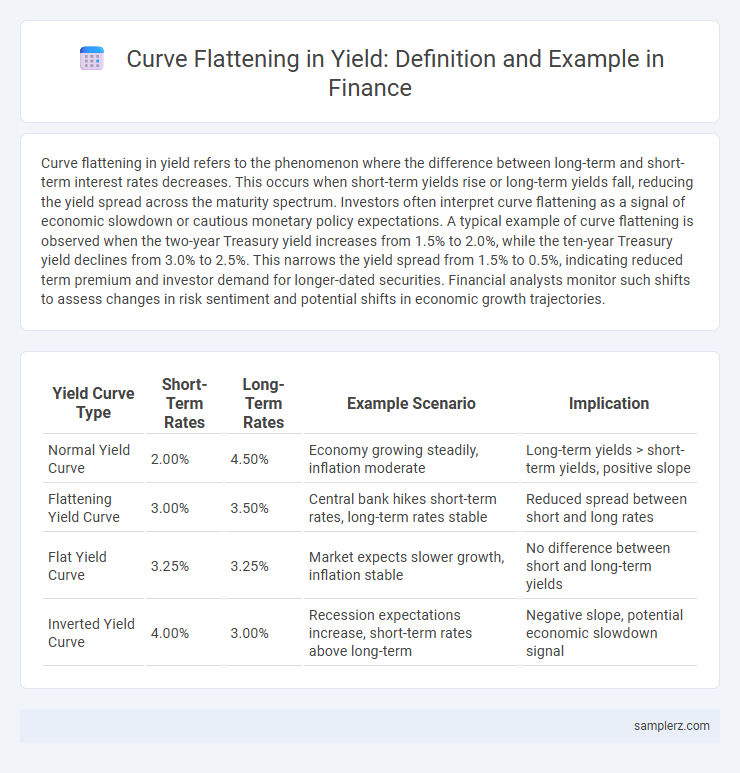

Curve flattening in yield refers to the phenomenon where the difference between long-term and short-term interest rates decreases. This occurs when short-term yields rise or long-term yields fall, reducing the yield spread across the maturity spectrum. Investors often interpret curve flattening as a signal of economic slowdown or cautious monetary policy expectations. A typical example of curve flattening is observed when the two-year Treasury yield increases from 1.5% to 2.0%, while the ten-year Treasury yield declines from 3.0% to 2.5%. This narrows the yield spread from 1.5% to 0.5%, indicating reduced term premium and investor demand for longer-dated securities. Financial analysts monitor such shifts to assess changes in risk sentiment and potential shifts in economic growth trajectories.

Table of Comparison

| Yield Curve Type | Short-Term Rates | Long-Term Rates | Example Scenario | Implication |

|---|---|---|---|---|

| Normal Yield Curve | 2.00% | 4.50% | Economy growing steadily, inflation moderate | Long-term yields > short-term yields, positive slope |

| Flattening Yield Curve | 3.00% | 3.50% | Central bank hikes short-term rates, long-term rates stable | Reduced spread between short and long rates |

| Flat Yield Curve | 3.25% | 3.25% | Market expects slower growth, inflation stable | No difference between short and long-term yields |

| Inverted Yield Curve | 4.00% | 3.00% | Recession expectations increase, short-term rates above long-term | Negative slope, potential economic slowdown signal |

Definition and Overview of Yield Curve Flattening

Yield curve flattening occurs when the difference between long-term and short-term bond yields decreases, indicating reduced expectations for economic growth or inflation. This phenomenon often signals investor caution, as long-term yields fall relative to short-term rates, potentially reflecting central bank policies or shifting market sentiment. Curve flattening can impact financial institutions by narrowing net interest margins and influencing investment strategies across various asset classes.

Historical Examples of Curve Flattening Events

Historic yield curve flattening events include the late 1990s, when the Federal Reserve raised short-term rates aggressively, narrowing the gap between 2-year and 10-year Treasury yields. Another notable instance occurred in 2019, driven by trade tensions and global growth concerns, resulting in inverted spreads between short and long-term bonds. These periods often signal market expectations of slower economic growth or impending recessions.

