Recourse in a loan refers to the lender's legal right to pursue the borrower's personal assets if the borrower defaults on the loan and the collateral does not cover the outstanding debt. In a recourse loan, the lender can seize assets beyond the collateral, such as bank accounts or other property, to recover the balance owed. This type of loan increases the lender's security and reduces the risk of loss in the event of default. One common example of recourse in a loan is a personal guarantee on a business loan, where the business owner pledges personal assets in addition to the company's assets. Another example includes mortgage loans that allow lenders to pursue the borrower's other assets if the home value does not satisfy the mortgage balance after foreclosure. These practices underscore the lender's broader claim rights and reinforce borrower accountability.

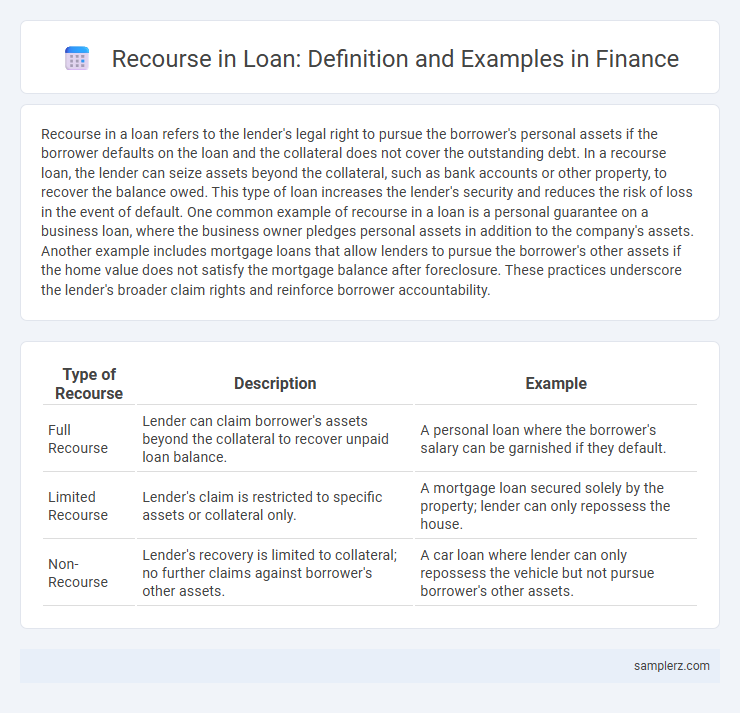

Table of Comparison

| Type of Recourse | Description | Example |

|---|---|---|

| Full Recourse | Lender can claim borrower's assets beyond the collateral to recover unpaid loan balance. | A personal loan where the borrower's salary can be garnished if they default. |

| Limited Recourse | Lender's claim is restricted to specific assets or collateral only. | A mortgage loan secured solely by the property; lender can only repossess the house. |

| Non-Recourse | Lender's recovery is limited to collateral; no further claims against borrower's other assets. | A car loan where lender can only repossess the vehicle but not pursue borrower's other assets. |

Understanding Recourse Loans in Finance

Recourse loans allow lenders to pursue the borrower's personal assets if the collateral does not cover the outstanding debt, providing greater security for the lender. In finance, this means borrowers are personally liable beyond the collateral, increasing the risk but potentially resulting in lower interest rates. Understanding recourse loans is crucial for borrowers to assess their financial risk and obligations when securing credit.

Key Features of Recourse Loan Agreements

Recourse loan agreements allow lenders to pursue the borrower's personal assets if the collateral does not cover the outstanding debt, enhancing lender security and reducing default risk. Key features include personal liability of the borrower, enforceability of full repayment beyond collateral, and often higher borrower credit requirements to mitigate lender exposure. These agreements typically involve comprehensive legal documentation specifying the lender's rights to recover losses through additional financial claims on the borrower.

Common Examples of Recourse in Personal Loans

Common examples of recourse in personal loans include situations where lenders can seize personal assets such as savings accounts, vehicles, or other valuable property if the borrower defaults. Recourse loans often allow creditors to pursue the borrower's wages through garnishment to recover outstanding debt. These mechanisms provide lenders with greater assurance of repayment by holding borrowers personally liable beyond the collateral.

Recourse Provisions in Business Lending

Recourse provisions in business lending allow lenders to seek repayment from the borrower's personal assets if the business defaults on the loan, strengthening lender protection beyond the collateral. These provisions typically require personal guarantees, ensuring that business owners are personally liable for the loan balance. Strong recourse clauses reduce lender risk and can influence loan terms such as interest rates and loan covenants.

Mortgage Loans: Recourse vs Non-Recourse Examples

Mortgage loans classified as recourse loans allow lenders to pursue the borrower's other assets beyond the collateral property in case of default. Non-recourse mortgage loans limit the lender's recovery to the foreclosure sale proceeds, preventing claims on the borrower's additional assets. This distinction significantly impacts borrower risk exposure and lender recovery strategies in mortgage financing.

Recourse Actions in Auto Loan Defaults

Recourse actions in auto loan defaults include repossession of the vehicle, legal claims for any remaining balance after sale, and reporting the default to credit bureaus, which impacts the borrower's credit score. Lenders may also pursue wage garnishment or bank levies to recover outstanding debts when the loan is recourse-based. These measures ensure lenders mitigate losses and enforce repayment obligations.

Practical Case Studies: Recourse Loan Outcomes

In recourse loans, borrowers remain personally liable, as demonstrated in practical case studies where defaulted small business loans led to personal asset seizures. For example, a commercial real estate loan with recourse resulted in the lender recovering losses by claiming the borrower's other financial assets beyond the collateral property. Such outcomes emphasize the heightened risk exposure for borrowers compared to non-recourse loans, influencing strategic financial decision-making.

Legal Implications of Recourse Clauses

Recourse clauses in loan agreements grant lenders the legal right to seek repayment from a borrower's personal assets if the collateralized property value is insufficient to cover the debt. The enforceability of recourse provisions depends on jurisdiction and contract specificity, often resulting in borrowers facing extended liability beyond the secured asset. This legal framework impacts bankruptcy proceedings, influencing the lender's ability to recover funds through litigation or asset seizure.

Borrower Protections Against Recourse

Recourse loans allow lenders to pursue the borrower's assets beyond collateral if the loan defaults, but borrower protections against recourse include bankruptcy exemptions, anti-deficiency statutes, and negotiated loan agreements limiting lender claims. These protections vary by jurisdiction, with some states imposing strict limits on deficiency judgments to shield borrowers from excessive financial liability. Understanding these borrower protections is essential to mitigate risk and safeguard personal assets in recourse lending scenarios.

Comparing Recourse and Non-Recourse Loan Structures

Recourse loans require borrowers to personally guarantee the debt, allowing lenders to pursue personal assets beyond the collateral if the loan defaults, making them less risky for lenders and often resulting in lower interest rates. Non-recourse loans limit lenders' claims to the collateral alone, protecting borrowers' personal assets but typically carrying higher interest rates due to increased lender risk. Understanding the difference between recourse and non-recourse loan structures is crucial for both borrowers and lenders in assessing risk, financial liability, and loan cost.

example of recourse in loan Infographic

samplerz.com

samplerz.com