A trigger event in a credit default swap (CDS) occurs when the reference entity experiences a credit event that activates the contract. Common examples include bankruptcy, failure to pay, and restructuring of debt. These events signal a deterioration in the creditworthiness of the reference entity, prompting settlements between the swap buyer and seller. The identification of a trigger event relies on predefined criteria outlined in the ISDA Master Agreement. Data such as missed payments, court rulings, or public announcements play a crucial role in confirming the event. Accurate tracking of these credit events enables effective risk management and pricing in the CDS market.

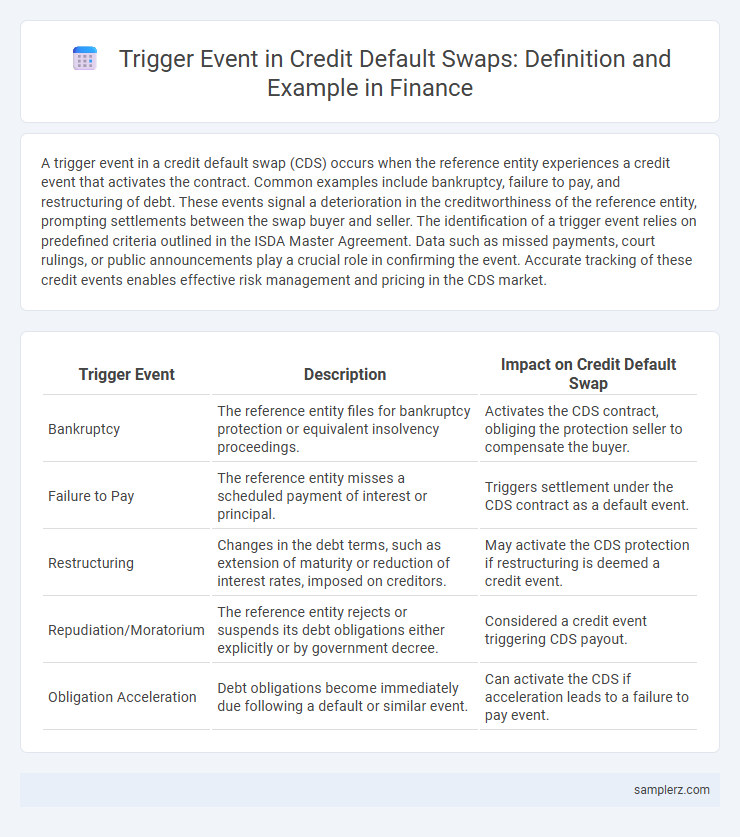

Table of Comparison

| Trigger Event | Description | Impact on Credit Default Swap |

|---|---|---|

| Bankruptcy | The reference entity files for bankruptcy protection or equivalent insolvency proceedings. | Activates the CDS contract, obliging the protection seller to compensate the buyer. |

| Failure to Pay | The reference entity misses a scheduled payment of interest or principal. | Triggers settlement under the CDS contract as a default event. |

| Restructuring | Changes in the debt terms, such as extension of maturity or reduction of interest rates, imposed on creditors. | May activate the CDS protection if restructuring is deemed a credit event. |

| Repudiation/Moratorium | The reference entity rejects or suspends its debt obligations either explicitly or by government decree. | Considered a credit event triggering CDS payout. |

| Obligation Acceleration | Debt obligations become immediately due following a default or similar event. | Can activate the CDS if acceleration leads to a failure to pay event. |

Introduction to Trigger Events in Credit Default Swaps

A trigger event in a credit default swap (CDS) refers to a specific occurrence that activates the protection buyer's right to receive compensation from the protection seller. Common examples include bankruptcy, failure to pay debt, or restructuring of the reference entity's obligations. Understanding these trigger events is crucial for accurately assessing counterparty risk and the value of CDS contracts in financial markets.

What Constitutes a Trigger Event?

