A bad bank is a financial entity created to isolate and manage non-performing assets (NPAs) from troubled banks during restructuring. One notable example is India's National Asset Reconstruction Company Limited (NARCL), established to acquire stressed loans exceeding Rs500 crore from various banks. This approach helps clean up bank balance sheets by segregating toxic assets, allowing parent banks to focus on core financial operations. Germany's Landesbank Sachsen is another example where government intervention targeted restructuring after the financial crisis. By transferring risky assets to a separate bad bank, authorities stabilized the institution and restored trust in regional banking. The bad bank mechanism enhances risk management and improves capital adequacy ratios critical for regulatory compliance.

Table of Comparison

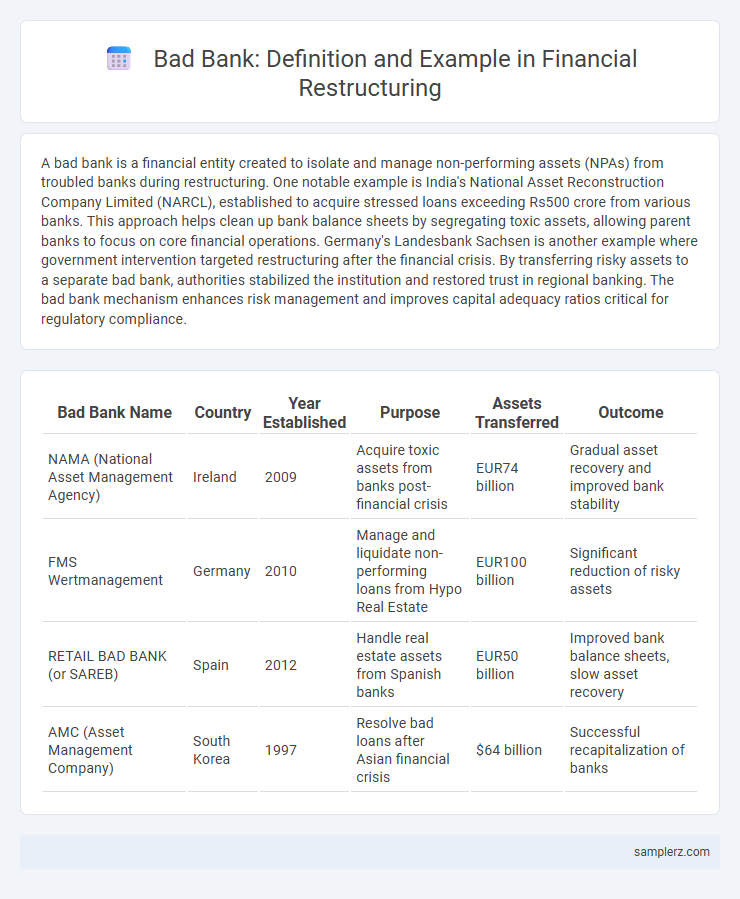

| Bad Bank Name | Country | Year Established | Purpose | Assets Transferred | Outcome |

|---|---|---|---|---|---|

| NAMA (National Asset Management Agency) | Ireland | 2009 | Acquire toxic assets from banks post-financial crisis | EUR74 billion | Gradual asset recovery and improved bank stability |

| FMS Wertmanagement | Germany | 2010 | Manage and liquidate non-performing loans from Hypo Real Estate | EUR100 billion | Significant reduction of risky assets |

| RETAIL BAD BANK (or SAREB) | Spain | 2012 | Handle real estate assets from Spanish banks | EUR50 billion | Improved bank balance sheets, slow asset recovery |

| AMC (Asset Management Company) | South Korea | 1997 | Resolve bad loans after Asian financial crisis | $64 billion | Successful recapitalization of banks |

Bad Bank Concept: Definition and Purpose in Financial Restructuring

The Bad Bank concept involves creating a separate entity to isolate non-performing assets from a financial institution's healthy portfolio, facilitating effective restructuring and risk management. One notable example is the Resolution Trust Corporation (RTC) in the United States during the savings and loan crisis of the 1980s, which managed bad loans to stabilize the banking sector. This approach aims to restore confidence in the banking system by segregating toxic assets and enabling the core bank to focus on profitable operations.

Historical Overview: Notable Bad Banks in Global Finance

The concept of bad banks emerged prominently during the 1990s financial crises, with Sweden's Securum being a notable example that isolated non-performing loans to stabilize the banking sector. During the 2008 global financial crisis, Ireland's National Asset Management Agency (NAMA) played a critical role by acquiring impaired real estate assets from banks to restore liquidity. These restructuring initiatives highlight how bad banks serve as effective tools to manage and recover toxic assets in distressed financial environments.

