A backdoor listing in an IPO occurs when a private company becomes publicly traded by merging with an already listed shell company, bypassing the traditional initial public offering process. This method allows the private company to gain stock exchange access quickly, often resulting in reduced regulatory scrutiny and lower listing expenses. Data from recent financial markets show an increase in backdoor listings, especially in sectors such as technology and healthcare, where rapid market entry is crucial. Entities involved in a backdoor listing include the private company seeking to go public, the publicly listed shell company, and regulatory bodies overseeing the transaction. Financial statements and market capitalization of these companies typically undergo significant changes post-merger, reflecting the private entity's operational scale and financial metrics. Historical data indicate that backdoor listings can lead to substantial stock price volatility immediately following the transaction due to market uncertainty and investor speculation.

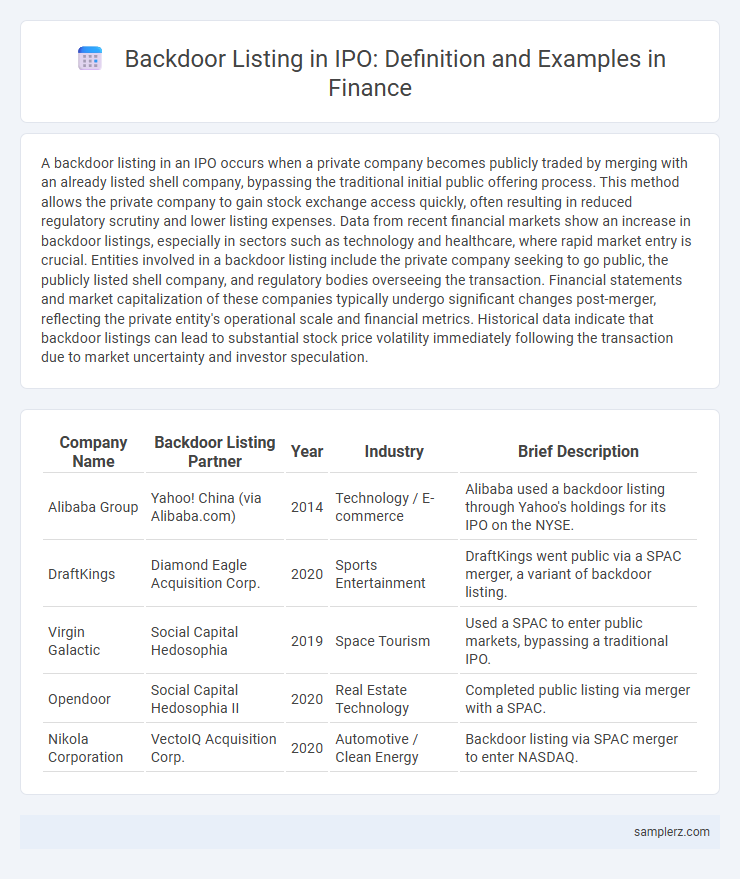

Table of Comparison

| Company Name | Backdoor Listing Partner | Year | Industry | Brief Description |

|---|---|---|---|---|

| Alibaba Group | Yahoo! China (via Alibaba.com) | 2014 | Technology / E-commerce | Alibaba used a backdoor listing through Yahoo's holdings for its IPO on the NYSE. |

| DraftKings | Diamond Eagle Acquisition Corp. | 2020 | Sports Entertainment | DraftKings went public via a SPAC merger, a variant of backdoor listing. |

| Virgin Galactic | Social Capital Hedosophia | 2019 | Space Tourism | Used a SPAC to enter public markets, bypassing a traditional IPO. |

| Opendoor | Social Capital Hedosophia II | 2020 | Real Estate Technology | Completed public listing via merger with a SPAC. |

| Nikola Corporation | VectoIQ Acquisition Corp. | 2020 | Automotive / Clean Energy | Backdoor listing via SPAC merger to enter NASDAQ. |

Introduction to Backdoor Listing in IPOs

Backdoor listing in IPOs involves a private company acquiring a publicly listed shell company to bypass the traditional initial public offering process, accelerating market entry and reducing regulatory scrutiny. This strategy allows firms to access capital markets efficiently while avoiding lengthy IPO timelines and high underwriting costs. Notable examples include Alibaba's acquisition of a publicly listed entity, facilitating its fast-track public listing.

