A regulatory sandbox in finance is a controlled environment where fintech companies can test innovative products, services, or business models under a regulator's supervision. Entities like the UK's Financial Conduct Authority (FCA) have implemented sandboxes to enable firms to experiment with technologies such as blockchain, digital payments, and robo-advisors without immediately facing full regulatory requirements. This approach facilitates data collection on new financial innovations, helping regulators understand risks and consumer impacts while supporting market growth. Financial regulatory sandboxes often include strict eligibility criteria and data reporting mandates to ensure transparency and compliance during testing phases. Firms entering these sandboxes must provide detailed data on their operations, customer outcomes, and risk management strategies, enabling regulators to make informed decisions about wider market authorization. The insights gained from sandbox data assist entities in crafting tailored regulations that balance innovation with consumer protection and financial stability.

Table of Comparison

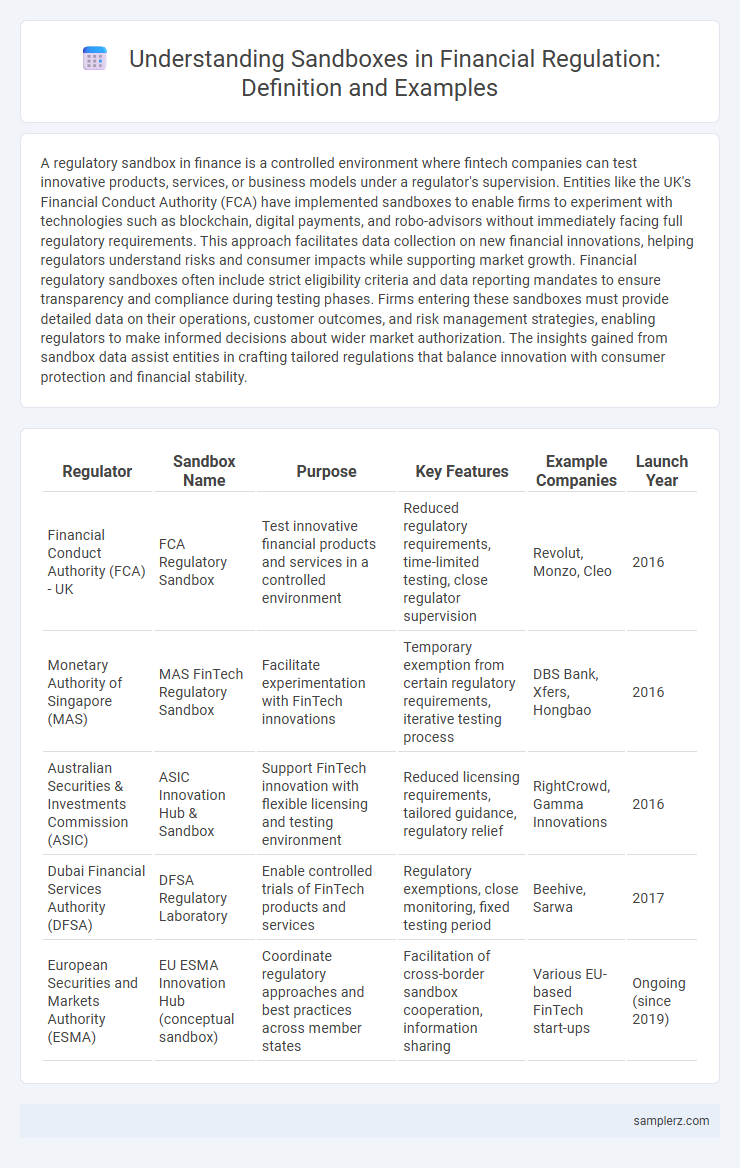

| Regulator | Sandbox Name | Purpose | Key Features | Example Companies | Launch Year |

|---|---|---|---|---|---|

| Financial Conduct Authority (FCA) - UK | FCA Regulatory Sandbox | Test innovative financial products and services in a controlled environment | Reduced regulatory requirements, time-limited testing, close regulator supervision | Revolut, Monzo, Cleo | 2016 |

| Monetary Authority of Singapore (MAS) | MAS FinTech Regulatory Sandbox | Facilitate experimentation with FinTech innovations | Temporary exemption from certain regulatory requirements, iterative testing process | DBS Bank, Xfers, Hongbao | 2016 |

| Australian Securities & Investments Commission (ASIC) | ASIC Innovation Hub & Sandbox | Support FinTech innovation with flexible licensing and testing environment | Reduced licensing requirements, tailored guidance, regulatory relief | RightCrowd, Gamma Innovations | 2016 |

| Dubai Financial Services Authority (DFSA) | DFSA Regulatory Laboratory | Enable controlled trials of FinTech products and services | Regulatory exemptions, close monitoring, fixed testing period | Beehive, Sarwa | 2017 |

| European Securities and Markets Authority (ESMA) | EU ESMA Innovation Hub (conceptual sandbox) | Coordinate regulatory approaches and best practices across member states | Facilitation of cross-border sandbox cooperation, information sharing | Various EU-based FinTech start-ups | Ongoing (since 2019) |

Introduction to Regulatory Sandboxes in Finance

Regulatory sandboxes in finance allow fintech startups to test innovative products under regulatory supervision without full compliance burdens, enabling controlled real-world experimentation. The UK Financial Conduct Authority (FCA) pioneered this approach in 2016, fostering innovation while managing risks. Governments worldwide now adopt sandboxes to accelerate technology adoption, enhance consumer protection, and adapt regulations to fintech advancements.

