Price talk in an issuance refers to the preliminary price range communicated by underwriters to potential investors before finalizing the offering price of a new security. This range helps gauge investor demand and market conditions, enabling issuers to adjust pricing strategies for optimal capital raising. For example, during a bond issuance, underwriters might indicate a price talk range of 99-101, reflecting the anticipated yield and credit quality of the issuer. In equity offerings, price talk guides investors on expected share pricing, often influencing subscription levels and allocation decisions. A typical scenario involves underwriters proposing a price talk range of $25 to $27 per share based on company valuation and market sentiment. Tracking price talk data provides valuable insights into market reception and can impact the success of the issuance process.

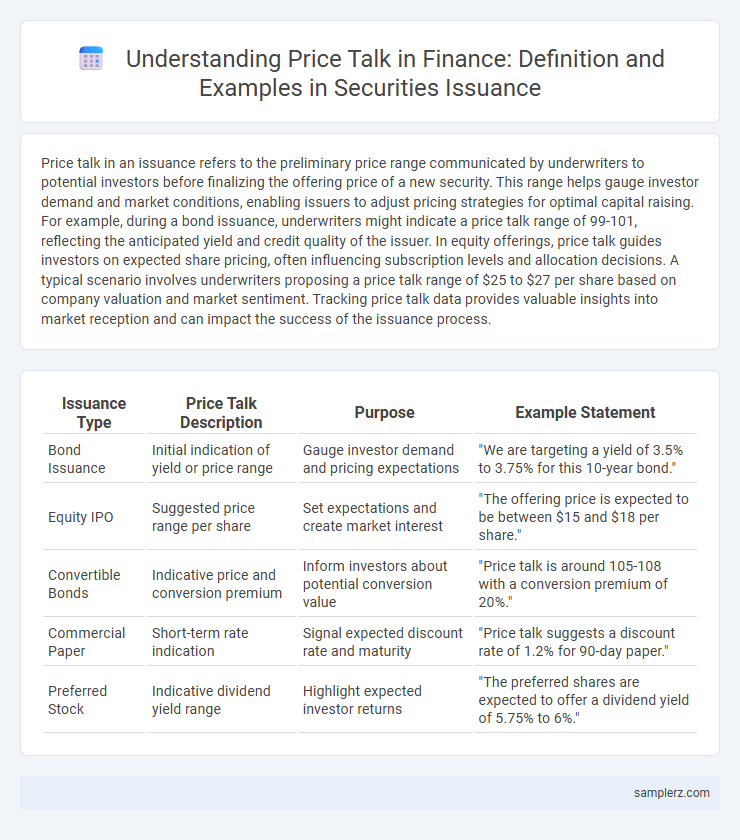

Table of Comparison

| Issuance Type | Price Talk Description | Purpose | Example Statement |

|---|---|---|---|

| Bond Issuance | Initial indication of yield or price range | Gauge investor demand and pricing expectations | "We are targeting a yield of 3.5% to 3.75% for this 10-year bond." |

| Equity IPO | Suggested price range per share | Set expectations and create market interest | "The offering price is expected to be between $15 and $18 per share." |

| Convertible Bonds | Indicative price and conversion premium | Inform investors about potential conversion value | "Price talk is around 105-108 with a conversion premium of 20%." |

| Commercial Paper | Short-term rate indication | Signal expected discount rate and maturity | "Price talk suggests a discount rate of 1.2% for 90-day paper." |

| Preferred Stock | Indicative dividend yield range | Highlight expected investor returns | "The preferred shares are expected to offer a dividend yield of 5.75% to 6%." |

Understanding Price Talk in Financial Issuance

Price talk in financial issuance occurs when underwriters provide preliminary guidance on the expected pricing range of securities before the official pricing announcement. This communication helps gauge investor demand and market sentiment, allowing issuers to set an optimal price that balances yield and subscription levels. Understanding price talk enables investors to anticipate issuance pricing dynamics and participate more effectively in primary market offerings.

