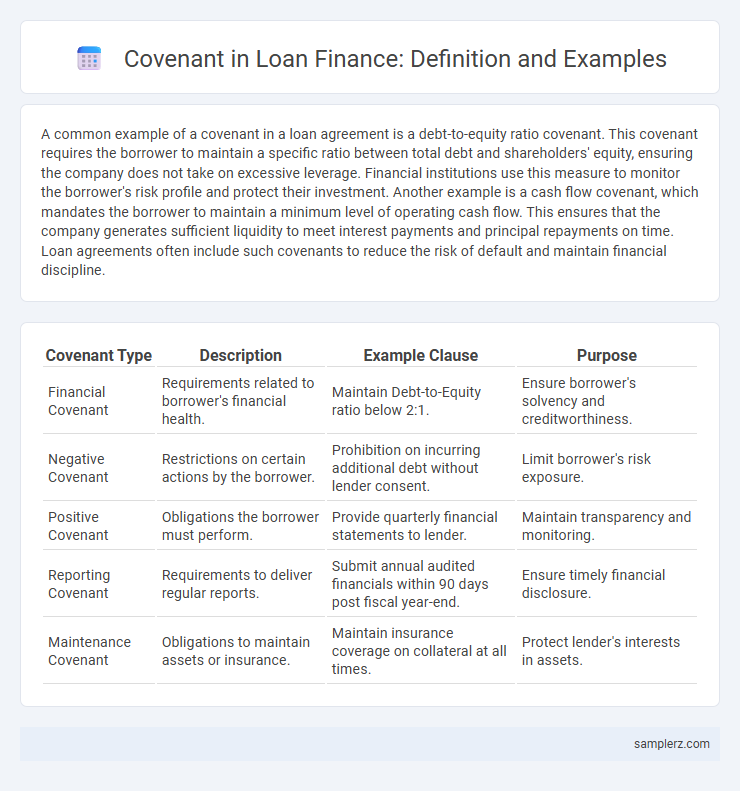

A common example of a covenant in a loan agreement is a debt-to-equity ratio covenant. This covenant requires the borrower to maintain a specific ratio between total debt and shareholders' equity, ensuring the company does not take on excessive leverage. Financial institutions use this measure to monitor the borrower's risk profile and protect their investment. Another example is a cash flow covenant, which mandates the borrower to maintain a minimum level of operating cash flow. This ensures that the company generates sufficient liquidity to meet interest payments and principal repayments on time. Loan agreements often include such covenants to reduce the risk of default and maintain financial discipline.

Table of Comparison

| Covenant Type | Description | Example Clause | Purpose |

|---|---|---|---|

| Financial Covenant | Requirements related to borrower's financial health. | Maintain Debt-to-Equity ratio below 2:1. | Ensure borrower's solvency and creditworthiness. |

| Negative Covenant | Restrictions on certain actions by the borrower. | Prohibition on incurring additional debt without lender consent. | Limit borrower's risk exposure. |

| Positive Covenant | Obligations the borrower must perform. | Provide quarterly financial statements to lender. | Maintain transparency and monitoring. |

| Reporting Covenant | Requirements to deliver regular reports. | Submit annual audited financials within 90 days post fiscal year-end. | Ensure timely financial disclosure. |

| Maintenance Covenant | Obligations to maintain assets or insurance. | Maintain insurance coverage on collateral at all times. | Protect lender's interests in assets. |

Introduction to Loan Covenants

Loan covenants are contractual clauses in finance agreements that impose specific conditions or restrictions on borrowers to protect lenders' interests. A common example includes maintaining a minimum debt service coverage ratio, which ensures the borrower generates sufficient cash flow to meet loan payments. These covenants help mitigate credit risk by enforcing financial discipline throughout the loan term.

