Tromboning in a leveraged buyout occurs when complex financial transactions create circular flows of funds to obscure the true source or use of debt financing. For example, a private equity firm might use tromboning by routing debt through multiple special purpose vehicles (SPVs) before funneling the capital into the operating company. This technique can inflate leverage ratios artificially and make the financial structure harder for analysts to decode. In a specific case, the acquiring firm could raise debt at the holding company level, transfer those funds down to an SPV, then borrow again against that SPV to inject capital into the portfolio company. The cyclical movement of funds creates layers that mask the actual debt burden borne by the operating company. Tromboning can trigger regulatory scrutiny as well as raises concerns about financial transparency and risk assessment in leveraged buyouts.

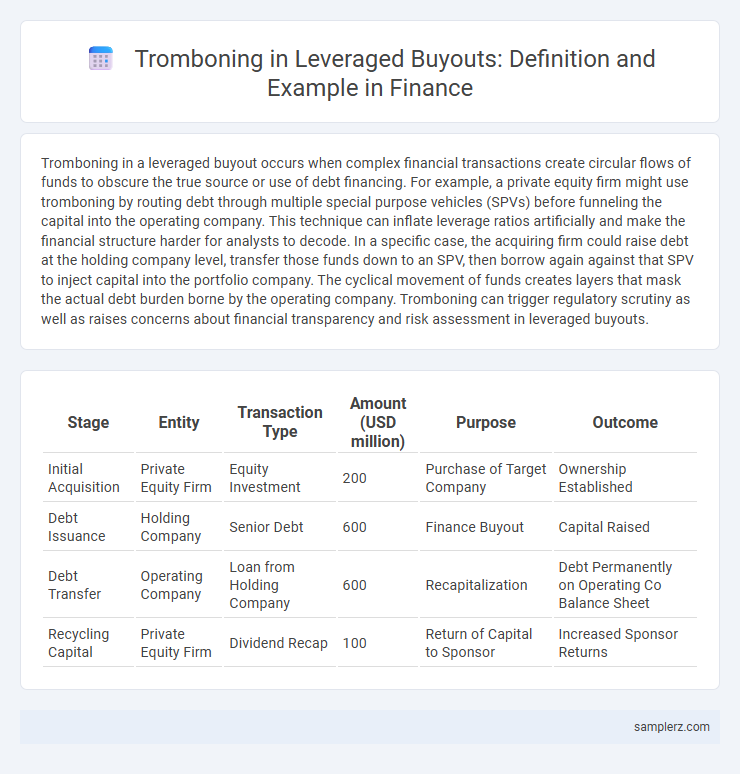

Table of Comparison

| Stage | Entity | Transaction Type | Amount (USD million) | Purpose | Outcome |

|---|---|---|---|---|---|

| Initial Acquisition | Private Equity Firm | Equity Investment | 200 | Purchase of Target Company | Ownership Established |

| Debt Issuance | Holding Company | Senior Debt | 600 | Finance Buyout | Capital Raised |

| Debt Transfer | Operating Company | Loan from Holding Company | 600 | Recapitalization | Debt Permanently on Operating Co Balance Sheet |

| Recycling Capital | Private Equity Firm | Dividend Recap | 100 | Return of Capital to Sponsor | Increased Sponsor Returns |

Understanding Tromboning in Leveraged Buyouts

Tromboning in leveraged buyouts involves a financial structure where debt is passed through multiple entities within the acquisition group to optimize tax benefits and improve cash flow management. This technique allows the acquiring company to consolidate interest expenses at a higher group level, effectively reducing the overall cost of debt through tax shields. Understanding tromboning is crucial for structuring buyouts to enhance leverage efficiency and maximize shareholder returns.

Key Mechanisms of Tromboning in LBO Finance

Tromboning in leveraged buyouts (LBOs) involves the cyclical movement of funds between subsidiary and parent companies to optimize debt structure and enhance tax benefits. Key mechanisms include intercompany loans that shift leverage inward, allowing the parent to maximize interest deductions while minimizing consolidated financial risk. This strategic cash flow rotation supports efficient capital allocation and can improve overall transaction returns by leveraging tax shields.

