Tail risk in hedge funds refers to the risk of rare but severe losses that occur at the extreme ends of a probability distribution. An example of tail risk is a sudden market crash caused by an unexpected geopolitical event, which can lead to drastic drops in asset values within the hedge fund's portfolio. This type of risk is often underestimated by traditional risk models that assume normal market conditions. Hedge funds employ strategies like options and other derivatives to hedge against tail risk, aiming to protect the portfolio from significant downside events. The 2008 financial crisis exemplified tail risk when many hedge funds suffered enormous losses due to the collapse of mortgage-backed securities. Managing tail risk requires continuous monitoring of market conditions and stress testing to ensure the fund's resilience against extreme market movements.

Table of Comparison

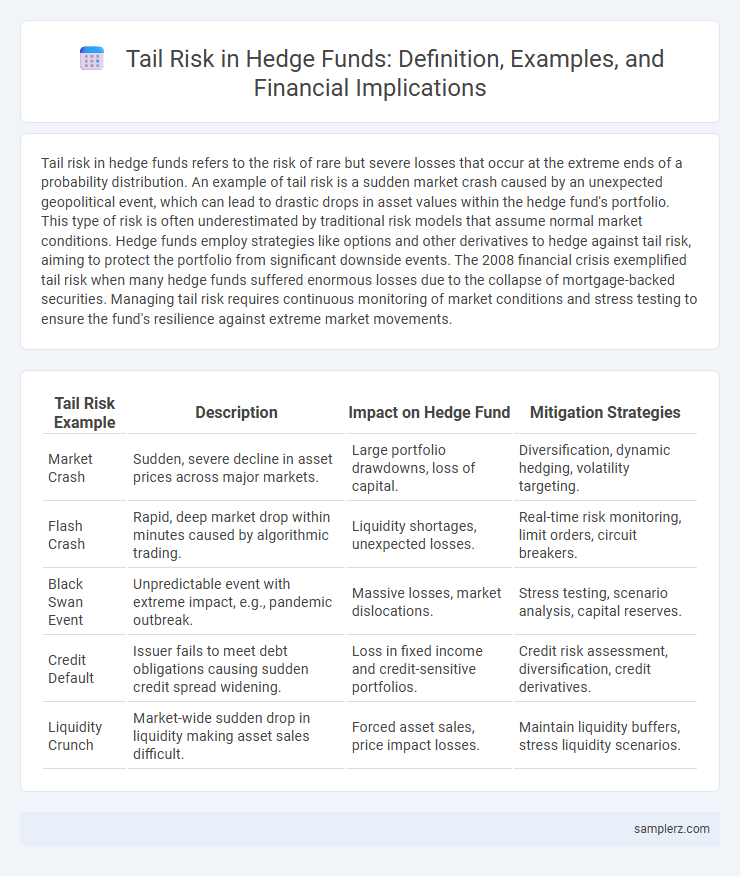

| Tail Risk Example | Description | Impact on Hedge Fund | Mitigation Strategies |

|---|---|---|---|

| Market Crash | Sudden, severe decline in asset prices across major markets. | Large portfolio drawdowns, loss of capital. | Diversification, dynamic hedging, volatility targeting. |

| Flash Crash | Rapid, deep market drop within minutes caused by algorithmic trading. | Liquidity shortages, unexpected losses. | Real-time risk monitoring, limit orders, circuit breakers. |

| Black Swan Event | Unpredictable event with extreme impact, e.g., pandemic outbreak. | Massive losses, market dislocations. | Stress testing, scenario analysis, capital reserves. |

| Credit Default | Issuer fails to meet debt obligations causing sudden credit spread widening. | Loss in fixed income and credit-sensitive portfolios. | Credit risk assessment, diversification, credit derivatives. |

| Liquidity Crunch | Market-wide sudden drop in liquidity making asset sales difficult. | Forced asset sales, price impact losses. | Maintain liquidity buffers, stress liquidity scenarios. |

Understanding Tail Risk in Hedge Funds

Tail risk in hedge funds refers to the extreme possibility of significant losses occurring in rare market events, often beyond normal distribution expectations. These risks are highlighted during financial crises, when asset correlations spike unexpectedly, leading to outsized negative impacts on hedged portfolios. Properly managing tail risk requires incorporating stress testing and scenario analysis to identify vulnerabilities from market shocks, liquidity crunches, or systemic failures in alternative investment strategies.