Purpose of Loan Covenants in Finance

Loan covenants serve as binding conditions set by lenders to protect their financial interests and ensure borrower compliance. These covenants can include requirements like maintaining a minimum debt-to-equity ratio, restricting additional borrowing, or mandating regular financial reporting. Their purpose is to reduce credit risk, monitor borrower performance, and promote timely loan repayment.

Common Types of Loan Covenants

Common types of loan covenants include financial covenants, such as maintaining a minimum debt service coverage ratio (DSCR) and a maximum loan-to-value (LTV) ratio, which ensure the borrower's financial stability. Affirmative covenants require borrowers to provide regular financial statements and maintain insurance on collateral. Negative covenants restrict additional borrowing, dividend payments, or asset sales to protect the lender's interests.

Positive (Affirmative) Covenant Examples

Positive covenants in loan agreements require borrowers to maintain specified financial ratios, such as a minimum debt service coverage ratio (DSCR) of 1.25 to ensure timely loan repayments. Borrowers must provide regular financial statements, often quarterly, to lenders for ongoing assessment of creditworthiness. Additionally, maintaining adequate insurance on collateral assets protects lenders' interests throughout the loan term.

Negative (Restrictive) Covenant Examples

Negative covenants in loan agreements often include restrictions on additional borrowing, prohibiting the borrower from incurring further debt beyond a specified limit to protect the lender's interests. Another common example is limitations on asset sales, where the borrower cannot dispose of key assets without lender approval, ensuring collateral value is preserved. These covenants may also restrict dividend payments, preventing excessive cash outflows that could weaken the borrower's financial position and affect loan repayment capacity.

Financial Covenant Example in Loan Agreements

A common financial covenant in loan agreements is the maintenance of a minimum debt service coverage ratio (DSCR), which ensures the borrower generates sufficient cash flow to meet debt obligations. Lenders often require the borrower to keep a maximum leverage ratio, such as a debt-to-equity ratio below a specified threshold, to limit excessive borrowing. Failure to comply with these financial covenants can trigger default clauses or financial penalties, safeguarding lender interests.

Maintenance Covenant Sample Clauses

Maintenance covenants in loan agreements require the borrower to uphold specific financial ratios, such as maintaining a minimum Debt Service Coverage Ratio (DSCR) or a maximum Debt-to-Equity Ratio, to ensure ongoing creditworthiness. Sample clauses typically mandate maintaining a current ratio above 1.2 or restricting Total Leverage Ratio to below 4.0, safeguarding the lender's investment by limiting financial risk. These covenants are regularly tested quarterly through audited financial statements, enabling proactive measures if thresholds approach breach levels.

Incurrence Covenant in Lending Contracts

An incurrence covenant in lending contracts restricts borrowers from taking specific actions, such as incurring additional debt or making significant asset sales, without lender approval. These covenants protect lenders by ensuring the borrower maintains financial stability and limits risk exposure during the loan term. Violating an incurrence covenant can trigger default, allowing lenders to demand immediate repayment or renegotiate loan terms.

Real-World Examples of Loan Covenant Breaches

A notable example of a loan covenant breach occurred when Tesla violated its debt-to-equity ratio covenant in 2018, prompting renegotiation with lenders. Another real-world case involves Chesapeake Energy, which breached cash flow covenants in 2020 amid plummeting oil prices, leading to covenant waivers and restructuring. These breaches highlight the critical role of financial covenants in monitoring borrower risk and triggering corrective actions in loan agreements.

Impact of Loan Covenants on Borrowers and Lenders

Loan covenants, such as maintaining a minimum debt-to-equity ratio or restricting additional borrowing, directly influence borrowers' financial flexibility and operational decisions. Lenders benefit from these covenants by reducing credit risk and ensuring timely debt repayment, which helps maintain portfolio quality. Violations of loan covenants can trigger penalties, increased interest rates, or loan recalls, significantly impacting the borrower's access to capital and overall financial health.

example of covenant in loan Infographic

samplerz.com

samplerz.com