A wash sale occurs when an investor sells a security at a loss and repurchases the same or a substantially identical security within 30 days before or after the sale. This transaction triggers the wash sale rule, which disallows the deduction of the loss for tax purposes. For example, if an investor sells 100 shares of XYZ Corp at a loss on March 1 and buys back the same 100 shares on March 20, the loss cannot be claimed on the tax return. The disallowed loss from a wash sale is added to the cost basis of the repurchased security, effectively deferring the recognition of the loss until the new position is sold. Wash-sale rules aim to prevent taxpayers from claiming artificial losses while maintaining their investment positions. Investors must carefully track transactions to avoid triggering wash sales, especially during periods of market volatility or portfolio rebalancing.

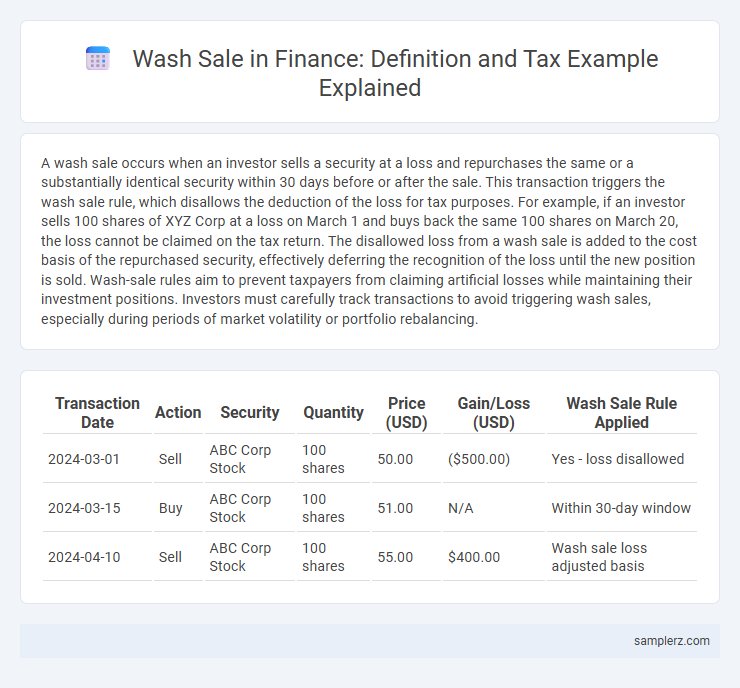

Table of Comparison

| Transaction Date | Action | Security | Quantity | Price (USD) | Gain/Loss (USD) | Wash Sale Rule Applied |

|---|---|---|---|---|---|---|

| 2024-03-01 | Sell | ABC Corp Stock | 100 shares | 50.00 | ($500.00) | Yes - loss disallowed |

| 2024-03-15 | Buy | ABC Corp Stock | 100 shares | 51.00 | N/A | Within 30-day window |

| 2024-04-10 | Sell | ABC Corp Stock | 100 shares | 55.00 | $400.00 | Wash sale loss adjusted basis |

Understanding Wash-Sale Rules in Taxation

A wash sale occurs when an investor sells a security at a loss and repurchases the same or a substantially identical security within 30 days before or after the sale, triggering disallowance of the loss deduction for tax purposes. The IRS wash-sale rule aims to prevent taxpayers from claiming artificial losses while maintaining their position in a security. Understanding these rules helps investors optimize tax strategies by identifying when losses are disallowed and adjusting their trading activities accordingly.

What Constitutes a Wash-Sale?

A wash-sale occurs when an investor sells a security at a loss and repurchases the same or a substantially identical security within 30 days before or after the sale date, triggering disallowed loss deductions for tax purposes. The IRS specifically targets transactions involving stocks, bonds, options, and mutual funds to prevent taxpayers from claiming artificial tax losses while maintaining their investment position. Understanding the 61-day window and the definition of "substantially identical" securities is crucial for proper tax compliance and optimizing capital loss strategies.

Common Wash-Sale Scenarios for Investors

Common wash-sale scenarios for investors involve selling a security at a loss and repurchasing the same or a substantially identical stock within 30 days before or after the sale. This rule disallows claiming the loss for tax deduction purposes, often triggered by reinvesting dividends or buying shares in different accounts. Understanding these scenarios helps investors avoid unintentional disallowed losses and ensures compliance with IRS regulations.

Example: Wash-Sale with Stocks

A wash-sale occurs when an investor sells a stock at a loss and repurchases the same or substantially identical stock within 30 days before or after the sale, disallowing the loss for tax deduction purposes. For example, if an investor sells 100 shares of XYZ Corp at a loss and buys the same 100 shares within the 30-day window, the loss is disallowed and added to the cost basis of the new shares. This IRS rule prevents taxpayers from claiming artificial losses to reduce taxable income while maintaining their position in a stock.

Wash-Sale Example Involving Mutual Funds

A wash-sale occurs when an investor sells mutual fund shares at a loss and repurchases substantially identical shares within 30 days, disallowing the loss for current tax deduction. For instance, selling 100 shares of a mutual fund at a $1,000 loss and buying the same or a substantially identical mutual fund within 30 days triggers the wash-sale rule. This rule defers the loss by adding it to the cost basis of the newly purchased shares, impacting tax reporting.

Tax Implications of Triggering a Wash-Sale

Triggering a wash-sale occurs when an investor sells a security at a loss and repurchases the same or a substantially identical security within 30 days before or after the sale, disallowing the claimed loss for tax deduction purposes. The disallowed loss is added to the cost basis of the repurchased security, deferring the tax benefit until the new security is sold. This rule aims to prevent taxpayers from realizing artificial losses to reduce taxable income, impacting investment strategies and tax planning.

How Wash-Sale Rules Affect Loss Deductions

Wash-sale rules disallow tax deductions for losses on the sale of a security if the same or substantially identical security is purchased within 30 days before or after the sale. This prevents investors from claiming artificial losses to offset capital gains, thereby reducing tax liability. As a result, the disallowed loss is added to the cost basis of the repurchased security, deferring the tax benefit until the security is ultimately sold.

Avoiding Wash-Sale Violations: Practical Examples

Selling a stock at a loss and repurchasing the same or substantially identical stock within 30 days before or after the sale triggers a wash-sale violation, disallowing the loss deduction for tax purposes. For instance, selling 100 shares of XYZ Corp at a loss on January 1 and buying those shares back on January 20 constitutes a wash sale. To avoid such violations, investors can wait at least 31 days to repurchase the stock or buy a different security with similar market exposure.

Real-World Case Studies of Wash-Sales

In a real-world case study, an investor sold shares of Company XYZ at a loss and repurchased the same shares within 30 days, triggering a wash-sale disallowance under IRS rules. The disallowed loss was added to the cost basis of the repurchased shares, postponing the recognition of the capital loss for tax purposes. This scenario is a common example of how investors inadvertently violate wash-sale provisions, resulting in deferred tax benefits.

Key Takeaways: Wash-Sale Examples for Tax Reporting

A wash sale occurs when an investor sells a security at a loss and repurchases the same or a substantially identical security within 30 days before or after the sale, disallowing the loss deduction for tax purposes. For example, selling 100 shares of stock at a loss on December 1 and buying the same 100 shares on December 20 triggers the wash-sale rule, requiring the loss to be added to the cost basis of the new shares. Proper tax reporting requires adjusting cost basis to avoid double-counting losses while complying with IRS wash-sale regulations.

example of wash-sale in tax Infographic

samplerz.com

samplerz.com