Alt-A mortgages represent a category of home loans that fall between prime and subprime lending in terms of risk. These loans often feature less stringent documentation requirements compared to traditional prime mortgages, making them appealing to borrowers with non-standard income or credit profiles. For instance, an Alt-A mortgage might allow a borrower to qualify without full income verification or with a higher loan-to-value ratio. Data shows that Alt-A loans typically have higher interest rates than prime loans due to their increased risk exposure. Loan amounts for Alt-A mortgages can vary widely but often cater to borrowers seeking to finance properties quickly without meeting all conventional underwriting standards. Financial institutions may offer Alt-A mortgages to self-employed individuals or investors who lack traditional documentation but demonstrate the ability to repay through alternative means.

Table of Comparison

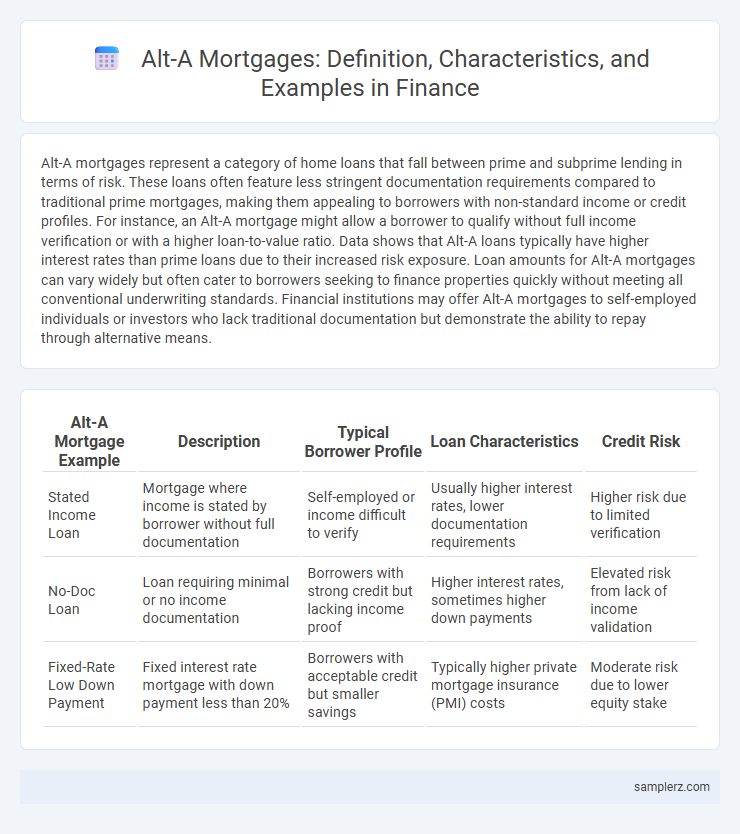

| Alt-A Mortgage Example | Description | Typical Borrower Profile | Loan Characteristics | Credit Risk |

|---|---|---|---|---|

| Stated Income Loan | Mortgage where income is stated by borrower without full documentation | Self-employed or income difficult to verify | Usually higher interest rates, lower documentation requirements | Higher risk due to limited verification |

| No-Doc Loan | Loan requiring minimal or no income documentation | Borrowers with strong credit but lacking income proof | Higher interest rates, sometimes higher down payments | Elevated risk from lack of income validation |

| Fixed-Rate Low Down Payment | Fixed interest rate mortgage with down payment less than 20% | Borrowers with acceptable credit but smaller savings | Typically higher private mortgage insurance (PMI) costs | Moderate risk due to lower equity stake |

Understanding Alt-A Mortgages in Finance

Alt-A mortgages, positioned between prime and subprime loans, often feature reduced documentation requirements and higher loan-to-value ratios, appealing to borrowers with strong credit who lack full income verification. These loans typically carry higher interest rates than conventional mortgages due to increased risk factors such as limited borrower income proof or investment properties. Understanding Alt-A mortgages involves recognizing their role in providing financing options for borrowers outside standard underwriting criteria while balancing risk for lenders.

