Overcollateralization in securitization occurs when the value of the underlying assets exceeds the amount of issued securities, providing a cushion to absorb potential losses. For example, a mortgage-backed security (MBS) might be backed by $120 million in home loans while only $100 million in bonds are issued to investors. This excess collateral guarantees that even if some loans default, bondholders still receive their payments. In a corporate loan securitization, overcollateralization also reduces credit risk by offering more assets than liabilities. Suppose a pool of corporate loans valued at $150 million is securitized by issuing $130 million in asset-backed securities (ABS). The $20 million surplus protects investors from credit losses and improves the credit rating of the issued bonds.

Table of Comparison

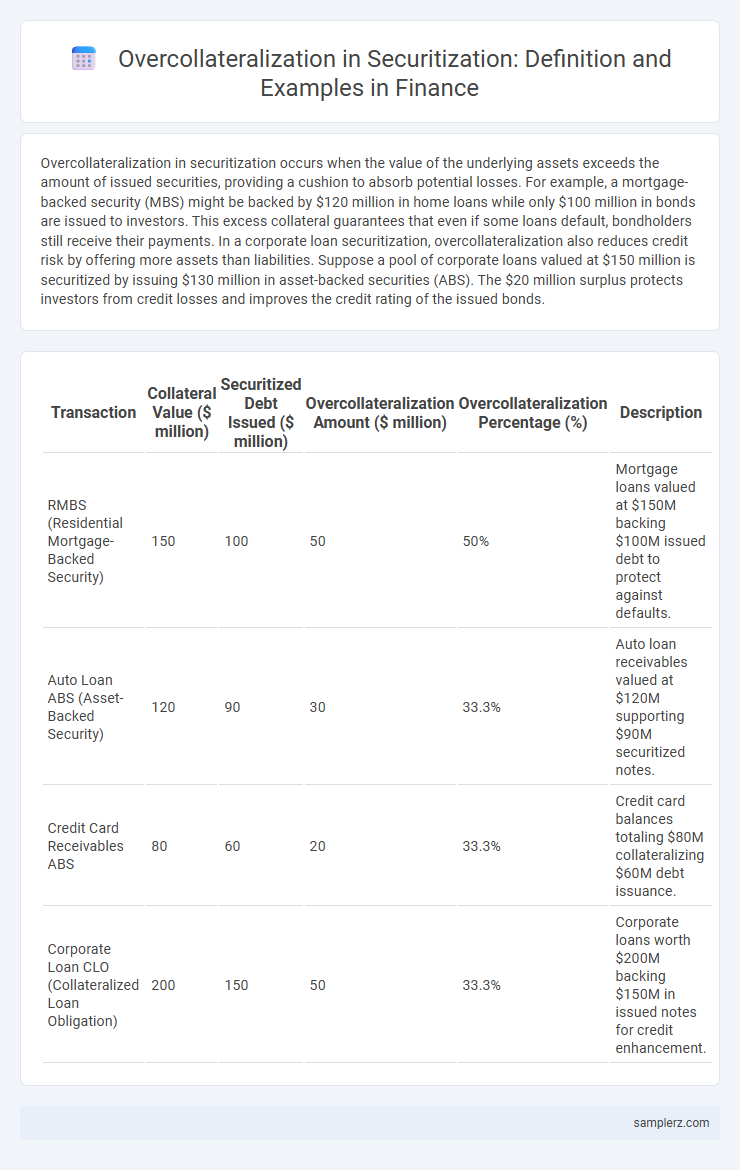

| Transaction | Collateral Value ($ million) | Securitized Debt Issued ($ million) | Overcollateralization Amount ($ million) | Overcollateralization Percentage (%) | Description |

|---|---|---|---|---|---|

| RMBS (Residential Mortgage-Backed Security) | 150 | 100 | 50 | 50% | Mortgage loans valued at $150M backing $100M issued debt to protect against defaults. |

| Auto Loan ABS (Asset-Backed Security) | 120 | 90 | 30 | 33.3% | Auto loan receivables valued at $120M supporting $90M securitized notes. |

| Credit Card Receivables ABS | 80 | 60 | 20 | 33.3% | Credit card balances totaling $80M collateralizing $60M debt issuance. |

| Corporate Loan CLO (Collateralized Loan Obligation) | 200 | 150 | 50 | 33.3% | Corporate loans worth $200M backing $150M in issued notes for credit enhancement. |

Understanding Overcollateralization in Securitization

Overcollateralization in securitization occurs when the value of the collateral assets exceeds the amount of issued securities, providing a credit enhancement that reduces risk for investors. For example, a $100 million mortgage-backed security might be backed by $120 million in mortgages, creating a $20 million cushion against potential losses. This excess collateral mitigates default risk, improving the credit rating and marketability of the securitized asset.

