A basis point is a unit of measurement used in finance to describe the percentage change in interest rates or other financial percentages. One basis point equals 0.01%, or one one-hundredth of a percent. For example, if an interest rate increases from 3.50% to 3.75%, it has risen by 25 basis points. Basis points are crucial for accurately expressing small changes in interest rates without ambiguity. Financial professionals often use basis points to discuss changes in bond yields, loan rates, and investment returns. A movement of 100 basis points corresponds to a 1% change in interest rates, which can significantly impact borrowing costs and investment valuations.

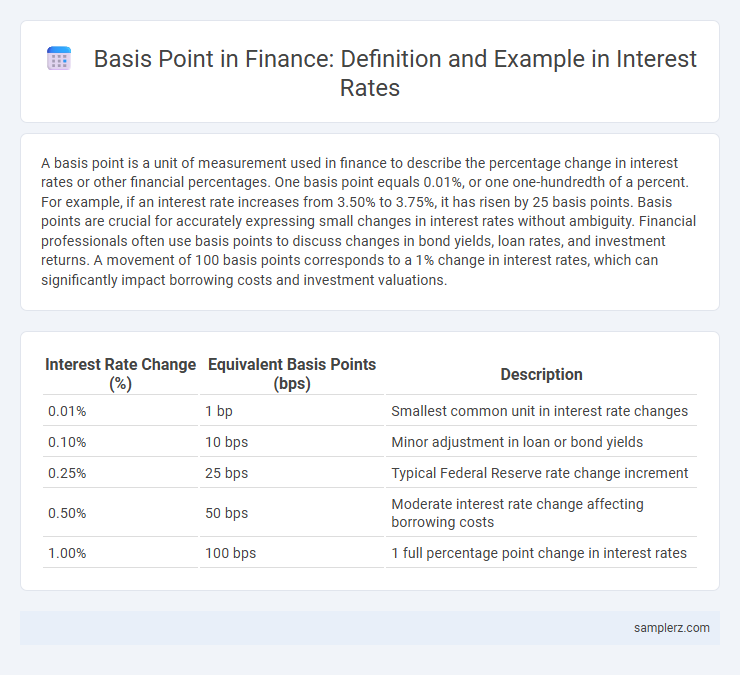

Table of Comparison

| Interest Rate Change (%) | Equivalent Basis Points (bps) | Description |

|---|---|---|

| 0.01% | 1 bp | Smallest common unit in interest rate changes |

| 0.10% | 10 bps | Minor adjustment in loan or bond yields |

| 0.25% | 25 bps | Typical Federal Reserve rate change increment |

| 0.50% | 50 bps | Moderate interest rate change affecting borrowing costs |

| 1.00% | 100 bps | 1 full percentage point change in interest rates |

Understanding Basis Points in Interest Rates

A basis point represents one hundredth of a percentage point, meaning 100 basis points equal 1% in interest rate changes. For instance, if a loan's interest rate rises from 3.00% to 3.25%, it has increased by 25 basis points. Understanding basis points is crucial for accurately interpreting shifts in bond yields, mortgage rates, and central bank policies.

How to Calculate Basis Points in Finance

Basis points measure changes in interest rates where one basis point equals 0.01% or 0.0001 in decimal form. To calculate basis points, subtract the old interest rate from the new interest rate, then multiply the result by 10,000. For example, an increase from 2.50% to 2.75% corresponds to 25 basis points (0.0275 - 0.0250 = 0.0025 x 10,000 = 25 basis points).

Real-World Example: Basis Points and Loan Interest

A basis point represents 0.01% and is commonly used to describe changes in loan interest rates, such as a 25 basis point increase raising a 3.50% interest rate to 3.75%. For instance, if a mortgage lender adjusts the interest rate by 50 basis points, the monthly payment on a $200,000 loan will increase significantly, reflecting the impact of even small fluctuations in basis points on borrowing costs. Understanding basis points helps borrowers evaluate the true cost changes in loan interest over time.

Impact of Basis Points Changes on Mortgage Rates

A basis point represents 0.01% in interest rate changes, significantly influencing mortgage rates and monthly payments. A 50 basis point increase in mortgage rates can raise monthly payments by hundreds of dollars, affecting borrower affordability and overall housing market demand. Financial institutions and consumers closely monitor basis point fluctuations to assess credit risk and lending terms.

Basis Points in Central Bank Interest Rate Decisions

Central banks often adjust interest rates in increments of basis points, where one basis point equals 0.01%. For example, a 25 basis point increase raises the rate from 1.50% to 1.75%, signaling a tightening of monetary policy. These precise adjustments help control inflation and stabilize economic growth by influencing borrowing costs and market expectations.

Comparing Investment Returns Using Basis Points

A basis point, equivalent to 0.01%, is a crucial metric for comparing investment returns, as even small differences can significantly impact yields over time. For example, an investment with a 150 basis point higher return than another translates to a 1.5% increased yield annually, which compounds to substantial gains in multi-year portfolios. Understanding basis points allows investors to precisely evaluate and differentiate performance among bonds, mutual funds, and savings accounts.

Basis Points in Bond Yield Adjustments

A basis point represents 0.01% and is commonly used to measure changes in bond yields, where a 25 basis point increase raises the yield from 2.50% to 2.75%. This precise measurement allows investors to gauge small fluctuations in interest rates, significantly impacting bond prices and investment returns. Tracking basis point adjustments helps portfolio managers optimize bond strategies in response to central bank rate changes and market conditions.

Tracking Credit Card Interest with Basis Points

Tracking credit card interest using basis points provides a precise measure of rate changes, where one basis point equals 0.01%. For example, if a credit card's annual interest rate increases from 15.00% to 15.25%, that 25 basis point rise directly impacts the cost of borrowing. Monitoring these small increments in basis points helps consumers and financial analysts accurately assess fluctuations in credit card interest expenses.

Role of Basis Points in Savings Account Rates

Basis points measure changes in savings account interest rates, where 100 basis points equal a 1% change, helping consumers understand rate adjustments precisely. For instance, a 25 basis point increase on a 1.50% savings rate raises the rate to 1.75%, directly impacting earned interest. Monitoring basis point shifts enables savers to compare offers and optimize returns effectively.

Visualizing Interest Movements with Basis Point Examples

A 25 basis point increase in interest rates means a 0.25% rise, which can significantly impact loan repayments and investment yields. Visualizing this, if a mortgage rate rises from 3.00% to 3.25%, monthly payments increase noticeably, affecting borrowers' affordability. Investors tracking bond yields see a similar shift as a 50 basis point decline from 2.00% to 1.50% boosts bond prices, illustrating how small interest rate changes influence financial decisions.

example of basis point in interest Infographic

samplerz.com

samplerz.com