Roll yield in futures refers to the return generated when an investor rolls over a futures contract from a near-expiring contract to a longer-dated contract. This yield arises due to the difference in price between the expiring contract and the new contract. For example, in the crude oil futures market, if the near-month contract trades at $70 per barrel and the next-month contract trades at $72, the positive roll yield is $2 per barrel. Investors in commodities like gold or natural gas often encounter roll yield as part of their total returns. If a gold futures contract expiring in one month is priced at $1,800 and a contract expiring three months later is priced at $1,790, the negative roll yield of $10 can reduce profits. Understanding roll yield is critical for futures traders because it impacts the net performance beyond spot price movements.

Table of Comparison

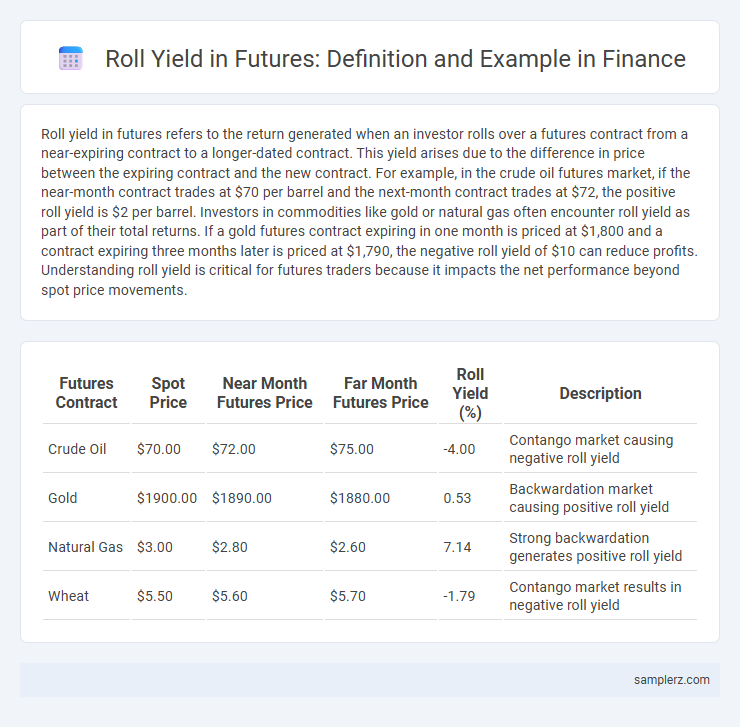

| Futures Contract | Spot Price | Near Month Futures Price | Far Month Futures Price | Roll Yield (%) | Description |

|---|---|---|---|---|---|

| Crude Oil | $70.00 | $72.00 | $75.00 | -4.00 | Contango market causing negative roll yield |

| Gold | $1900.00 | $1890.00 | $1880.00 | 0.53 | Backwardation market causing positive roll yield |

| Natural Gas | $3.00 | $2.80 | $2.60 | 7.14 | Strong backwardation generates positive roll yield |

| Wheat | $5.50 | $5.60 | $5.70 | -1.79 | Contango market results in negative roll yield |

Understanding Roll Yield in Futures Contracts

Roll yield in futures contracts occurs when an investor sells a near-expiration contract and simultaneously buys a longer-dated contract, profiting from the price difference between the two. This yield is positive in backwardated markets, where futures prices are lower than spot prices, and negative in contango markets, where futures prices exceed spot prices. Understanding roll yield is crucial for commodity investors and portfolio managers aiming to optimize returns in futures trading.

How Roll Yield Impacts Futures Returns

Roll yield significantly influences futures returns by capturing the profit or loss when a position is rolled from a near-expiring contract to a longer-dated one, especially in commodities markets. In contango markets, negative roll yield erodes returns as investors sell lower-priced expiring contracts and buy higher-priced futures, while backwardation generates positive roll yield benefiting the investor. Understanding roll yield is essential for accurately assessing the total returns of futures investments and managing risk in portfolio strategies involving commodity or interest rate futures.

Positive vs. Negative Roll Yield: Key Differences

Positive roll yield occurs when futures prices are in backwardation, allowing investors to profit as contracts near expiration typically trade lower than spot prices. Negative roll yield arises in contango markets, where futures prices exceed spot prices, causing losses during contract rollovers. Understanding the distinction between these scenarios is crucial for optimizing returns in commodity futures trading and managing associated risks.

Real-World Example: Roll Yield in Crude Oil Futures

Roll yield in crude oil futures occurs when investors maintain exposure by rolling contracts forward as they near expiration, often experiencing gains or losses depending on market contango or backwardation. For instance, during periods of contango in the WTI crude oil market, futures prices are higher for distant delivery dates than near-term ones, causing negative roll yield as contracts are sold low and repurchased higher. This dynamic significantly impacts the total returns of oil futures ETFs and managed futures portfolios relying on continuous contract rolls.

Roll Yield Analysis in Commodity Futures Markets

Roll yield in commodity futures markets occurs when investors roll over expiring contracts into longer-dated futures, capturing gains or losses from the price difference between contracts. In markets experiencing backwardation, positive roll yield arises as near-term contracts trade below longer-term contracts, generating profits upon contract rollover. Conversely, contango markets produce negative roll yield, where futures prices exceed spot prices, leading to losses when positions are rolled forward.

Calculating Roll Yield: Step-by-Step Example

To calculate roll yield in futures, first identify the current futures price and the spot price of the underlying asset. Subtract the spot price from the futures price to determine the price difference, then adjust for the time to contract expiration by annualizing the difference. This calculation reveals whether the futures contract is in contango or backwardation, indicating a positive or negative roll yield for the investor.

The Role of Contango and Backwardation in Roll Yield

Roll yield in futures trading is significantly influenced by market conditions known as contango and backwardation. In contango, futures prices are higher than spot prices, causing negative roll yield as contracts are sold at a lower spot price and replaced with more expensive futures; conversely, backwardation occurs when futures prices are below spot prices, generating positive roll yield by selling higher-priced futures and buying cheaper spot equivalents. Understanding the interplay between contango and backwardation is crucial for optimizing returns in commodity futures portfolios.

Roll Yield Effects in Financial Futures Strategies

Roll yield in financial futures strategies occurs when traders profit from the difference between spot prices and futures contract prices as contracts near expiration. For example, in commodity futures, if a trader holds a long position in a futures contract experiencing backwardation, they can benefit from a positive roll yield as the futures price converges upward toward the spot price. This roll yield effect is crucial in strategies involving continuous rolling of contracts, impacting overall returns in markets such as oil, gold, and treasury futures.

Risk Management: Mitigating Negative Roll Yield

Negative roll yield occurs when a futures contract in contango expires and is replaced by a contract with a higher price, resulting in a loss for the investor. Effective risk management strategies include diversifying across different maturities and asset classes to minimize exposure to adverse roll yield impacts. Utilizing options and employing dynamic hedging can further mitigate potential losses by providing downside protection during unfavorable market conditions.

Practical Implications of Roll Yield for Investors

Investors in commodity futures often experience roll yield when they maintain positions through contract expiration and rollover into the next contract, which can lead to gains in a backwardated market or losses in a contango market. For example, an investor holding crude oil futures might realize positive roll yield if near-month contracts trade at a premium to deferred contracts, effectively boosting returns during the rollover process. Understanding roll yield assists investors in managing the risks of futures-based investment strategies and optimizing portfolio performance over time.

example of roll yield in futures Infographic

samplerz.com

samplerz.com