A Material Adverse Change (MAC) clause in a merger agreement protects the buyer by allowing contract termination if significant negative changes affect the target company's financial health. Typically, a MAC clause specifies key financial metrics such as revenue declines over a certain percentage, major asset losses, or unforeseen legal liabilities. These conditions enable buyers to mitigate risks arising from substantial adverse events between signing and closing. In a typical merger agreement, a MAC clause might state, "If the target company's consolidated revenue decreases by more than 15% compared to the prior fiscal year, or if any event causes a material impairment of over $50 million in assets, the buyer may terminate the agreement." Data points such as quarterly revenue, EBITDA, and outstanding debt levels are often monitored under the clause. This clause is critical for managing uncertainty and ensuring fair deal terms in dynamic market conditions.

Table of Comparison

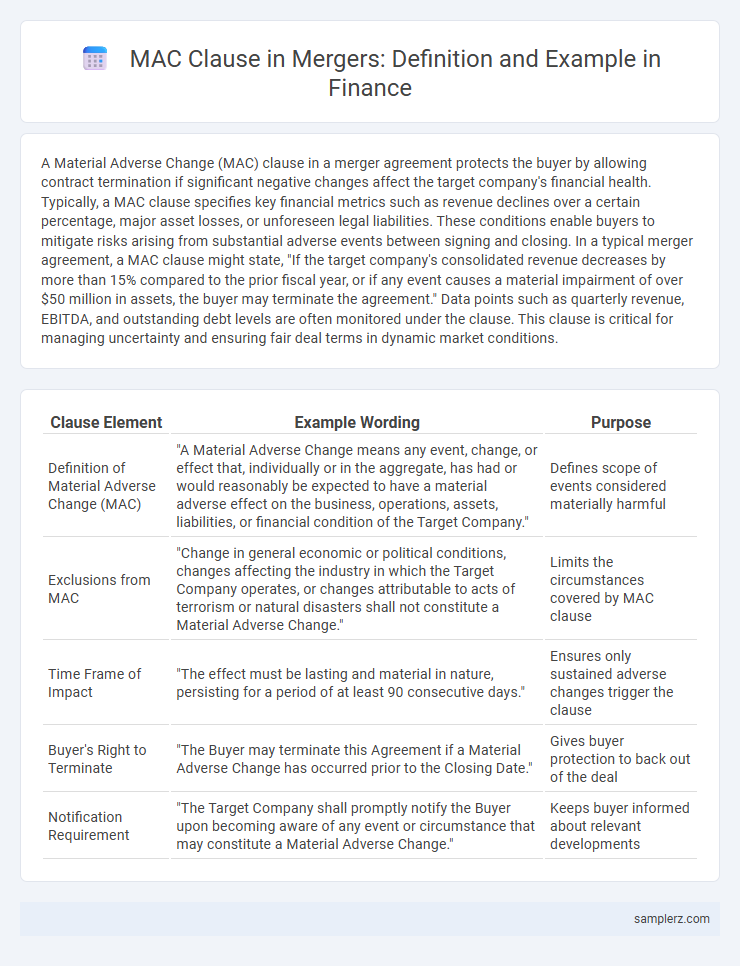

| Clause Element | Example Wording | Purpose |

|---|---|---|

| Definition of Material Adverse Change (MAC) | "A Material Adverse Change means any event, change, or effect that, individually or in the aggregate, has had or would reasonably be expected to have a material adverse effect on the business, operations, assets, liabilities, or financial condition of the Target Company." | Defines scope of events considered materially harmful |

| Exclusions from MAC | "Change in general economic or political conditions, changes affecting the industry in which the Target Company operates, or changes attributable to acts of terrorism or natural disasters shall not constitute a Material Adverse Change." | Limits the circumstances covered by MAC clause |

| Time Frame of Impact | "The effect must be lasting and material in nature, persisting for a period of at least 90 consecutive days." | Ensures only sustained adverse changes trigger the clause |

| Buyer's Right to Terminate | "The Buyer may terminate this Agreement if a Material Adverse Change has occurred prior to the Closing Date." | Gives buyer protection to back out of the deal |

| Notification Requirement | "The Target Company shall promptly notify the Buyer upon becoming aware of any event or circumstance that may constitute a Material Adverse Change." | Keeps buyer informed about relevant developments |

Understanding MAC Clauses: Definition and Importance in Mergers

Material Adverse Change (MAC) clauses are contractual provisions in merger agreements that protect parties from significant negative shifts in a target company's financial condition or business operations before the deal closes. These clauses specify conditions that qualify as material adverse changes, such as substantial declines in revenue, loss of key customers, or regulatory challenges, allowing the buyer to terminate or renegotiate the transaction. Understanding MAC clauses is crucial for managing transaction risks and ensuring fair valuation in mergers and acquisitions.

