In finance, subordination in debt refers to the ranking of debts based on their priority for repayment in case of borrower default. Subordinated debt, also known as junior debt, is repaid only after senior debt obligations are fully satisfied. This hierarchy impacts risk assessment and interest rates, with subordinated debt generally carrying higher yields due to increased risk. Entities involved in debt subordination include senior creditors, subordinated creditors, and the borrowing company. Data on debt structures, such as loan agreements and bond indentures, explicitly detail the order of payment priority. Understanding subordination clauses helps investors evaluate the creditor's position in the capital structure and make informed lending or investment decisions.

Table of Comparison

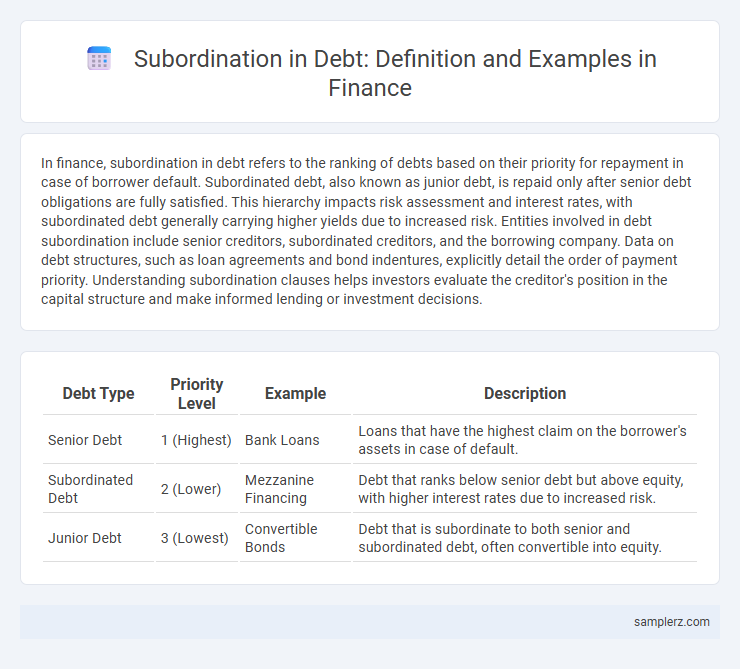

| Debt Type | Priority Level | Example | Description |

|---|---|---|---|

| Senior Debt | 1 (Highest) | Bank Loans | Loans that have the highest claim on the borrower's assets in case of default. |

| Subordinated Debt | 2 (Lower) | Mezzanine Financing | Debt that ranks below senior debt but above equity, with higher interest rates due to increased risk. |

| Junior Debt | 3 (Lowest) | Convertible Bonds | Debt that is subordinate to both senior and subordinated debt, often convertible into equity. |

Understanding Debt Subordination: Key Concepts

Debt subordination occurs when one debt ranks below another in priority for repayment, affecting the order creditors receive payments during liquidation. Senior debt holds higher priority over subordinated debt, meaning subordinated lenders face greater risk but often receive higher interest rates as compensation. Understanding the hierarchy between senior and subordinated debt is crucial for assessing credit risk and structuring financing agreements.

Types of Debt: Senior vs. Subordinated Loans

Senior loans hold priority over subordinated loans in repayment schedules, ensuring senior creditors receive payment before subordinated lenders during default or bankruptcy. Subordinated loans, also known as junior debt, carry higher risk and typically offer higher interest rates to compensate for their lower claim on assets. This subordination hierarchy impacts a company's capital structure and influences investor risk assessment and lending terms.

Real-World Examples of Subordination Clauses

Subordination clauses are commonly seen in mortgage agreements where a second mortgage is subordinated to the first mortgage, ensuring the primary lender has priority in case of default. In corporate finance, subordinated debt like mezzanine financing ranks below senior debt, impacting recovery rates during bankruptcy proceedings. Real-world cases include the 2008 financial crisis, where subordinated debt instruments significantly influenced creditor repayments.

Subordination Agreements in Corporate Finance

Subordination agreements in corporate finance establish the priority of debt repayment, ensuring that junior creditors agree to subordinate their claims to senior creditors in the event of default or liquidation. These agreements help structure complex financing by clearly defining the order of debt servicing, which can improve the company's credit profile and facilitate additional borrowing. Enforcing subordination provisions protects senior lenders' interests and supports the issuance of multiple debt layers within a capital structure.

How Subordination Impacts Creditor Rights

Subordination in debt determines the priority of creditor claims during debtor default or bankruptcy, with subordinated creditors receiving repayments only after senior creditors are paid in full. This hierarchy impacts creditor rights by increasing risk exposure for subordinated lenders, often resulting in higher interest rates to compensate for delayed repayment. Understanding subordination clauses is critical for creditors to assess recovery prospects and enforceability of claims.

Subordination in Bankruptcy Proceedings

Subordination in bankruptcy proceedings prioritizes the order in which creditors are paid from a debtor's remaining assets, where subordinated debt ranks below senior debt in repayment hierarchy. Creditors holding subordinated claims often recover less or nothing if senior claims exhaust available funds, reflecting their increased risk exposure. This legal framework impacts lending strategies by influencing interest rates and credit terms for different classes of debt.

Case Study: Subordinated Debt in Mergers and Acquisitions

In mergers and acquisitions, subordinated debt plays a crucial role by ranking below senior debt in repayment priority, as demonstrated in the Hertz acquisition of Dollar Thrifty. The subordinated lenders accepted higher risk in exchange for potentially higher yields, facilitating leveraged buyouts without disrupting senior creditors. This structure optimizes capital stack flexibility, ensuring efficient allocation of risk and return among stakeholders during complex financial transactions.

Benefits and Risks of Subordinated Debt Instruments

Subordinated debt instruments offer investors higher yields compared to senior debt due to increased risk exposure, benefiting companies by improving capital structure without diluting equity. However, these instruments carry the risk of lower recovery rates in bankruptcy scenarios since they are paid after senior obligations. Careful assessment of creditworthiness and market conditions is essential to balance the benefits and risks associated with subordinated debt.

Subordination in Mezzanine Financing

Subordination in mezzanine financing places these loans below senior debt but above equity in the capital structure hierarchy, creating a higher risk profile compensated by increased interest rates. This financing layer often includes subordinated debt or preferred equity, which absorbs losses after senior lenders but before common equity holders. Mezzanine financing's subordination ensures that senior lenders are paid first, enhancing their security while offering mezzanine investors higher returns for taking on additional risk.

Legal Considerations in Debt Subordination

Legal considerations in debt subordination include ensuring clear contractual language that defines priority among creditors, which is crucial for enforceability in bankruptcy proceedings. Courts often rely on the explicit subordination clauses in loan agreements to determine repayment order, emphasizing the importance of precise drafting. Understanding relevant jurisdictional laws and regulations further protects subordinated creditors' interests by clarifying their rights during debtor insolvency.

example of subordination in debt Infographic

samplerz.com

samplerz.com