A poison pill is a defensive strategy used by companies to thwart hostile takeover attempts during mergers. One common example involves issuing new shares at a discount to existing shareholders, excluding the potential acquirer. This dilutes the acquirer's stake, making the takeover prohibitively expensive. Another example includes granting shareholders rights to purchase additional stock if any one investor acquires a large percentage of company shares. This tactic significantly increases the number of shares outstanding, diluting ownership and deterring hostile bidders. Companies employ poison pills to protect their valuation and maintain control during merger negotiations.

Table of Comparison

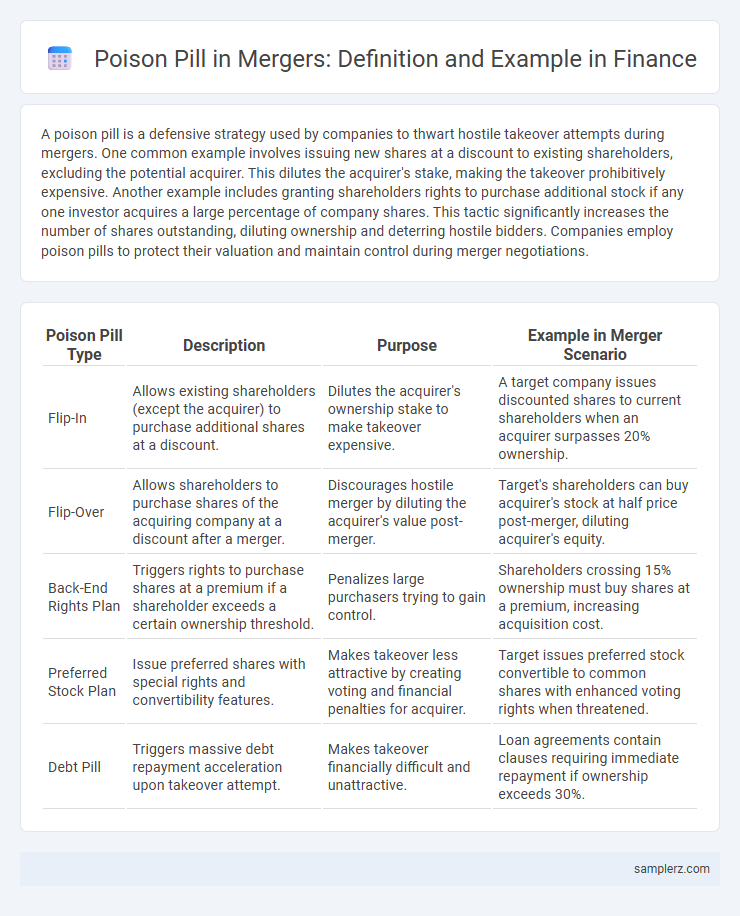

| Poison Pill Type | Description | Purpose | Example in Merger Scenario |

|---|---|---|---|

| Flip-In | Allows existing shareholders (except the acquirer) to purchase additional shares at a discount. | Dilutes the acquirer's ownership stake to make takeover expensive. | A target company issues discounted shares to current shareholders when an acquirer surpasses 20% ownership. |

| Flip-Over | Allows shareholders to purchase shares of the acquiring company at a discount after a merger. | Discourages hostile merger by diluting the acquirer's value post-merger. | Target's shareholders can buy acquirer's stock at half price post-merger, diluting acquirer's equity. |

| Back-End Rights Plan | Triggers rights to purchase shares at a premium if a shareholder exceeds a certain ownership threshold. | Penalizes large purchasers trying to gain control. | Shareholders crossing 15% ownership must buy shares at a premium, increasing acquisition cost. |

| Preferred Stock Plan | Issue preferred shares with special rights and convertibility features. | Makes takeover less attractive by creating voting and financial penalties for acquirer. | Target issues preferred stock convertible to common shares with enhanced voting rights when threatened. |

| Debt Pill | Triggers massive debt repayment acceleration upon takeover attempt. | Makes takeover financially difficult and unattractive. | Loan agreements contain clauses requiring immediate repayment if ownership exceeds 30%. |

Introduction to Poison Pills in Mergers

A poison pill, also known as a shareholder rights plan, is a defensive strategy used by companies to prevent or discourage hostile takeovers during mergers and acquisitions. This tactic grants existing shareholders the right to purchase additional shares at a discount, diluting the ownership interest of a potential acquirer and increasing the cost of the takeover. Prominent examples include Netflix's 2012 poison pill to fend off activist shareholder Carl Icahn and Papa John's 2018 rights plan designed to block board threats.

