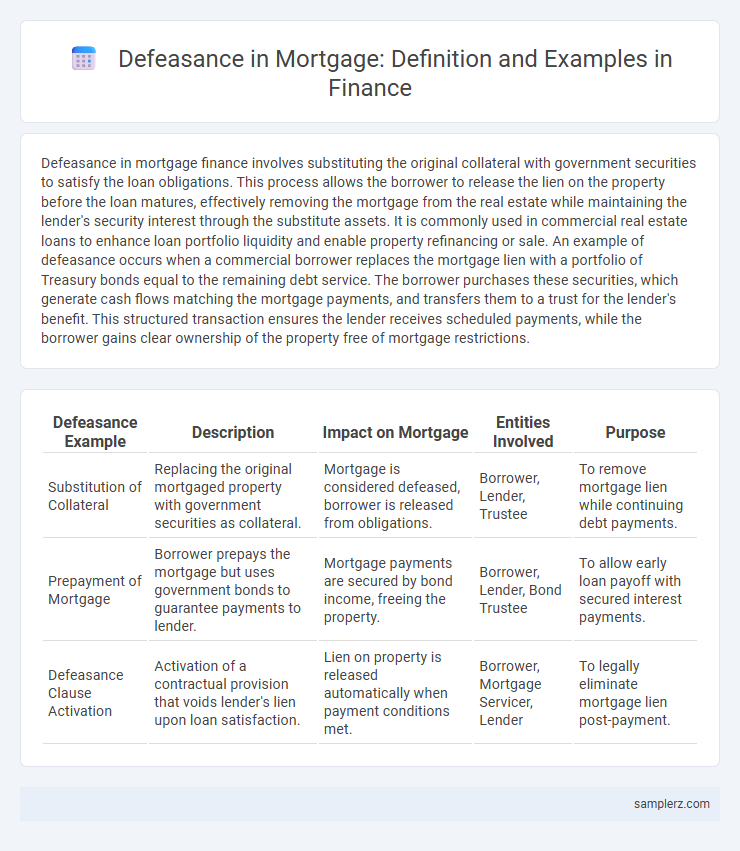

Defeasance in mortgage finance involves substituting the original collateral with government securities to satisfy the loan obligations. This process allows the borrower to release the lien on the property before the loan matures, effectively removing the mortgage from the real estate while maintaining the lender's security interest through the substitute assets. It is commonly used in commercial real estate loans to enhance loan portfolio liquidity and enable property refinancing or sale. An example of defeasance occurs when a commercial borrower replaces the mortgage lien with a portfolio of Treasury bonds equal to the remaining debt service. The borrower purchases these securities, which generate cash flows matching the mortgage payments, and transfers them to a trust for the lender's benefit. This structured transaction ensures the lender receives scheduled payments, while the borrower gains clear ownership of the property free of mortgage restrictions.

Table of Comparison

| Defeasance Example | Description | Impact on Mortgage | Entities Involved | Purpose |

|---|---|---|---|---|

| Substitution of Collateral | Replacing the original mortgaged property with government securities as collateral. | Mortgage is considered defeased, borrower is released from obligations. | Borrower, Lender, Trustee | To remove mortgage lien while continuing debt payments. |

| Prepayment of Mortgage | Borrower prepays the mortgage but uses government bonds to guarantee payments to lender. | Mortgage payments are secured by bond income, freeing the property. | Borrower, Lender, Bond Trustee | To allow early loan payoff with secured interest payments. |

| Defeasance Clause Activation | Activation of a contractual provision that voids lender's lien upon loan satisfaction. | Lien on property is released automatically when payment conditions met. | Borrower, Mortgage Servicer, Lender | To legally eliminate mortgage lien post-payment. |

Understanding Defeasance in Mortgage Finance

Defeasance in mortgage finance involves replacing the original collateral with government securities, allowing borrowers to free their property from the loan's lien while keeping the loan outstanding. This process enables borrowers to sell or refinance commercial real estate properties without early repayment penalties effectively. By substituting Treasury bonds or similar securities, lenders receive the loan's cash flows, maintaining security while borrowers regain asset flexibility.

