In finance, pari passu refers to the equal ranking of loans or securities in terms of repayment priority. For example, two lenders may provide a $5 million loan to a company under a pari passu agreement, ensuring both lenders have an equal claim on the company's assets if default occurs. This means neither lender's debt is subordinate, and they share repayments proportionally. A practical scenario involves a syndicated loan where multiple banks extend credit on a pari passu basis. Each bank holds an equal lien on the borrower's collateral, avoiding prioritization among lenders. This structure reduces risk and promotes cooperation by guaranteeing that all lenders receive repayments simultaneously and equitably.

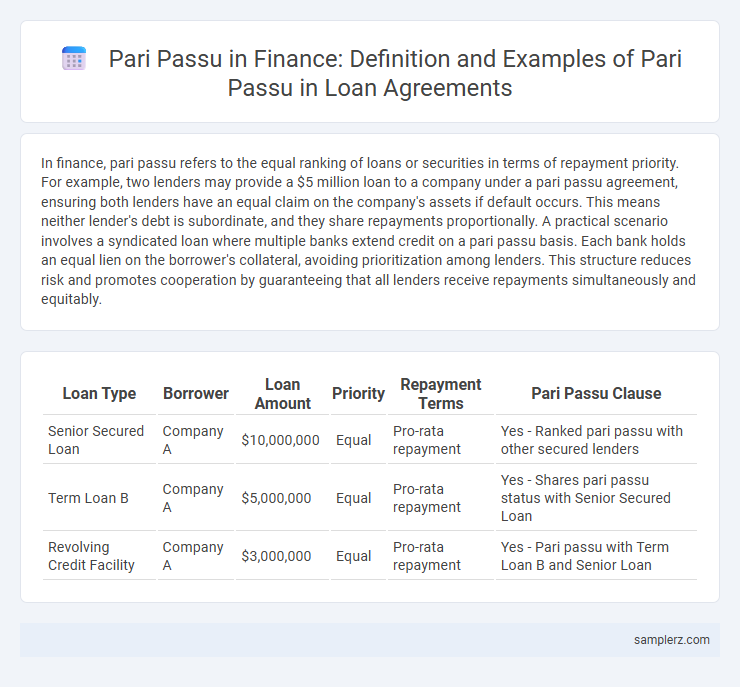

Table of Comparison

| Loan Type | Borrower | Loan Amount | Priority | Repayment Terms | Pari Passu Clause |

|---|---|---|---|---|---|

| Senior Secured Loan | Company A | $10,000,000 | Equal | Pro-rata repayment | Yes - Ranked pari passu with other secured lenders |

| Term Loan B | Company A | $5,000,000 | Equal | Pro-rata repayment | Yes - Shares pari passu status with Senior Secured Loan |

| Revolving Credit Facility | Company A | $3,000,000 | Equal | Pro-rata repayment | Yes - Pari passu with Term Loan B and Senior Loan |

Understanding Pari Passu in Loan Agreements

Pari passu in loan agreements refers to multiple lenders sharing equal rights to repayment without any preference or priority among them. This means that if the borrower defaults, all lenders are repaid proportionally from the available assets or cash flows. Understanding pari passu clauses is crucial for assessing risk exposure and ensuring fair treatment among creditors in syndicated loans.

Real-World Examples of Pari Passu Clauses

In the 2008 financial crisis, several syndicated loans included pari passu clauses to ensure that all creditors received equal treatment in debt repayments, preventing any lender from gaining priority over others. A notable example is the Eurobank loan facility where pari passu provisions safeguarded equal rights among international creditors amid restructuring. Such clauses remain integral in multi-lender agreements, maintaining balanced risk distribution and enforcing equitable payment rankings.

Types of Loans with Pari Passu Provisions

Types of loans with pari passu provisions commonly include syndicated loans, where multiple lenders share equal security interests and repayment rights to ensure proportional distribution of recovery in case of default. Term loans and revolving credit facilities often incorporate pari passu clauses to maintain equal ranking among creditors, preventing preferential treatment. These provisions enhance lender confidence by establishing clear priority rules, promoting equitable risk distribution in complex financing structures.

Pari Passu in Syndicated Loan Structures

Pari passu in syndicated loan structures ensures that multiple lenders share equal rights and claims on the borrower's assets without any lender having priority over others. This arrangement guarantees that repayments, interest, and security interests are distributed proportionally among all syndicate members. Such equal ranking mitigates risk and promotes fairness, making syndicated loans more attractive to diverse institutional lenders.

Pari Passu: Secured vs. Unsecured Lending

Pari passu in finance refers to creditors sharing equal rights to repayment without priority, commonly seen in both secured and unsecured lending agreements. In secured lending, pari passu means creditors have equal claim on the same collateral, such as real estate or equipment, ensuring fair distribution if the borrower defaults. Unsecured pari passu loans involve creditors sharing the same rank in claims but lack collateral backing, increasing risk and often resulting in higher interest rates.

Pari Passu Example: Corporate Debt Financing

In corporate debt financing, pari passu refers to multiple lenders holding equal claims on a company's assets and repayments, ensuring no single creditor is prioritized over others. For example, if a corporation issues a $100 million loan syndicated across five banks on a pari passu basis, each bank has an equal right to repayment and collateral security proportionate to its share. This arrangement minimizes risk disparities among lenders and simplifies debt restructuring processes.

Impact of Pari Passu on Lender Priorities

Pari passu clauses in loan agreements ensure lenders share equal rights and claims on collateral, preventing any lender from gaining priority over others during default or bankruptcy. This equal ranking impacts lender priorities by limiting the ability of any single lender to accelerate repayment or enforce security interests ahead of peers. Consequently, pari passu provisions promote balanced risk distribution among creditors but can complicate recovery efforts in distressed loan scenarios.

Pari Passu and Cross-Border Loan Scenarios

Pari passu in cross-border loan scenarios ensures all lenders hold equal rights and rank equally in claims against the borrower's assets, preventing any preferential treatment. This mechanism is crucial in syndicated international loans where multiple jurisdictions and legal frameworks intersect. Maintaining pari passu status helps mitigate risks and enhances lender confidence in complex global financing arrangements.

Pari Passu Enforcement in Loan Defaults

In loan defaults, pari passu enforcement ensures that all lenders share equally in repayment proceeds according to their loan agreements, preventing preferential treatment. This principle guarantees proportional distribution of recoveries among creditors, maintaining fairness and protecting senior and subordinated debt positions. Courts often uphold pari passu clauses to enforce equitable creditor rights during insolvency or restructuring scenarios.

Lessons Learned from Pari Passu Case Studies

Pari passu clauses in loan agreements ensure equal ranking of creditors, preventing preferential treatment during debt repayment and safeguarding lender interests. Case studies reveal that clear documentation and consistent enforcement of pari passu provisions mitigate risks of legal disputes and asset distribution conflicts among creditors. Implementing stringent monitoring mechanisms enhances transparency and collaboration, reinforcing balanced creditor rights in syndicated loans.

example of pari passu in loan Infographic

samplerz.com

samplerz.com