Key Role of Overcollateralization in Credit Enhancement

Overcollateralization serves as a critical credit enhancement technique in securitization by providing a cushion of excess collateral beyond the secured debt amount, reducing investor risk and improving credit ratings. For example, in mortgage-backed securities (MBS), the total value of underlying home loans exceeds the issued bonds, ensuring that even if some loans default, bondholders are protected from losses. This excess collateral absorbs potential defaults and supports higher credit quality, facilitating lower borrowing costs and increased investor confidence.

Classic Example: Mortgage-Backed Securities (MBS)

Mortgage-Backed Securities (MBS) often demonstrate overcollateralization by including mortgage pools whose face value exceeds the issued securities' total principal, providing a cushion against borrower defaults. This excess collateral enhances credit quality and reduces risk for investors, as losses up to the overcollateralization amount are absorbed before impacting MBS payments. Overcollateralization in MBS structure improves bond ratings and attracts broader market participation by ensuring principal and interest payments remain stable under adverse conditions.

Overcollateralization in Auto Loan Securitization

Overcollateralization in auto loan securitization occurs when the value of the underlying auto loan assets exceeds the issued securities, providing a credit enhancement to safeguard investors against defaults. For instance, a $100 million auto loan portfolio might back $90 million of asset-backed securities, creating a $10 million collateral cushion that absorbs losses before impacting bondholders. This structure improves the credit rating of the securitized notes, reducing financing costs for issuers and enhancing investor confidence.

Credit Card Receivable Securitization and Excess Collateral

In Credit Card Receivable Securitization, overcollateralization occurs when the value of the underlying credit card receivables exceeds the principal amount of the issued securities, providing excess collateral to investors. This excess collateral acts as a credit enhancement, mitigating default risk and improving the credit rating of the securitized notes. Overcollateralization levels typically range from 10% to 20%, ensuring sufficient coverage against potential losses in the credit card receivable pool.

Overcollateralization Structures in Asset-Backed Securities (ABS)

Overcollateralization in Asset-Backed Securities (ABS) involves issuing bonds backed by assets whose value exceeds the total debt issued, enhancing credit quality and reducing investor risk. For example, a mortgage-backed security might be collateralized by loans with a combined principal balance of $110 million, while only $100 million in ABS bonds are issued, creating a 10% overcollateralization buffer. This structure absorbs potential losses from defaults, improving the rating and marketability of ABS tranches.

Quantitative Illustration: How Overcollateralization Works

Overcollateralization in securitization occurs when the value of the collateral exceeds the issued debt, providing a cushion against losses. For example, if a $100 million securitized bond issue is backed by $120 million in underlying assets, the 20% excess collateral absorbs potential defaults before bondholders incur losses. This quantitative buffer enhances credit ratings by reducing the risk exposure to investors.

Impact of Overcollateralization on Tranche Risk Ratings

Overcollateralization in securitization enhances credit support by providing excess collateral beyond the issued securities, thereby reducing the likelihood of losses. This structural feature improves the senior tranche risk ratings by absorbing initial defaults within subordinate tranches, which maintain higher credit quality as a result. Rating agencies assign higher investment-grade ratings to senior tranches due to overcollateralization's buffer effect, reflecting lower expected default probabilities and loss severities.

Real-World Case Study: Overcollateralized Securitization Deal

A prominent example of overcollateralization in securitization is the 2017 deal by BlackRock, where mortgage-backed securities were backed by assets exceeding the issued notes' value by 15%. This overcollateralization structure provided a significant credit enhancement, reducing the risk for investors and improving the tranche's credit ratings. The excess collateral acted as a buffer against defaults, ensuring higher investor confidence and more stable cash flows throughout the securitization lifecycle.

Benefits and Limitations of Overcollateralization in Finance

Overcollateralization in securitization involves pledging collateral exceeding the original debt value, enhancing creditworthiness and lowering default risk for investors. This cushion improves investor confidence by absorbing potential losses, leading to better credit ratings and reduced borrowing costs. However, it ties up additional capital, limiting liquidity and potentially reducing returns for issuers due to the higher collateral requirements.

example of overcollateralization in securitization Infographic

samplerz.com

samplerz.com