Key Elements of a Material Adverse Change (MAC) Clause

A Material Adverse Change (MAC) clause in a merger typically includes key elements such as the definition of what constitutes a material adverse effect, specifying financial thresholds or operational impacts that significantly diminish the target company's value or earnings. The clause often outlines exclusions, like general economic downturns or industry-wide conditions, to protect parties from broad market fluctuations. Timeframes for evaluating the adverse change and the required notice periods for invoking the clause are critical to ensure clarity and enforceability in merger agreements.

Real-World Examples of MAC Clauses in High-Profile Mergers

The 2016 AT&T and Time Warner merger prominently featured a Material Adverse Change (MAC) clause, which was scrutinized during the subsequent legal battle over antitrust concerns. In the Dell and EMC acquisition in 2016, the MAC clause provided protection against significant market disruptions, ensuring the transaction could be renegotiated if unforeseen financial downturns occurred. These high-profile cases illustrate how MAC clauses function as critical safeguards in mergers, protecting parties from drastic economic shifts or regulatory obstacles that may impact deal valuation or viability.

Common Triggers for Invoking a MAC Clause

Common triggers for invoking a Material Adverse Change (MAC) clause in mergers include significant declines in financial performance metrics such as revenue, EBITDA, or net income, substantial regulatory or legal obstacles, and major disruptions in key markets or supply chains. These triggers typically involve events that drastically affect the target company's business operations or financial condition, making the transaction less favorable or riskier for the acquiring party. MAC clauses serve as critical protections, allowing buyers to withdraw or renegotiate terms if unforeseen material negative changes occur before deal closure.

Case Study: Failed Mergers Due to MAC Clause Invocation

In the 2017 Dell-EMC merger, the invocation of the Material Adverse Change (MAC) clause arose from unexpected market downturns affecting EMC's financial performance, leading to extensive legal scrutiny. The case highlighted how severe stock price fluctuations and negative earnings reports can trigger disputes over MAC definitions in merger agreements. Such failed mergers underscore the critical role of precise MAC clause drafting to mitigate risks in high-stakes financial transactions.

How MAC Clauses Protect Buyers and Sellers in M&A Deals

Material Adverse Change (MAC) clauses in mergers and acquisitions protect buyers by allowing deal termination if significant negative events affect the target's financial health or business operations before closing. Sellers benefit from MAC clauses by clearly defining conditions under which the buyer can withdraw, preventing arbitrary deal cancellations. These provisions balance risk allocation and provide legal safeguards to both parties during volatile market conditions.

Legal Precedents Shaping MAC Clause Enforcement

Legal precedents such as the Delaware Supreme Court's decision in Akorn, Inc. v. Fresenius Kabi AG have significantly shaped Material Adverse Change (MAC) clause enforcement in mergers, emphasizing the necessity for a substantial and durational impact on the target company's business. Courts scrutinize whether the event affects the company's overall earnings potential rather than isolated or short-term occurrences, reinforcing the high threshold plaintiffs must meet to invoke MAC clauses. This rigorous standard, established through landmark rulings, ensures that buyers cannot easily walk away from merger agreements without demonstrating clear, material adverse effects grounded in the contract's specific language.

Drafting Effective MAC Clauses: Best Practices

Drafting effective Material Adverse Change (MAC) clauses in mergers requires precise language to clearly define what constitutes a significant adverse event, such as major financial losses or regulatory changes impacting the target company's core operations. Including specific thresholds and exclusions related to industry-wide downturns or market fluctuations helps minimize ambiguity and potential disputes. Employing tailored definitions aligned with the transaction's business context ensures enforceability and protects parties from unforeseen risks during the deal process.

Negotiating MAC Clauses: Strategies for Both Parties

Negotiating MAC clauses in merger agreements requires precise definitions of material adverse effects to balance risk between buyer and seller, often focusing on financial metrics such as revenue declines exceeding a specified percentage or significant regulatory obstacles. Buyers typically seek broader MAC definitions to protect against unforeseen market downturns, while sellers push for narrower language limiting clauses to extraordinary, impact-specific events. Clear carve-outs for general economic conditions or industry-wide shifts help prevent triggers based on normal business fluctuations, ensuring both parties maintain proportional protections.

Impact of MAC Clauses on Deal Valuation and Risk Allocation

Material Adverse Change (MAC) clauses in mergers serve as critical mechanisms to protect buyers from significant declines in target company value due to unforeseen events. These clauses directly influence deal valuation by allowing adjustments or deal termination if substantial negative shifts occur in financial metrics, market conditions, or regulatory environments. By allocating risks associated with potential adverse developments, MAC clauses balance negotiation leverage and safeguard parties against disproportionate losses.

example of MAC clause in merger Infographic

samplerz.com

samplerz.com