Notable Historical Tail Risk Events

The 2008 financial crisis exemplifies tail risk in hedge funds, where extreme market downturns led to unprecedented losses across many hedge fund strategies. The Long-Term Capital Management (LTCM) collapse in 1998 highlighted how leverage and illiquidity magnify tail risks, causing systemic disruptions. More recently, the 2020 COVID-19 market crash triggered rapid asset devaluations, underscoring the vulnerability of hedge funds to sudden, severe market shocks.

The LTCM Collapse: A Classic Case

The LTCM collapse in 1998 exemplifies tail risk in hedge funds, where extreme market events caused massive losses beyond standard risk models. The fund's leveraged positions in fixed income arbitrage were vulnerable to unforeseen Russian debt default and subsequent market volatility. This catastrophic downturn exposed limitations in risk management and highlighted the critical importance of accounting for rare, high-impact tail events.

2008 Financial Crisis and Hedge Fund Losses

The 2008 Financial Crisis exposed severe tail risk in hedge funds as many faced unprecedented losses due to extreme market volatility and liquidity freezes. Hedge funds relying heavily on leverage and complex derivatives suffered dramatic drawdowns, with some experiencing losses exceeding 30% in a single quarter. The crisis underscored the importance of robust risk management practices and stress testing for rare but catastrophic events in hedge fund portfolios.

Flash Crash of 2010: Impact on Hedge Funds

The Flash Crash of 2010, characterized by a sudden and severe market plunge within minutes, exemplifies tail risk for hedge funds exposed to high-frequency trading and liquidity-sensitive positions. During this event, hedge funds faced unprecedented volatility and rapid price dislocations, resulting in significant mark-to-market losses and forced liquidations. The incident underscored the vulnerability of hedge fund portfolios to extreme, low-probability market shocks that disrupt normal trading dynamics and challenge risk management models.

COVID-19 Market Shock: Tail Risk Realized

The COVID-19 market shock in early 2020 exemplified tail risk for hedge funds as unprecedented volatility triggered significant portfolio drawdowns. Many strategies, particularly those with leveraged positions in equities and credit markets, faced extreme losses beyond typical risk models. The event highlighted the necessity for robust tail risk hedging, such as options or volatility derivatives, to mitigate sudden, severe market disruptions.

Swiss Franc Unpegging and Hedge Fund Exposure

The Swiss Franc unpegging in January 2015 represents a classic example of tail risk in hedge funds, where abrupt policy changes caused extreme market volatility and significant losses. Many hedge funds exposed to currency carry trades or Swiss Franc-denominated assets faced unexpected devaluations, highlighting the challenges of managing rare, high-impact financial events. This incident underscores the importance of robust risk management techniques to mitigate tail risk in global currency markets.

Archegos Capital: Hidden Tail Risk Unveiled

Archegos Capital exemplifies tail risk in hedge funds through its sudden collapse triggered by highly leveraged, concentrated equity positions. The unexpected margin calls in March 2021 caused massive forced liquidations, exposing systemic vulnerabilities in risk management practices. This event highlights the critical importance of monitoring hidden tail risks embedded within opaque investment structures.

Strategies for Managing Tail Risk in Hedge Funds

Tail risk in hedge funds often materializes through strategies exposed to rare but severe market downturns, such as those relying heavily on leverage or concentrated positions in illiquid assets. Effective strategies for managing tail risk include employing dynamic hedging techniques, utilizing options for downside protection, and diversifying across uncorrelated asset classes to mitigate extreme losses. Stress testing and scenario analysis further allow hedge fund managers to anticipate potential tail events and adjust their portfolios proactively.

Lessons Learned from Past Tail Risk Events

Tail risk in hedge funds became evident during the 2008 financial crisis when extreme market downturns caused significant losses despite diversification strategies. The collapse of Long-Term Capital Management in 1998 highlighted the vulnerability to rare but severe market events, emphasizing the importance of robust risk management and stress testing. These past tail risk events underscore the necessity for hedge funds to implement dynamic hedging techniques and maintain adequate liquidity buffers to withstand unexpected market shocks.

example of tail risk in hedge fund Infographic

samplerz.com

samplerz.com