Real-World Examples of Tromboning in LBO Deals

Tromboning in leveraged buyouts (LBOs) refers to the practice of a private equity firm repeatedly refinancing debt to extend maturities and manage interest expenses, often seen in large deals like Dell's 2013 go-private transaction. In real-world examples, tromboning allowed firms to optimize cash flows and maintain control while gradually paying down obligations, as demonstrated in the LBO of TXU Energy by Kohlberg Kravis Roberts (KKR) in 2007. This refinancing technique leverages market conditions to adjust capital structures dynamically, enhancing financial flexibility throughout the investment horizon.

Tromboning vs. Traditional Debt Repayment Structures

Tromboning in leveraged buyouts involves refinancing debt through multiple intermediaries or entities, creating a complex web of obligations that can obscure the true leverage and risk profile of the acquisition. Unlike traditional debt repayment structures, which feature straightforward amortization schedules and clear creditor-debtor relationships, tromboning complicates cash flow analysis and may enhance short-term liquidity at the expense of long-term financial transparency. This strategy can lead to challenges in risk assessment, regulatory scrutiny, and potential difficulties in restructuring during financial distress.

Risks Associated with Tromboning in Leveraged Transactions

Tromboning in leveraged buyouts involves complex fund movements that can obscure true leverage levels and increase financial opacity, heightening regulatory scrutiny and legal risk. This practice may amplify credit risk by creating unrealistic asset valuations, leading to potential covenant breaches and liquidity shortfalls. Exposure to reputational damage and higher borrowing costs arises from decreased investor confidence and perceived manipulation in capital structure management.

Impact of Tromboning on LBO Financial Performance

Tromboning in leveraged buyouts (LBOs) involves the artificial cycling of capital through affiliated entities to manipulate financial statements, boosting apparent earnings and leverage ratios. This practice often distorts cash flow projections, leading to inflated debt capacity assessments and masking true financial risk, which can undermine investor confidence and increase the likelihood of default. The impact on LBO financial performance includes reduced operational transparency, impaired valuation accuracy, and potential regulatory scrutiny affecting long-term returns.

Regulatory Perspectives on Tromboning Practices

Tromboning in leveraged buyouts involves reusing cash flows from a subsidiary to service debt at the parent level, raising significant regulatory scrutiny due to potential masking of true financial risk. Regulatory authorities often examine tromboning to prevent manipulation of consolidated financial statements and ensure transparency in debt servicing and risk exposure. Enhanced disclosure requirements and stress testing are common regulatory tools applied to monitor and mitigate systemic risks associated with tromboning practices in leveraged buyouts.

Tromboning Strategies Used by Private Equity Firms

Tromboning strategies in leveraged buyouts involve private equity firms using multiple layers of debt refinancing to optimize capital structure and enhance returns. By orchestrating complex debt repayments and re-borrowing within the portfolio companies, firms improve cash flow management and reduce overall financing costs. These tactics are instrumental in maximizing leverage benefits while maintaining flexibility for operational improvements and exit strategies.

Case Study: Tromboning in High-Profile LBOs

In leveraged buyouts (LBOs), tromboning occurs when a parent company sells assets to a subsidiary, which then borrows extensively to finance the acquisition, effectively transferring debt and risk internally. A prominent case study is the $50 billion LBO of TXU Corporation in 2007, where Energy Future Holdings used tromboning to restructure its capital, layering debt through subsidiaries to optimize tax benefits and control financial exposure. This strategic maneuver in TXU's LBO illustrates how tromboning can increase leverage while enabling complex debt management within high-profile transactions.

Mitigating Tromboning Risks in Leveraged Buyouts

Mitigating tromboning risks in leveraged buyouts involves implementing robust transfer pricing policies and monitoring intra-group transactions to prevent artificial inflation of debt or equity positions. Enhanced due diligence and transparent financial reporting ensure early detection of tromboning activities, preserving the transaction's integrity and compliance with regulatory standards. Leveraging advanced analytics tools helps identify unusual cash flows and mitigates the risk of value erosion caused by asset shuffling within the corporate structure.

example of tromboning in leveraged buyout Infographic

samplerz.com

samplerz.com