A trigger event in a credit default swap (CDS) refers to specific occurrences that signal a credit event, such as bankruptcy, failure to pay, or restructuring of the reference entity. These events directly impact the performance of the underlying debt and activate the CDS contract, compelling the protection seller to compensate the buyer. Accurately identifying a trigger event is crucial for assessing credit risk and valuing the CDS instrument.

Common Types of Trigger Events in CDS Contracts

Common types of trigger events in credit default swap (CDS) contracts include bankruptcy, failure to pay, and restructuring. Bankruptcy occurs when the reference entity legally declares insolvency, while failure to pay involves missed or delayed scheduled debt payments. Restructuring refers to significant modifications to the original debt terms, such as maturity extension or interest rate reduction, that adversely affect the creditor's recovery prospects.

Bankruptcy as a Credit Event Example

Bankruptcy serves as a primary trigger event in credit default swaps, activating the swap contract when a reference entity files for insolvency under legal jurisdiction. This credit event signals significant financial distress, often leading to the settlement process where protection buyers receive compensation for their losses. Understanding bankruptcy as a trigger event is crucial for investors managing counterparty risk and assessing creditworthiness in the derivatives market.

Failure to Pay and Its Role as a Trigger

Failure to pay is a primary trigger event in credit default swaps, occurring when the reference entity misses a scheduled debt payment, such as interest or principal, beyond the agreed grace period. This non-payment signifies a credit event, prompting the protection seller to compensate the protection buyer for losses. The occurrence of failure to pay ensures timely activation of credit default swap settlements, providing a risk mitigation mechanism in credit markets.

Restructuring of Debt as a Qualifying Event

Restructuring of debt in a credit default swap (CDS) occurs when the issuer modifies the terms of its existing debt obligations, such as extending maturity, reducing principal or interest payments, or changing covenants, which significantly impairs creditor rights. This trigger event qualifies as a credit event under most CDS contracts because it reflects heightened default risk and potential loss to the protection buyer. Investors closely monitor restructuring announcements to assess the likelihood of CDS payouts and to adjust credit exposure accordingly.

Obligation Acceleration and Its Impact

Obligation acceleration in credit default swaps occurs when the issuer of a debt obligation defaults on timely payments, prompting the acceleration clause to demand immediate repayment of the entire principal. This trigger event significantly increases the swap's risk exposure, as the protection buyer can now claim compensation on the full accelerated amount rather than periodic payments. The acceleration of debt obligations often leads to heightened market volatility and impacts the valuation and settlement processes of credit default swaps.

Obligation Default: Definition and Instances

Obligation Default in a credit default swap (CDS) occurs when the reference entity fails to meet its payment obligations, such as missing interest or principal payments on debt. Common instances include failure to pay scheduled coupon payments, missed principal repayment at maturity, or breach of financial covenants triggering a payment default. These events activate the CDS protection seller's obligation to compensate the buyer for losses incurred due to the default.

Repudiation/Moratorium as a Trigger Event

Repudiation or moratorium as a trigger event in credit default swaps occurs when a sovereign borrower publicly refuses or suspends debt payments, signaling potential default risk. This event activates the credit protection, allowing the protection buyer to demand compensation for losses linked to the debt's impaired status. Such triggers are critical in managing sovereign credit exposure and mitigating financial risk within structured credit markets.

Case Studies: Real-Life Examples of CDS Trigger Events

In credit default swaps, a common trigger event involves a sovereign debt restructuring, exemplified by Greece's 2012 debt crisis where the country negotiated a significant haircut on its bonds, activating CDS contracts for investors. Another case is the Lehman Brothers bankruptcy in 2008, which led to widespread CDS payouts due to its sudden default on credit obligations. These real-life examples illustrate how bankruptcy filings and official debt rescheduling serve as definitive credit events that trigger CDS claims.

example of trigger event in credit default swap Infographic

samplerz.com

samplerz.com