Case Study: The Irish National Asset Management Agency (NAMA)

The Irish National Asset Management Agency (NAMA) serves as a notable example of a bad bank established during the 2008 financial crisis to manage toxic assets from Irish banks. NAMA acquired over EUR74 billion in distressed loans, primarily related to real estate, aiming to stabilize the banking sector and facilitate economic recovery. Despite criticism over asset valuations and long-term costs to taxpayers, NAMA effectively reduced banking sector risks and recovered significant funds through asset sales and loan repayments.

Case Study: India’s IDBI Stressed Asset Stabilization Fund (SASF)

India's IDBI Stressed Asset Stabilization Fund (SASF) exemplifies a bad bank set up to manage and resolve non-performing assets (NPAs) from the Industrial Development Bank of India. The SASF was designed to isolate stressed assets, improve asset quality, and facilitate more effective recovery processes, but faced challenges such as delayed resolutions and limited accountability. Despite its intent to unlock value and stabilize the financial sector, SASF underscored complexities in bad bank models, including governance issues and operational inefficiencies within India's banking restructuring framework.

How Bad Banks Address Non-Performing Assets (NPAs)

Bad banks specialize in isolating and managing Non-Performing Assets (NPAs) by acquiring distressed loans from commercial banks to clean up their balance sheets. They employ rigorous asset valuation and restructuring strategies, including debt recovery, resale, or converting loans into equity to maximize recovery. By segregating NPAs, bad banks help improve the lending institutions' capital adequacy and restore financial stability in the banking sector.

Lessons from the Swedish Securum and Retriva Experience

The Swedish experience with Securum and Retriva highlights key lessons in bad bank restructuring, demonstrating the effectiveness of isolating non-performing assets to restore financial stability. Securum, created in response to the early 1990s banking crisis, successfully managed toxic assets by ensuring transparent governance and efficient asset disposal, which accelerated recovery. Retriva's approach emphasized timely intervention and regulatory support, underscoring the importance of government involvement in bad bank frameworks to minimize systemic risk.

Bad Bank Restructuring Strategies: Key Approaches and Outcomes

The National Asset Management Agency (NAMA) in Ireland exemplifies a bad bank restructuring strategy aimed at isolating toxic assets from financial institutions to restore market confidence. By acquiring impaired loans and managing distressed assets, NAMA facilitated bank recapitalization and improved balance sheet transparency. This approach demonstrated mixed outcomes, including initial market stabilization but challenges in asset liquidation and long-term economic impact.

Success Factors and Common Pitfalls in Bad Bank Implementation

Effective bad bank implementation hinges on clear asset segregation, robust regulatory support, and transparent communication with stakeholders to restore trust and stabilize financial institutions. Common pitfalls include inadequate capital buffers, poor asset valuation, and lack of coordination between the bad bank and original entity, which can undermine recovery efforts and prolong uncertainty. Success factors also involve strong governance frameworks and timely resolution strategies to mitigate systemic risks and optimize asset recovery.

Regulatory Frameworks Governing Bad Banks in Major Economies

The Bad Bank model implemented during India's 2021 financial restructuring exemplifies challenges in regulatory frameworks, where the Reserve Bank of India's guidelines imposed stringent asset quality evaluation and capital adequacy norms, limiting flexibility in managing distressed assets. In contrast, Europe's Asset Management Companies (AMCs), regulated under the European Central Bank and national authorities, provide more adaptive frameworks allowing for tailored resolution strategies but still face difficulties in standardizing cross-border regulations. The U.S. experience with the Resolution Trust Corporation during the 1990s highlights gaps in coordination between federal and state regulatory bodies, underscoring the need for unified policies to enhance the efficiency of bad banks in financial restructuring.

Future Trends: The Evolving Role of Bad Banks in Financial Stability

Bad banks like the National Asset Management Agency (NAMA) in Ireland demonstrate the evolving role of these entities in financial restructuring by isolating toxic assets to stabilize balance sheets and restore market confidence. Future trends indicate bad banks will increasingly integrate advanced analytics and artificial intelligence to enhance asset recovery processes and improve transparency in distressed asset management. The emphasis on digital transformation and regulatory support signals a shift toward more dynamic, technology-driven solutions in maintaining systemic financial stability.

example of bad bank in restructuring Infographic

samplerz.com

samplerz.com