Key Features of Financial Regulatory Sandboxes

Financial regulatory sandboxes allow fintech startups to test innovative products under regulatory supervision, reducing time-to-market and compliance costs. Key features include controlled environments with predefined testing parameters, real-time monitoring by regulators, and the ability to collect data for informed policy adjustments. These sandboxes enhance regulatory flexibility while ensuring consumer protection and market stability.

Global Examples of Financial Regulatory Sandboxes

Financial regulatory sandboxes in jurisdictions like the United Kingdom's Financial Conduct Authority (FCA) and Singapore's Monetary Authority of Singapore (MAS) offer controlled environments for fintech innovations, enabling real-world testing under regulatory supervision. The FCA sandbox approved hundreds of projects since its 2016 launch, fostering advancements in payments, blockchain, and digital banking. MAS's approach supports cross-border testing and collaboration, accelerating regional fintech development while managing consumer protection risks.

Case Study: UK Financial Conduct Authority Sandbox

The UK Financial Conduct Authority (FCA) Sandbox enables fintech firms to test innovative financial products within a controlled regulatory environment, minimizing risks while ensuring consumer protection. Companies like Revolut and Monzo have leveraged the FCA Sandbox to validate their digital banking services, accelerating market entry and regulatory compliance. This approach fosters innovation by providing real-world feedback and regulatory guidance before full-scale launch.

Example: Monetary Authority of Singapore Sandbox

The Monetary Authority of Singapore Sandbox enables financial institutions and fintech startups to test innovative products and services in a controlled regulatory environment without immediately incurring full compliance requirements. This regulatory sandbox fosters experimentation while ensuring consumer protection and market integrity by imposing tailored safeguards and monitoring frameworks. It has accelerated the development of digital banking solutions, payment systems, and blockchain applications within Singapore's financial sector.

Regulatory Sandbox Implementation in the United States

The Regulatory Sandbox Implementation in the United States allows fintech companies to test innovative financial products and services under regulatory supervision, fostering innovation while ensuring consumer protection. Agencies such as the Consumer Financial Protection Bureau (CFPB) and the Securities and Exchange Commission (SEC) have established frameworks facilitating controlled market experimentation. This approach accelerates product development and regulatory compliance, reducing time-to-market for startups in the financial sector.

Successful FinTech Innovations from Sandboxes

Regulatory sandboxes have enabled groundbreaking FinTech innovations such as Monzo, a UK-based challenger bank that developed its app-based banking services within the FCA sandbox, allowing real-time testing and iterative improvements. Another example is Brazil's Nubank, which leveraged sandbox frameworks to refine its digital credit offerings, facilitating rapid market entry and customer acquisition. These sandboxes provide controlled environments for companies to innovate while ensuring compliance with financial regulations, significantly accelerating the adoption of new technologies in the financial sector.

Challenges Faced in Sandbox Operations

Regulatory sandboxes in finance face challenges such as balancing innovation with consumer protection, managing limited testing periods, and ensuring adequate risk assessment without stifling development. Operational difficulties often include navigating complex compliance requirements and addressing potential financial crimes within a controlled environment. These hurdles demand adaptability from both regulators and fintech firms to successfully foster growth while maintaining market integrity.

Impact of Regulatory Sandboxes on Market Development

Regulatory sandboxes, such as the UK's Financial Conduct Authority (FCA) sandbox, enable fintech firms to test innovative financial products under controlled conditions, accelerating market entry and enhancing competition. These frameworks reduce time-to-market for startups by providing regulatory clarity and risk mitigation, fostering increased investment and consumer trust in emerging financial technologies. The resulting market dynamism often leads to improved financial inclusion, diversified service offerings, and robust ecosystem development.

Future Trends in Financial Regulatory Sandboxes

Financial regulatory sandboxes are evolving to integrate advanced technologies such as artificial intelligence and blockchain, enabling more adaptive and transparent testing environments. Future trends emphasize cross-border collaboration to harmonize regulatory standards and accelerate innovation in fintech. Enhanced data analytics within these sandboxes improve risk assessment and compliance, fostering safer market entry for emerging financial products.

example of sandbox in regulation Infographic

samplerz.com

samplerz.com