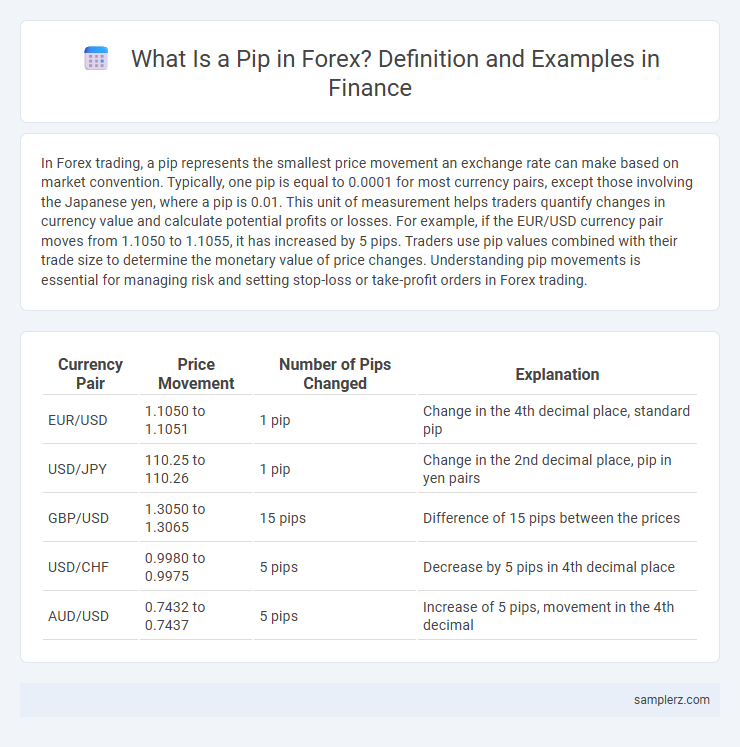

In Forex trading, a pip represents the smallest price movement an exchange rate can make based on market convention. Typically, one pip is equal to 0.0001 for most currency pairs, except those involving the Japanese yen, where a pip is 0.01. This unit of measurement helps traders quantify changes in currency value and calculate potential profits or losses. For example, if the EUR/USD currency pair moves from 1.1050 to 1.1055, it has increased by 5 pips. Traders use pip values combined with their trade size to determine the monetary value of price changes. Understanding pip movements is essential for managing risk and setting stop-loss or take-profit orders in Forex trading.

Table of Comparison

| Currency Pair | Price Movement | Number of Pips Changed | Explanation |

|---|---|---|---|

| EUR/USD | 1.1050 to 1.1051 | 1 pip | Change in the 4th decimal place, standard pip |

| USD/JPY | 110.25 to 110.26 | 1 pip | Change in the 2nd decimal place, pip in yen pairs |

| GBP/USD | 1.3050 to 1.3065 | 15 pips | Difference of 15 pips between the prices |

| USD/CHF | 0.9980 to 0.9975 | 5 pips | Decrease by 5 pips in 4th decimal place |

| AUD/USD | 0.7432 to 0.7437 | 5 pips | Increase of 5 pips, movement in the 4th decimal |

Understanding Pips in Forex Trading

A pip in Forex trading represents the smallest price move that a currency pair can make, typically equal to 0.0001 for most currency pairs like EUR/USD. Understanding pips is crucial since traders measure profits and losses in pips, allowing precise calculation of risk and reward. For example, if EUR/USD moves from 1.1050 to 1.1060, it has moved 10 pips, directly impacting the trader's position value.

What Is a Pip? Definition and Basics

A pip, short for "percentage in point," is the smallest price movement in the forex market, typically representing a one-digit change in the fourth decimal place for most currency pairs, such as EUR/USD moving from 1.1050 to 1.1051. Understanding pip value is crucial for traders to measure price changes and calculate potential profits or losses accurately. Forex brokers and trading platforms commonly use pips to standardize price movements, making it easier to compare and analyze currency pair fluctuations across different markets.

How to Calculate Pips in Currency Pairs

A pip in Forex typically represents the smallest price move in a currency pair, often the fourth decimal place (0.0001) for most major pairs like EUR/USD. To calculate pips, subtract the initial price from the final price and multiply by 10,000 if the pair is quoted to four decimal places; for example, a movement from 1.1050 to 1.1075 equals 25 pips (0.0025 x 10,000). For pairs quoted to two decimal places, such as USD/JPY, multiply by 100 to determine the pip value accurately.

Pip Example: Major Currency Pair EUR/USD

In Forex trading, a pip represents the smallest price movement in a currency pair, typically 0.0001 for most major pairs like EUR/USD. For example, if the EUR/USD exchange rate moves from 1.1800 to 1.1805, it has increased by 5 pips. Understanding pip values helps traders calculate potential profits and losses accurately in currency trading.

Pip Example: Minor and Exotic Pairs

In Forex trading, a pip represents the smallest price movement in currency pairs, typically 0.0001 for minor pairs like EUR/GBP and 0.01 for exotic pairs such as USD/TRY. Minor pairs experience pip changes reflecting minute fluctuations, essential for precise risk management and strategy adjustments. Exotic pairs, with higher pip values due to lower liquidity and greater volatility, demand careful analysis to capitalize on market movements while managing increased risk exposure.

Pip Value Calculation in Forex

In Forex trading, a pip represents the smallest price change in a currency pair, typically 0.0001 for most pairs except Japanese yen pairs where it is 0.01. The pip value is calculated by multiplying one pip by the lot size and then converting it to the trader's account currency using the current exchange rate. For example, for a standard lot of 100,000 units in EUR/USD with a pip size of 0.0001, the pip value equals $10.

Pipettes: The Fractional Pip Explained

In Forex trading, a pip typically represents the smallest price move in the exchange rate, often 0.0001 for most currency pairs. Pipettes are fractional pips, measuring one-tenth of a pip, or 0.00001, allowing traders to gauge even finer price movements and execute more precise trades. This increased granularity enhances risk management and profit calculation in high-frequency trading strategies.

Real-World Scenarios: Pips in Action

A pip in Forex represents the smallest price movement in currency pairs, typically 0.0001 for most major pairs like EUR/USD. For example, if EUR/USD moves from 1.1050 to 1.1055, that 5-pip change can translate to a $50 profit or loss on a standard lot of 100,000 units. Professional traders closely monitor pip fluctuations to manage risk and optimize entry and exit points in dynamic market conditions.

The Role of Pips in Forex Risk Management

A pip in Forex represents the smallest price movement in a currency pair, often equivalent to 0.0001 for most pairs, crucial for calculating profit and loss. Effective risk management uses pips to set stop-loss and take-profit levels, helping traders limit potential losses and lock in gains. Understanding pip value and its impact on margin requirements enhances precision in managing overall trade risk.

Common Pip Calculation Mistakes to Avoid

A common mistake in pip calculation in Forex trading is confusing pips with pipettes, which differ by a decimal place and can lead to incorrect profit or loss estimations. Traders often neglect to adjust pip value based on lot size and currency pair, causing inaccurate risk management and position sizing. Ensuring precise pip calculations requires understanding that one pip typically equals 0.0001 for most currency pairs, except for JPY pairs, where one pip equals 0.01.

example of pip in Forex Infographic

samplerz.com

samplerz.com