Key Features of Alt-A Mortgage Loans

Alt-A mortgage loans typically feature moderate documentation requirements, allowing borrowers to provide limited income verification compared to prime loans. These loans often target borrowers with credit scores ranging from 620 to 700, balancing higher risk and interest rates. Key features include higher loan-to-value ratios, flexible underwriting standards, and the possibility of interest-only or adjustable-rate terms.

Typical Borrowers of Alt-A Mortgages

Typical borrowers of Alt-A mortgages often include self-employed individuals, real estate investors, and those with inconsistent income documentation. These borrowers usually have credit scores ranging from 620 to 700 and may lack full verification of income, assets, or employment. Alt-A loans serve as an intermediary risk category between prime and subprime, catering to borrowers who do not meet traditional mortgage criteria but have relatively stable financial profiles.

Comparison: Alt-A vs Prime and Subprime

Alt-A mortgages typically fall between prime and subprime loans, featuring moderate credit requirements and lower documentation standards than prime but higher borrower credit profiles than subprime. Compared to prime loans, Alt-A offers more flexible underwriting with potentially higher interest rates, while subprime loans cater to borrowers with poor credit history, often resulting in the highest rates and risk. Investors analyze Alt-A loans for balanced risk-return profiles, as they capture borrowers who do not qualify for prime terms but are less risky than subprime borrowers.

Real-World Examples of Alt-A Mortgage Scenarios

Alt-A mortgages often involve borrowers with credit scores between prime and subprime ranges, typically around 620 to 700, who may have limited documentation of income or assets. A common real-world example includes self-employed individuals who show bank statements instead of traditional tax returns to verify income, meeting lenders' requirements for Alt-A loans. These scenarios highlight the balance between risk and accessibility, where lenders approve loans without full documentation but maintain moderate credit standards.

Risk Factors Associated with Alt-A Loans

Alt-A mortgages often carry higher risk factors due to limited documentation and borrower credit profiles that are less stringent than prime loans but better than subprime. These loans may involve higher loan-to-value ratios, increased loan amounts, or income verification challenges, contributing to a greater likelihood of default. Lenders face amplified exposure to economic downturns and fluctuating real estate markets when underwriting Alt-A loan portfolios.

Documentation Standards in Alt-A Mortgages

Alt-A mortgages often feature relaxed documentation standards compared to prime loans, primarily requiring reduced income verification such as stated income or limited documentation loans. Borrowers may provide alternative evidence like bank statements or asset statements instead of full tax returns. This flexibility supports creditworthy applicants who lack traditional documentation but still present manageable risk levels for lenders.

Impact of Alt-A Mortgages on Financial Markets

Alt-A mortgages, characterized by moderate risk profiles between prime and subprime loans, significantly influenced financial markets by expanding credit availability to borrowers with imperfect documentation or credit histories. The proliferation of Alt-A loans contributed to increased mortgage-backed securities issuance, injecting liquidity but also amplifying systemic risk due to their less stringent underwriting standards. Market volatility intensified as defaults on Alt-A mortgages surged during economic downturns, underscoring their impact on financial stability and investor confidence.

Alt-A Mortgage Case Studies

Alt-A mortgages, positioned between prime and subprime lending, often involve borrowers with strong credit but limited documentation or higher loan-to-value ratios. Case studies reveal that many Alt-A loans were granted without full income verification, leading to higher default rates during economic downturns. Analysis of these mortgages underscores the importance of thorough risk assessment to mitigate potential losses in volatile housing markets.

Lessons from the Alt-A Mortgage Crisis

The Alt-A mortgage crisis exposed significant risks associated with loans issued to borrowers with limited documentation and non-traditional credit profiles, often characterized by higher loan-to-value ratios and weaker income verification. Lenders underestimated the default probabilities tied to these Alt-A mortgages, leading to widespread delinquencies and foreclosures during the 2007-2008 financial crisis. Risk management strategies now emphasize rigorous borrower underwriting standards and enhanced transparency to prevent recurrence of similar systemic vulnerabilities.

example of alt-A in mortgage Infographic

samplerz.com

samplerz.com