Factors That Lead to Yield Curve Flattening

Factors that lead to yield curve flattening include central bank interest rate hikes aimed at controlling inflation, which increase short-term yields more aggressively than long-term ones. Economic uncertainty and slower growth expectations reduce demand for long-duration bonds, compressing long-term yields relative to short-term yields. Changes in investor risk appetite and shifts in monetary policy guidance also contribute to the narrowing spread between short-term and long-term Treasury yields.

2006–2007 Yield Curve Flattening: Pre-Global Financial Crisis

The 2006-2007 yield curve flattening occurred as the spread between 10-year and 2-year U.S. Treasury yields narrowed significantly, signaling market expectations of slower economic growth and potential Federal Reserve interest rate hikes. This flattening reflected rising short-term rates amid concerns over the housing market and tightening credit conditions preceding the Global Financial Crisis. Investors closely monitored this compression in yield spreads as an early indicator of financial stress and economic slowdown.

COVID-19 Pandemic and Yield Curve Movements in 2020

The COVID-19 pandemic in 2020 led to significant yield curve flattening as short-term interest rates plummeted due to aggressive Federal Reserve rate cuts while long-term yields remained relatively stable amid economic uncertainty. The 2-year and 10-year Treasury yields narrowed considerably, reflecting market expectations of prolonged low growth and inflation. This flattening signaled investor concerns about the economic recovery and influenced fixed income portfolio strategies during the crisis.

Yield Curve Flattening During Federal Reserve Rate Hikes

Yield curve flattening often occurs during Federal Reserve rate hikes when short-term interest rates rise faster than long-term rates, compressing the spread between 2-year and 10-year Treasury yields. For instance, during the 2015-2018 rate hike cycle, the 2-year yield increased sharply as the Federal Reserve raised the federal funds rate from 0.25% to 2.5%, while the 10-year yield rose modestly, resulting in a flatter yield curve. This flattening signals market expectations of slower economic growth and potential future rate cuts by the Fed.

Implications of Curve Flattening for Bond Investors

Curve flattening occurs when the yield difference between long-term and short-term bonds narrows, often signaling investor concerns over future economic growth or inflation. Bond investors face implications such as reduced opportunities for earning higher yields on long-duration bonds and increased sensitivity to interest rate changes across the curve. Portfolio managers may shift towards short-term bonds or adopt more defensive strategies to mitigate risks associated with lower yield spreads and potential market volatility.

Case Study: US Treasury Yield Curve Flattening in Recent Years

The US Treasury yield curve flattening observed between 2018 and 2019 exemplifies a significant shift in bond market dynamics, driven by changes in Federal Reserve policy and investor expectations of slower economic growth. During this period, yields on short-term Treasuries rose due to rate hikes, while long-term yields declined as investors sought safe assets amid growth concerns, causing the spread between 2-year and 10-year Treasuries to narrow substantially. This phenomenon signaled increased market apprehension about future economic expansion and influenced portfolio strategies across fixed income markets.

Comparing Curve Flattening in Developed vs. Emerging Markets

Curve flattening in developed markets often results from monetary policy tightening, where short-term yields rise faster than long-term yields, reflecting investor expectations of slower economic growth. In emerging markets, curve flattening may be driven by capital inflows and inflation control measures, leading to a compression of yield differentials amid global risk sentiment shifts. Comparing both, developed market curves typically flatten due to central bank actions, while emerging market curves are more influenced by external financial conditions and local economic stability.

What Curve Flattening Signals for Economic Outlook

Curve flattening in yield, where short-term and long-term bond yields converge, often signals investor expectations of slower economic growth and potential interest rate cuts by central banks. This phenomenon reflects market anticipation of reduced inflationary pressures and a cautious outlook on future corporate earnings. Investors interpret a flattening curve as a warning sign of economic deceleration or an upcoming recession, prompting adjustments in portfolio strategies.

example of curve flattening in yield Infographic

samplerz.com

samplerz.com