The Role of Price Talk During Bond Offerings

Price talk during bond offerings serves as a crucial communication tool between issuers and investors, helping to establish a preliminary yield range based on market conditions and investor demand. This process allows underwriters to gauge interest levels and adjust pricing to optimize the bond's appeal and successful issuance. Effective price talk reduces pricing risk and enhances market transparency, ultimately facilitating a more efficient bond offering.

How Issuers Use Price Talk to Gauge Investor Sentiment

Issuers use price talk during bond or equity issuance to test investor appetite by sharing preliminary pricing ranges and gauging feedback before finalizing the offering terms. This communication helps underwriters assess demand elasticity and adjust coupon rates or pricing to optimize market reception and minimize volatility. Effective price talk allows issuers to balance achieving favorable financing costs with investor interest, thereby enhancing capital raise success.

Real-World Examples of Price Talk in Syndicated Loans

Price talk in syndicated loans typically involves lead arrangers gauging investor appetite by proposing indicative spreads and margins during the book-building process. For instance, JP Morgan's chatter around a $1 billion loan for a major energy firm included initial price talk at LIBOR + 350 basis points, which adjusted to LIBOR + 325 basis points after strong investor demand. Such real-world examples highlight how price talk shapes final pricing and allocation in syndicated loan issuances, directly impacting the borrower's cost of capital and syndicate participation.

Key Factors Influencing Price Talk in Debt Issuance

Price talk in debt issuance is influenced by key factors such as current market interest rates, issuer credit rating, and prevailing economic conditions. Investor demand and comparable recent deals also shape pricing discussions by providing benchmarks for yield expectations. Understanding these elements is crucial for aligning issuer and investor interests during negotiation.

Price Talk vs. Final Pricing: What’s the Difference?

Price talk refers to the initial range or indication of yield and price given by underwriters during a bond issuance roadshow to gauge investor interest before the official pricing. Final pricing occurs after assessing demand and market conditions, establishing the definitive yield and price at which the securities will be sold. Understanding the difference between price talk and final pricing is crucial for investors to evaluate the potential value and risks before committing capital.

The Impact of Market Conditions on Price Talk

Price talk in bond issuance is significantly influenced by prevailing market conditions, where high market volatility often leads to wider price talk ranges as issuers and investors negotiate yields to balance risk. Tight market conditions with strong demand typically result in narrower price talk, reflecting increased confidence and the issuer's ability to secure favorable pricing. Understanding these dynamics allows issuers to strategically time their offerings and optimize capital raise by aligning price talk with current investor sentiment and liquidity levels.

Price Talk Case Study: Corporate Bond Issuance

Price talk in corporate bond issuance involves preliminary discussions between underwriters and investors to gauge interest and set a pricing range. For instance, in a recent $500 million bond offering by a tech firm, underwriters proposed a yield range of 4.25% to 4.50%, adjusting based on investor feedback and market conditions. This price talk process helped achieve a successful issuance with favorable pricing, aligning investor demand with issuer objectives.

Regulatory Perspectives on Price Talk in Capital Markets

Price talk in capital markets refers to preliminary discussions between issuers and underwriters regarding the potential pricing range of a security before formal issuance. Regulatory frameworks, such as the SEC's guidelines under the Securities Act of 1933, strictly monitor these communications to prevent selective disclosure and maintain market fairness. Compliance ensures that price talk does not constitute an offer, thereby safeguarding investors from misleading information during the capital raising process.

Best Practices for Communicating Price Talk with Investors

Effective price talk in debt or equity issuance involves clear, concise communication of pricing guidance to investors to foster transparency and confidence. Best practices include providing a well-defined price range based on market conditions, offering rationale for pricing decisions tied to comparable issuances, and ensuring timely updates to manage investor expectations. Maintaining consistency in messaging across all channels helps minimize uncertainty and supports successful capital raising.

example of price talk in issuance Infographic

samplerz.com

samplerz.com