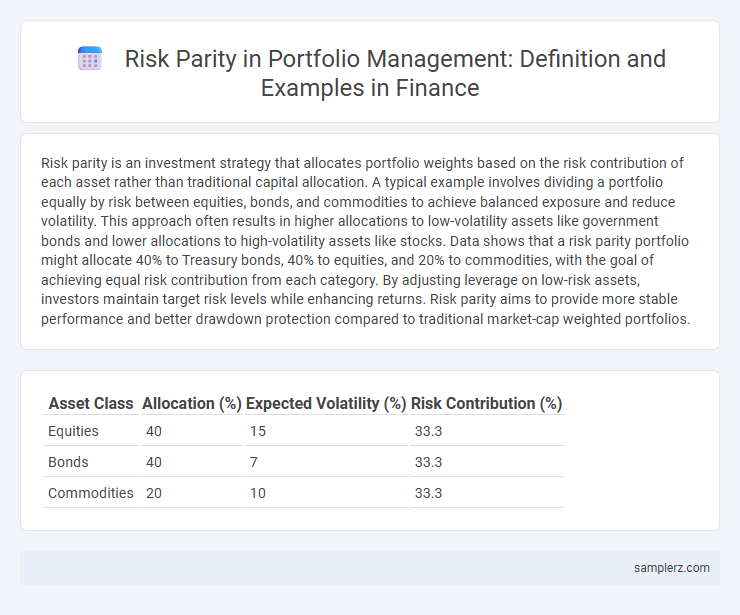

Risk parity is an investment strategy that allocates portfolio weights based on the risk contribution of each asset rather than traditional capital allocation. A typical example involves dividing a portfolio equally by risk between equities, bonds, and commodities to achieve balanced exposure and reduce volatility. This approach often results in higher allocations to low-volatility assets like government bonds and lower allocations to high-volatility assets like stocks. Data shows that a risk parity portfolio might allocate 40% to Treasury bonds, 40% to equities, and 20% to commodities, with the goal of achieving equal risk contribution from each category. By adjusting leverage on low-risk assets, investors maintain target risk levels while enhancing returns. Risk parity aims to provide more stable performance and better drawdown protection compared to traditional market-cap weighted portfolios.

Table of Comparison

| Asset Class | Allocation (%) | Expected Volatility (%) | Risk Contribution (%) |

|---|---|---|---|

| Equities | 40 | 15 | 33.3 |

| Bonds | 40 | 7 | 33.3 |

| Commodities | 20 | 10 | 33.3 |

Introduction to Risk Parity in Portfolio Management

Risk parity in portfolio management allocates assets based on their risk contribution rather than capital weight, aiming for balanced volatility across investments like equities, bonds, and commodities. This strategy reduces concentration risk by equalizing risk exposure, often enhancing diversification and improving risk-adjusted returns. Key implementations include leveraging low-volatility bonds to offset high-volatility equities, optimizing portfolio growth while maintaining controlled drawdowns.

Key Principles of Risk Parity Allocation

Risk parity allocation emphasizes balancing portfolio risk by assigning capital based on volatility rather than market value, aiming to equalize risk contribution from each asset class. This strategy enhances diversification through dynamic risk weighting, reducing dependence on traditional asset allocation assumptions. Core principles include using leverage prudently, emphasizing correlation structures, and continuously adjusting allocations to maintain risk equilibrium.

Traditional vs. Risk Parity Portfolio Approaches

Traditional portfolios typically allocate assets based on fixed weights, often favoring equities and bonds without adjusting for volatility or correlations. Risk parity portfolios, by contrast, distribute capital to equalize risk contributions from each asset class, aiming for more balanced volatility exposure. Studies show that risk parity approaches can enhance diversification and improve risk-adjusted returns compared to traditional allocation methods.

Real-World Example of a Risk Parity Portfolio

A real-world example of a risk parity portfolio is the Bridgewater All Weather Fund, which allocates assets based on risk contribution rather than capital. This portfolio balances exposure across equities, bonds, commodities, and inflation-linked assets to achieve consistent returns regardless of market conditions. By equalizing risk, the fund aims to reduce volatility and improve diversification compared to traditional asset-weighted portfolios.

Asset Classes Commonly Used in Risk Parity Strategies

Risk parity portfolios typically allocate capital across diverse asset classes such as equities, government bonds, commodities, and inflation-protected securities to balance risk contribution evenly. Treasury bonds often serve as a low-volatility anchor, while commodities and equities introduce diversification and growth potential, stabilizing returns during market fluctuations. Incorporation of real estate investment trusts (REITs) and corporate bonds can enhance yield without disproportionately increasing portfolio risk, supporting a more resilient risk parity strategy.

Risk Contribution Analysis in Portfolio Construction

Risk parity in portfolio construction focuses on balancing risk contributions from different asset classes to achieve stable returns and reduced volatility. Risk contribution analysis quantifies each asset's marginal impact on total portfolio risk, guiding allocations that ensure no single asset class dominates overall portfolio risk. By equalizing risk contributions rather than capital weights, portfolios optimize diversification and enhance risk-adjusted performance.

Performance Comparison: Risk Parity vs. 60/40 Portfolio

Risk parity portfolios typically achieve more consistent returns by allocating risk equally across asset classes, reducing volatility compared to the traditional 60/40 portfolio. Historical performance data shows that risk parity often outperforms the 60/40 approach during market downturns due to its diversified risk exposures across equities, bonds, and commodities. This strategy enhances risk-adjusted returns by minimizing concentration risk and improving portfolio resilience over time.

Diversification Benefits of Risk Parity Portfolios

Risk parity portfolios achieve diversification benefits by allocating capital based on asset risk contributions rather than nominal weights, resulting in balanced exposure across equities, bonds, and commodities. This approach reduces portfolio volatility and enhances risk-adjusted returns by mitigating concentration in high-volatility assets. Empirical studies demonstrate that risk parity strategies improve drawdown control during market downturns compared to traditional market-cap weighted portfolios.

Challenges and Limitations of Risk Parity Implementation

Risk parity portfolios often face challenges such as increased sensitivity to leverage and rising interest rates, which can amplify losses during market downturns. Limitations include reliance on historical volatility estimates that may fail to predict future market shifts and difficulty in capturing tail risks associated with extreme events. Moreover, risk parity strategies may underperform in sustained bull markets where traditional equity investments generate outsized returns.

Future Trends in Risk Parity Investing

Future trends in risk parity investing emphasize the integration of alternative data and machine learning algorithms to enhance asset allocation and risk management. Increasing adoption of ESG metrics within risk parity frameworks supports sustainable investing without compromising diversification benefits. Advancements in real-time analytics and dynamic rebalancing techniques are expected to improve portfolio responsiveness to market volatility and systemic risk factors.

example of risk parity in portfolio Infographic

samplerz.com

samplerz.com