Xetra is an electronic trading platform operated by Deutsche Borse, primarily used for trading stocks, bonds, and exchange-traded funds (ETFs). It provides a fully automated order book and enables fast, transparent price discovery with high liquidity. Xetra accounts for a significant portion of European equity trading, making it a key player in global financial markets. The platform handles millions of orders daily, supporting over 1,000 securities listed on the Frankfurt Stock Exchange. Its advanced trading algorithms optimize trade execution, reducing costs and enhancing efficiency for institutional and retail investors alike. Xetra's data feeds offer real-time market information, crucial for making informed investment decisions in a dynamic trading environment.

Table of Comparison

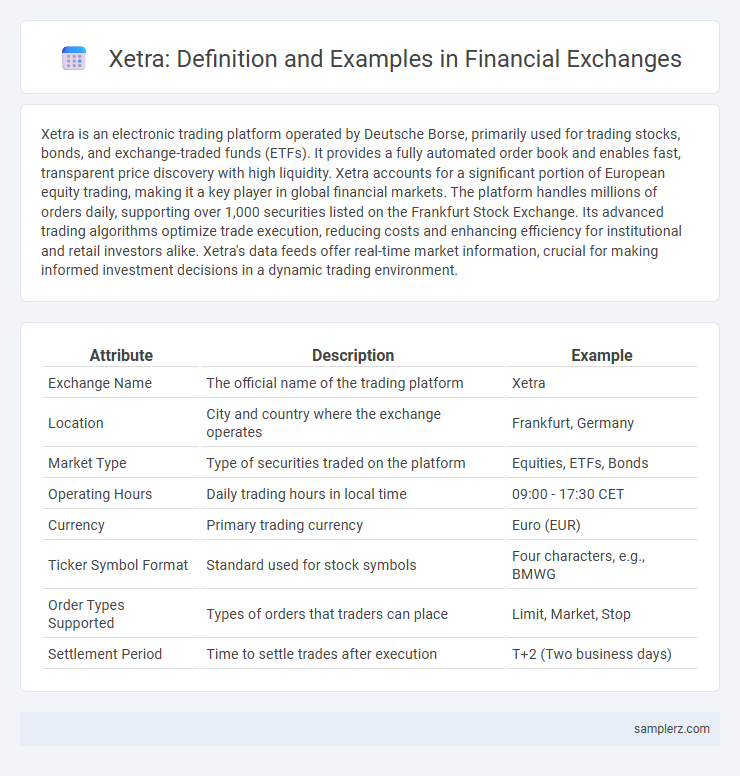

| Attribute | Description | Example |

|---|---|---|

| Exchange Name | The official name of the trading platform | Xetra |

| Location | City and country where the exchange operates | Frankfurt, Germany |

| Market Type | Type of securities traded on the platform | Equities, ETFs, Bonds |

| Operating Hours | Daily trading hours in local time | 09:00 - 17:30 CET |

| Currency | Primary trading currency | Euro (EUR) |

| Ticker Symbol Format | Standard used for stock symbols | Four characters, e.g., BMWG |

| Order Types Supported | Types of orders that traders can place | Limit, Market, Stop |

| Settlement Period | Time to settle trades after execution | T+2 (Two business days) |

Introduction to Xetra in Financial Exchanges

Xetra is a leading electronic trading platform operated by Deutsche Borse, primarily used for equities, bonds, and ETFs across European markets. Known for its high liquidity and low latency, Xetra facilitates efficient price discovery and seamless order execution through its advanced, fully automated order book system. With over 90% of trading volume on the Frankfurt Stock Exchange conducted via Xetra, it stands as a critical infrastructure in global financial exchanges.

Evolution of Xetra Trading Platform

The Xetra trading platform has evolved significantly since its launch in 1997, transitioning from a basic electronic trading system to a comprehensive, fully automated marketplace that supports a wide range of asset classes including equities, ETFs, bonds, and derivatives. Continuous technological upgrades have enhanced order execution speed, liquidity, and market transparency, making Xetra one of the leading trading platforms in Europe. Its integration with global trading networks and adoption of advanced algorithms have further optimized trading efficiency and accessibility for investors worldwide.

Key Features of Xetra Exchange

Xetra, operated by Deutsche Borse, is a leading electronic trading platform known for its high liquidity and efficient order execution across multiple asset classes including equities, bonds, and ETFs. It offers real-time price transparency, a fully automated trading environment, and supports a wide range of trading functions such as limit orders, stop orders, and auction mechanisms. Xetra's integration with global financial markets ensures seamless cross-border trading and accessibility for institutional and retail investors.

How Xetra Facilitates Electronic Trading

Xetra operates as a fully electronic trading platform that enhances market efficiency by providing real-time order matching and transparent price discovery for equities and exchange-traded funds (ETFs). Its advanced technology infrastructure supports high liquidity and allows investors to execute trades seamlessly with low latency. By integrating multiple asset classes on a single platform, Xetra streamlines electronic trading and improves access to Germany's primary stock exchange, the Frankfurt Stock Exchange.

Xetra’s Role in the Frankfurt Stock Exchange

Xetra, as the electronic trading platform of the Frankfurt Stock Exchange, facilitates seamless and efficient trading of stocks, bonds, and ETFs across global markets. Its advanced technology supports high liquidity and real-time price transparency, attracting institutional investors worldwide. The platform's integration with Deutsche Borse enhances market accessibility and streamlines order execution in Germany's financial hub.

Comparison: Xetra vs. Traditional Exchanges

Xetra offers electronic trading with faster execution and greater transparency compared to traditional floor-based exchanges, reducing latency to milliseconds and enabling real-time market data access. Its centralized order book improves liquidity and price discovery by aggregating buy and sell orders more efficiently than manual matching on trading floors. The digital infrastructure of Xetra supports extended trading hours and lower operational costs, contrasting with the limited hours and higher overheads typical of traditional exchanges.

Types of Securities Traded on Xetra

Xetra, a leading electronic trading platform operated by Deutsche Borse, facilitates the trading of various types of securities including equities, bonds, exchange-traded funds (ETFs), and derivatives. The platform dominates the German stock market by providing high liquidity and efficient price discovery for blue-chip stocks such as those in the DAX index. Institutional investors and retail traders benefit from Xetra's comprehensive market coverage and advanced order types across different asset classes.

Benefits of Using Xetra for Investors

Xetra offers investors fast and transparent trading with access to a wide range of securities including stocks, bonds, and ETFs across European markets. Its electronic order book provides high liquidity and real-time price discovery, ensuring competitive pricing and efficient execution. The platform's regulatory compliance and advanced risk management tools enhance investor confidence and protect capital during market volatility.

Case Study: Xetra Implementation Example

Xetra, the fully electronic trading system launched by Deutsche Borse, revolutionized European stock exchanges by enabling seamless order matching and end-to-end trading automation. The implementation showcased significant improvements in transaction speed, liquidity, and transparency, with daily trading volumes exceeding several billion euros across equities, ETFs, and bonds. This case study highlights Xetra's robust infrastructure, high throughput, and integration capabilities that set new standards for exchange platforms globally.

Xetra’s Impact on European Financial Markets

Xetra, the electronic trading platform operated by Deutsche Borse, revolutionized European financial markets by significantly increasing liquidity and transparency across equities and ETFs, facilitating faster execution and broader market access. Its advanced matching engine and real-time price discovery systems have attracted a diverse range of participants, from institutional investors to retail traders, enhancing market efficiency. The platform's integration with multiple national exchanges underpins the harmonization of trading standards and supports the growth of a unified European capital market.

example of Xetra in exchange Infographic

samplerz.com

samplerz.com