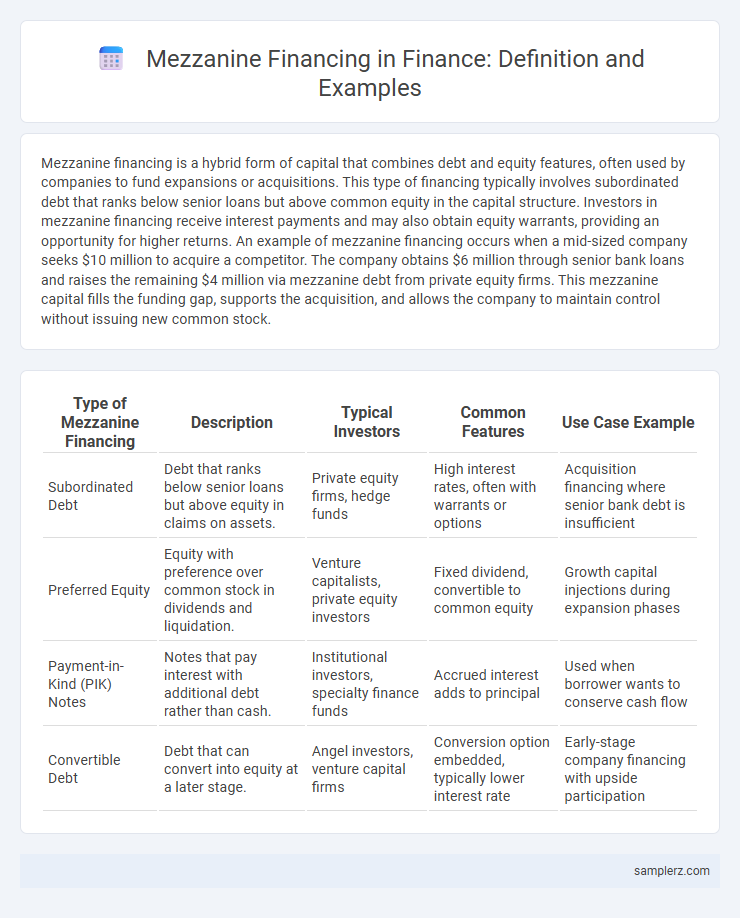

| Type of Mezzanine Financing | Description | Typical Investors | Common Features | Use Case Example |

|---|---|---|---|---|

| Subordinated Debt | Debt that ranks below senior loans but above equity in claims on assets. | Private equity firms, hedge funds | High interest rates, often with warrants or options | Acquisition financing where senior bank debt is insufficient |

| Preferred Equity | Equity with preference over common stock in dividends and liquidation. | Venture capitalists, private equity investors | Fixed dividend, convertible to common equity | Growth capital injections during expansion phases |

| Payment-in-Kind (PIK) Notes | Notes that pay interest with additional debt rather than cash. | Institutional investors, specialty finance funds | Accrued interest adds to principal | Used when borrower wants to conserve cash flow |

| Convertible Debt | Debt that can convert into equity at a later stage. | Angel investors, venture capital firms | Conversion option embedded, typically lower interest rate | Early-stage company financing with upside participation |

Introduction to Mezzanine Financing

Mezzanine financing is a hybrid form of capital that combines elements of debt and equity, commonly used by companies seeking growth capital without diluting ownership. It typically involves subordinated debt secured by warrants or options, allowing lenders to convert debt into equity under specific conditions. This form of financing bridges the gap between senior debt and equity, offering higher returns to investors while providing borrowers flexible funding solutions.

Key Features of Mezzanine Financing

Mezzanine financing typically involves a hybrid of debt and equity, often structured as subordinated debt with warrants or conversion options, providing higher yields than senior debt due to increased risk. It offers flexible repayment terms and is commonly used by companies for expansion, acquisitions, or recapitalization without diluting existing equity significantly. Key features include its subordinate claim on assets, interest payments often deferred or paid in kind, and the potential for equity participation through conversion rights.

How Mezzanine Financing Works

Mezzanine financing bridges the gap between senior debt and equity by providing a hybrid of debt and equity instruments, often including subordinated debt paired with warrants or options. This type of financing is typically used by companies to fund expansions or acquisitions without diluting ownership, as lenders receive fixed returns plus potential equity upside. The repayment structure usually involves interest payments during the term, with principal repaid at maturity, while the equity component aligns lenders' interests with the company's growth and profitability.

Common Structures in Mezzanine Deals

Common structures in mezzanine financing often include subordinated debt combined with attached warrants or equity options, allowing lenders to participate in upside potential. Mezzanine debt typically ranks below senior bank loans but above equity, providing flexible capital with higher interest rates to compensate for increased risk. This hybrid capital structure supports leveraged buyouts and growth expansions by bridging the gap between senior debt and equity financing.

Example: Mezzanine Financing in Business Expansion

Mezzanine financing played a crucial role in Company X's $50 million expansion by providing $15 million in subordinated debt combined with equity warrants, bridging the gap between senior loans and equity. This hybrid capital structure allowed the business to fund new product development and market entry without diluting existing shareholders significantly. The flexible repayment terms and potential equity upside attracted investors seeking higher returns compared to traditional debt instruments.

Case Study: Mezzanine for Real Estate Development

A notable case of mezzanine financing in real estate development involved a $20 million mezzanine loan provided to a luxury residential project in downtown Chicago, bridging the gap between senior debt and equity investment. This mezzanine capital enabled the developer to secure construction financing while preserving ownership stakes and offering lenders a higher return through subordinated debt structure. The flexible terms and interest rates linked to project milestones facilitated timely completion and optimized capital stack efficiency.

Benefits of Mezzanine Financing for Borrowers

Mezzanine financing offers borrowers flexible capital solutions, combining debt and equity features that minimize ownership dilution compared to issuing new equity. This form of financing typically involves subordinated debt with attached warrants, providing access to significant funds without compromising control. Borrowers benefit from longer repayment terms and fewer covenants, enhancing cash flow management and supporting growth initiatives.

Risks Associated with Mezzanine Funding

Mezzanine financing in corporate acquisitions often carries significant risks such as high-interest rates and subordination to senior debt, increasing default risk if cash flows decline. Investors face potential loss of capital due to the unsecured nature of mezzanine debt, which ranks below senior loans in the capital structure. The hybrid structure combining debt and equity features exposes lenders to fluctuating market valuations and potential dilution.

Comparison: Mezzanine vs. Traditional Debt

Mezzanine financing typically involves subordinated debt combined with equity warrants, offering higher returns and greater risk compared to traditional secured debt. While traditional debt holds priority in repayment during liquidation, mezzanine debt ranks below senior loans but above equity, making it suitable for companies seeking flexible capital without diluting ownership immediately. The cost of mezzanine financing averages between 12% and 20%, significantly higher than traditional bank loans, which usually carry interest rates of 4% to 8%.

Real-World Success Stories of Mezzanine Financing

Mezzanine financing played a pivotal role in the $1 billion expansion of Toys "R" Us by providing flexible capital that bridged the gap between senior debt and equity without diluting ownership. In the acquisition of Hilton Hotels, mezzanine debt enabled the private equity firms to leverage the deal effectively while minimizing equity contributions. These real-world success stories demonstrate mezzanine financing's ability to fuel growth and acquisitions by offering subordinated debt with equity conversion features.

example of mezzanine in financing Infographic

samplerz.com

samplerz.com