Key Features of Backdoor Listings

Backdoor listings in IPOs involve private companies acquiring publicly traded shell companies to bypass the traditional initial public offering process, enabling faster market access with reduced regulatory scrutiny. Key features include expedited listing procedures, cost efficiency compared to conventional IPOs, and potential risks such as inherited liabilities from the shell company. This method allows firms to leverage existing public company structures for capital raising and liquidity without undergoing extensive disclosure and underwriting requirements.

How Backdoor Listings Differ from Traditional IPOs

Backdoor listings enable private companies to become publicly traded by merging with an existing shell company, bypassing the lengthy regulatory process of traditional IPOs. Unlike traditional IPOs that involve underwriting, roadshows, and extensive due diligence, backdoor listings offer a faster, cost-effective path to public markets but may carry higher risks and less transparency. This method allows firms to access capital markets while avoiding some of the volatility and uncertainties associated with conventional IPO procedures.

Notable Global Examples of Backdoor Listings

Tesla Motors utilized a backdoor listing in 2010 by merging with a publicly traded special purpose acquisition company (SPAC), enabling faster access to public markets. DraftKings completed a backdoor IPO through a reverse merger with SBTech in 2020, bypassing traditional initial public offering processes while securing substantial capital. Virgin Galactic went public via a merger with Social Capital Hedosophia in 2019, exemplifying a high-profile backdoor listing in the aerospace sector.

Famous Backdoor Listing Cases in the US Market

Famous backdoor listing cases in the US market include the merger of DraftKings with SBTech via a special purpose acquisition company (SPAC), enabling DraftKings to go public without a traditional IPO process. Another notable example is Virgin Galactic's public debut through a reverse merger with Social Capital Hedosophia Holdings, a blank-check company, bypassing lengthy regulatory scrutiny. These cases highlight how backdoor listings offer faster market entry and capital access for innovative firms.

Remarkable Backdoor Listings in Asian Financial Markets

Notable backdoor listings in Asian financial markets include Alibaba's acquisition of a US-listed company, enabling it to bypass the traditional IPO process and list on the New York Stock Exchange. Another significant example is the merger of JD.com with a publicly traded special purpose acquisition company (SPAC), facilitating rapid market entry without extensive regulatory hurdles. These strategic moves highlight the growing preference for backdoor listings as an efficient alternative to conventional IPOs in Asia's dynamic financial landscape.

Successful Backdoor Listing Stories

Famous backdoor listing examples include the merger of Burger King with Justice Holdings in 2012, which allowed Burger King to go public without a traditional IPO process. Another successful case is DraftKings' reverse merger with Diamond Eagle Acquisition Corp in 2020, accelerating its entry to the stock market while accessing capital efficiently. These transactions demonstrate how backdoor listings provide fast-track public market access with potentially lower costs compared to conventional IPOs.

Lessons Learned from Failed Backdoor Listings

Failed backdoor listings, such as the 2013 attempt by Groupon's China affiliate to enter the Hong Kong market, highlight the risks of inadequate due diligence and regulatory scrutiny. These cases demonstrate that opaque corporate structures and incomplete financial disclosures can erode investor confidence and lead to suspension or delisting. Investors and companies must prioritize transparency and compliance to mitigate risks associated with backdoor IPOs.

Regulatory Responses to Backdoor Listings

Regulatory responses to backdoor listings in IPOs have intensified globally to enhance market transparency and protect investors. Authorities like the SEC and FCA have implemented stricter disclosure requirements and enhanced due diligence protocols to identify and curb backdoor listing practices. These measures aim to prevent market manipulation and ensure fair valuation in the capital markets.

The Future Outlook for Backdoor Listings in IPOs

Backdoor listings, also known as reverse takeovers, offer companies a faster and cost-effective alternative to traditional IPOs by acquiring existing publicly listed entities. Market trends indicate increasing regulatory scrutiny and evolving compliance requirements, which may impact the frequency and structure of future backdoor listings. Investors should monitor the regulatory landscape and company fundamentals closely, as backdoor listings could remain a viable strategy for emerging firms seeking rapid market entry amid fluctuating economic conditions.

example of backdoor listing in IPO Infographic

samplerz.com

samplerz.com