Rebalancing a portfolio involves adjusting the asset allocation to maintain a target risk level. For example, if an investor initially allocated 60% in stocks and 40% in bonds, market fluctuations may cause the stock portion to grow to 70%. The investor would then sell some stocks and buy bonds to restore the original 60/40 ratio, preserving the desired risk exposure. This process helps manage risk and optimize returns by preventing overexposure to any single asset class. Data from portfolio performance reports guide decisions on when and how much to rebalance. Rebalancing frequency varies, often occurring quarterly or annually, depending on investment strategy and market conditions.

Table of Comparison

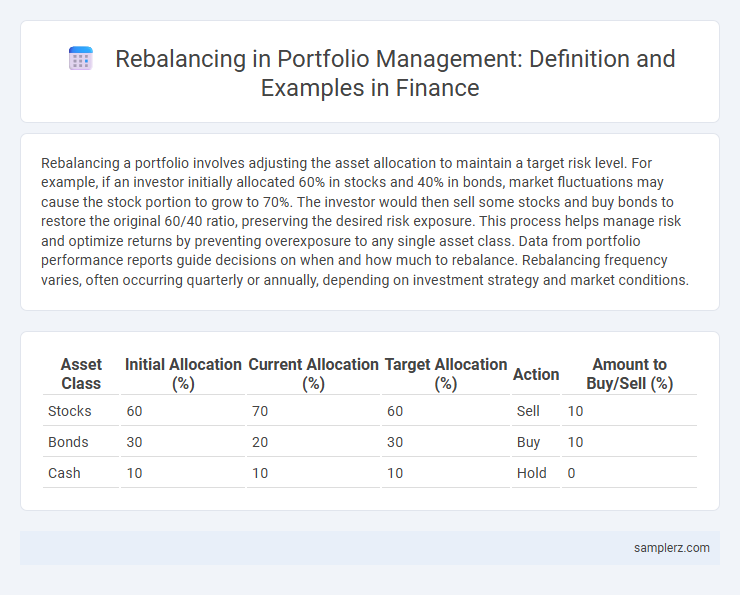

| Asset Class | Initial Allocation (%) | Current Allocation (%) | Target Allocation (%) | Action | Amount to Buy/Sell (%) |

|---|---|---|---|---|---|

| Stocks | 60 | 70 | 60 | Sell | 10 |

| Bonds | 30 | 20 | 30 | Buy | 10 |

| Cash | 10 | 10 | 10 | Hold | 0 |

Understanding Portfolio Rebalancing

Portfolio rebalancing involves adjusting asset allocations to maintain a target investment mix, such as shifting from 70% stocks and 30% bonds back to the original ratio after market fluctuations. This process helps manage risk and ensures alignment with an investor's financial goals and risk tolerance. Regular rebalancing can improve long-term portfolio performance by preventing overexposure to volatile asset classes.

Why Rebalancing Matters in Finance

Rebalancing in finance involves adjusting a portfolio's asset allocation to maintain the desired risk and return profile, ensuring alignment with investment goals. By periodically selling outperforming assets and buying underperforming ones, investors can lock in gains and avoid overexposure to volatile sectors. This disciplined approach reduces risk, enhances diversification, and improves long-term portfolio performance.

Common Methods of Rebalancing Portfolios

Common methods of rebalancing portfolios include calendar rebalancing, which adjusts asset allocations at predetermined intervals such as quarterly or annually, and threshold rebalancing, which triggers adjustments when asset weights deviate beyond set percentage thresholds. Another approach is constant-mix rebalancing, where gains in one asset class are sold to buy underperforming assets, maintaining a fixed allocation ratio. Strategic rebalancing blends long-term asset allocation targets with short-term market movements to optimize portfolio risk and return.

Step-by-Step Example of Portfolio Rebalancing

Rebalancing a portfolio begins by assessing the current asset allocation versus the target mix, such as 60% equities and 40% bonds. If equities have grown to 70% due to market gains, sell 10% worth of equities and use the proceeds to buy bonds, restoring the original allocation. This process maintains risk levels and aligns the investment strategy with long-term financial goals.

Rebalancing a 60/40 Stock-Bond Portfolio: A Case Study

Rebalancing a 60/40 stock-bond portfolio involves adjusting asset allocations to maintain the original risk profile after market fluctuations. For example, if stocks outperform and grow to 70% of the portfolio, rebalancing would require selling equities and buying bonds to restore the 60/40 target. This strategy controls risk exposure and helps lock in gains by systematically realigning the portfolio according to investment goals.

Tax Implications of Portfolio Rebalancing

Portfolio rebalancing involves adjusting asset allocations to maintain a desired risk level, often triggering taxable events such as capital gains. Selling appreciated securities during rebalancing can result in short-term or long-term capital gains taxes, depending on the holding period. Strategic tax-loss harvesting within the rebalancing process can offset gains and reduce overall tax liability.

How Often Should You Rebalance a Portfolio?

Rebalancing a portfolio typically occurs quarterly or annually to maintain the target asset allocation and manage risk exposure effectively. Frequent rebalancing, such as monthly, may lead to higher transaction costs and tax implications, while infrequent rebalancing risks drift from desired risk levels. Financial advisors often recommend rebalancing when asset allocations deviate by 5% or more from the target to optimize portfolio performance over time.

Tools and Techniques for Automated Rebalancing

Automated rebalancing leverages algorithms embedded in portfolio management software such as Robo-advisors, which use threshold-based triggers to realign asset allocations automatically. Techniques include calendar-based rebalancing, which adjusts portfolios at set intervals, and tolerance band rebalancing, where adjustments occur only when asset weights deviate beyond predefined limits. These tools enhance efficiency, reduce human error, and maintain the target risk-return profile without constant manual intervention.

Best Practices for Managing Risk Through Rebalancing

Rebalancing a portfolio involves periodically adjusting asset allocations to maintain targeted risk levels and investment goals, such as selling overperforming stocks and buying underperforming bonds to restore the original allocation. Best practices for managing risk through rebalancing include setting predefined thresholds, like a 5% deviation from target allocation, and conducting reviews quarterly or semi-annually to avoid emotional decision-making and market timing. Employing tax-efficient strategies, such as utilizing tax-loss harvesting during rebalancing, further optimizes portfolio returns while controlling risk exposure.

Mistakes to Avoid When Rebalancing Portfolios

Frequent rebalancing without considering transaction costs can erode portfolio returns, especially in taxable accounts. Ignoring market trends and rebalancing solely based on fixed intervals may lead to suboptimal adjustments that do not align with investment goals. Failing to account for tax implications and overtrading are common mistakes that can reduce overall portfolio efficiency and growth potential.

example of rebalancing in portfolio Infographic

samplerz.com

samplerz.com