Understanding How Poison Pills Work

A poison pill is a defensive strategy used by companies to prevent hostile takeovers by making their stock less attractive to potential acquirers. This tactic allows existing shareholders to purchase additional shares at a discount, diluting the value and ownership percentage of a hostile bidder. For example, in the 1985 takeover attempt of Unocal by Mesa Petroleum, Unocal implemented a poison pill by issuing discounted shares to its shareholders, effectively deterring the unwanted takeover.

Notable Real-World Examples of Poison Pill Strategies

In the 1985 merger battle for Revlon, McAndrews held the board's poison pill to deter Kohlberg Kravis Roberts' hostile takeover attempt. Netflix employed a poison pill in 2012 to prevent Carl Icahn's activist stake from enabling a hostile acquisition. More recently, Papa John's adopted a poison pill strategy in 2018 to block potential investor activist moves aimed at altering board control.

Case Study: Netflix's Poison Pill Defense

Netflix implemented a poison pill defense during its 2012 merger talks with Starz to prevent a hostile takeover by increasing the cost for potential acquirers. The strategy involved issuing new shares to existing shareholders at a discount, diluting the ownership stake of any acquiring party that attempted to gain control beyond a set threshold. This case exemplifies how poison pills can serve as an effective deterrent against unwanted mergers in the media and entertainment finance sector.

Yahoo’s Use of Poison Pill Against Microsoft

Yahoo implemented a poison pill strategy during Microsoft's 2008 unsolicited takeover attempt to dilute shares and prevent a hostile acquisition by issuing rights to existing shareholders, allowing them to purchase additional shares at a discount. This tactic effectively raised Microsoft's cost of acquisition and discouraged further takeover efforts, preserving Yahoo's independence. The case exemplifies how poison pills serve as a defensive mechanism within merger and acquisition scenarios to protect target companies from hostile bidders.

Airgas vs. Air Products: A Hostile Takeover Tale

The Airgas vs. Air Products case exemplifies a classic poison pill defense, where Airgas adopted a shareholder rights plan to thwart Air Products' hostile takeover bid. This strategy allowed Airgas to significantly dilute shares if an acquirer exceeded a 10% stake, deterring Air Products' aggressive acquisition attempts. The prolonged battle highlighted the effectiveness of poison pills in preserving corporate independence during contentious mergers.

The Papa John’s Shareholder Rights Plan Example

The Papa John's Shareholder Rights Plan, implemented in 2018, serves as a classic example of a poison pill strategy to prevent hostile takeovers during mergers. This plan allowed existing shareholders to purchase additional shares at a discount if any single investor acquired more than 15% of the company's stock, diluting the potential acquirer's stake. By triggering this dilution, the strategy effectively protected Papa John's management and board from unwelcome acquisition attempts, maintaining shareholder control.

Twitter’s Poison Pill to Thwart Elon Musk’s Takeover

Twitter implemented a poison pill strategy in April 2022, allowing existing shareholders to purchase additional shares at a discount if any single investor acquired more than 15% of the company's stock, effectively diluting Elon Musk's stake. This defensive tactic aimed to prevent Musk from gaining control without board approval, protecting Twitter from a hostile takeover. The poison pill significantly complicated Musk's acquisition efforts, exemplifying a strategic move to preserve shareholder value amid aggressive buyout attempts.

Impact of Poison Pill Provisions on Shareholder Value

Poison pill provisions can significantly dilute the ownership percentage of potential acquirers, deterring hostile takeovers and often leading to a decline in stock price due to perceived managerial entrenchment. Studies indicate that shareholders may experience short-term value reductions as these provisions limit premium offers from suitors, although long-term effects vary depending on the firm's strategic outcomes. Empirical evidence suggests shareholder value in firms with poison pills can underperform industry peers by 5-10% around takeover events, reflecting market skepticism of takeover defenses.

Lessons Learned from Famous Poison Pill Implementations

Famous poison pill implementations, such as the Netflix and PeopleSoft defenses, highlight the importance of tailoring shareholder rights plans to specific takeover threats, effectively deterring hostile bids without alienating investors. The experience from these cases underscores the necessity of maintaining clear communication with shareholders and regulatory bodies to ensure transparency and legal compliance during mergers. Companies learn that implementing a poison pill too late or without a strategic framework can weaken its defensive impact and erode shareholder trust.

example of poison pill in merger Infographic

samplerz.com

samplerz.com