Key Components of a Defeasance Transaction

A defeasance transaction in mortgage finance involves replacing the original collateral with government securities, effectively releasing the borrower from the mortgage obligation. Key components include identifying suitable collateral, establishing a defeasance trust to hold the securities, and coordinating with the mortgage servicer to ensure proper application of cash flows. This process requires precise valuation of securities to match remaining loan payments and compliance with loan agreement terms.

Step-by-Step Example of Mortgage Defeasance

Mortgage defeasance involves replacing the original mortgage with government securities that generate cash flows matching the loan's payments, allowing the borrower to sell or refinance the property free of the original mortgage. First, the borrower purchases a portfolio of U.S. Treasury bonds or other government securities equivalent to the remaining loan payments. Then, these securities are placed in a trust to ensure the lender receives the scheduled payments, effectively releasing the lien on the property and defeasing the mortgage.

Real Estate Defeasance: Practical Case Study

Real estate defeasance involves replacing a mortgage with government securities to ensure loan repayment while freeing the property from the lien. In a practical case study, a commercial property owner used defeasance to refinance their $10 million mortgage by purchasing Treasury bonds that matched remaining loan payments. This strategy maintained lender security, allowed debt restructuring without property sale, and improved cash flow flexibility for the borrower.

How Defeasance Impacts Loan Prepayment

Defeasance in mortgage finance allows borrowers to replace the original collateral--typically real estate--with government securities, enabling loan prepayment without violating the lender's security interests. This process impacts loan prepayment by effectively satisfying the debt obligation through substitute collateral, often avoiding prepayment penalties or fees. Consequently, defeasance provides a cost-effective and strategically efficient method for loan termination in commercial mortgage-backed securities (CMBS) markets.

Financial Benefits of Mortgage Defeasance

Mortgage defeasance provides financial benefits by allowing borrowers to replace their mortgage debt with government securities, effectively removing the loan from their balance sheet and improving credit profiles. This process enables early loan payoff without penalty, reducing interest expenses and freeing up capital for other investments. By mitigating prepayment risk and securing predictable cash flows, borrowers can enhance financial flexibility and optimize portfolio management.

Risks Involved in Mortgage Defeasance

Risks involved in mortgage defeasance include interest rate risk, as fluctuations can affect the value of the substitute securities used to repay the loan. Prepayment penalties or fees may reduce the financial benefits for borrowers attempting early defeasance. Additionally, complex legal and administrative processes increase transaction costs and timing uncertainties, potentially impacting the overall cost-effectiveness of the defeasance strategy.

Common Defeasance Structures in Commercial Loans

Common defeasance structures in commercial loans involve substituting the original collateral with a portfolio of government securities that generate cash flows matching the loan payments. This method enables borrowers to remove liens from the property while the lender continues to receive the agreed-upon cash flow stream, effectively reducing risk and maintaining credit quality. Typical setups include Treasury securities or agency bonds strategically laddered to coincide with the loan's amortization schedule, ensuring seamless defeasance execution.

Legal Considerations in Mortgage Defeasance

Mortgage defeasance involves replacing the original loan collateral with government securities to satisfy the debt, requiring strict compliance with legal frameworks governing lien releases and borrower rights. Legal considerations focus on ensuring clear title transfer, adherence to contractual clauses within the mortgage agreement, and compliance with state and federal regulations to prevent potential litigation. Proper documentation and approval from all parties, including trustees and servicers, are essential to validate the defeasance and achieve enforceable loan satisfaction.

Comparing Defeasance to Yield Maintenance in Mortgages

Defeasance in mortgages involves substituting the original loan collateral with government securities to release the borrower from the mortgage obligation early, providing flexibility in loan payoff without prepayment penalties. Yield maintenance, by contrast, requires the borrower to pay a premium covering the lender's lost interest income, ensuring the lender receives the loan's full yield despite early repayment. Defeasance is typically more complex and costly but allows for smoother loan transferability, while yield maintenance offers a straightforward prepayment cost aligned with interest rate risk.

example of defeasance in mortgage Infographic

samplerz.com

samplerz.com