A basis point is a unit of measurement equal to 0.01% used primarily in finance to describe the percentage change in yield or interest rates. For instance, if the yield on a bond increases from 3.50% to 3.75%, it has risen by 25 basis points. This precise measurement helps investors and analysts accurately track and compare fluctuations in yields and rates. In bond markets, basis points are crucial for evaluating investment performance and risk. A change of 100 basis points corresponds to a 1% shift in yield, impacting bond prices inversely. Understanding basis points enables better decision-making regarding interest rate movements and their effects on portfolio returns.

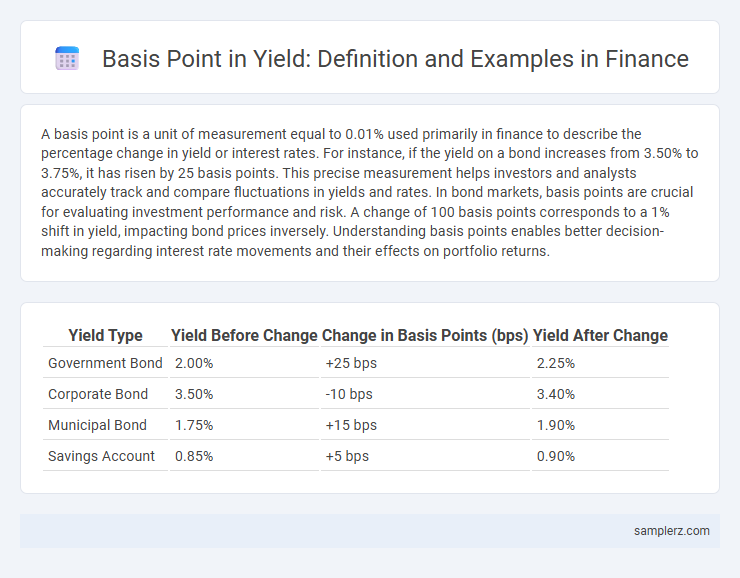

Table of Comparison

| Yield Type | Yield Before Change | Change in Basis Points (bps) | Yield After Change |

|---|---|---|---|

| Government Bond | 2.00% | +25 bps | 2.25% |

| Corporate Bond | 3.50% | -10 bps | 3.40% |

| Municipal Bond | 1.75% | +15 bps | 1.90% |

| Savings Account | 0.85% | +5 bps | 0.90% |

Understanding Basis Points in Yield Calculations

A basis point represents one-hundredth of a percentage point (0.01%) and is crucial in yield calculations for accurately measuring changes in interest rates or bond yields. For example, if a bond's yield increases from 3.00% to 3.25%, it has risen by 25 basis points, allowing investors to quantify small yield fluctuations with precision. Understanding basis points helps financial analysts compare investment returns and assess risk impacts across different fixed-income securities.

What is a Basis Point?

A basis point is a unit of measurement equal to 0.01% used to describe changes in interest rates or yields in finance, helping investors precisely quantify small fluctuations. For example, if a bond yield increases from 3.00% to 3.25%, it has risen by 25 basis points. This standardized metric allows accurate communication of yield movements without ambiguity in financial markets.

Practical Examples of Basis Points in Yield Changes

A 25 basis point increase in Treasury bond yields, changing from 2.00% to 2.25%, directly impacts fixed-income investments by altering bond prices and investor returns. Mutual funds tracking bond indices often adjust holdings based on these yield shifts, reflecting sensitivity to even small basis point movements. Corporations also consider basis point changes when evaluating loan interest rates, affecting borrowing costs and financial planning.

Calculating Yield Changes Using Basis Points

A basis point represents one-hundredth of a percentage point, or 0.01%, commonly used to measure yield changes in finance. If a bond yield increases from 3.00% to 3.25%, the change is 25 basis points, calculated by multiplying the yield difference (0.25%) by 100. Investors use basis points to precisely assess yield fluctuations, ensuring accurate comparisons and informed decisions on fixed-income securities.

How a 50 Basis Point Shift Impacts Bond Yields

A 50 basis point shift in bond yields represents a 0.50% change, significantly affecting bond prices and investor returns. For instance, if a bond's yield increases from 3.00% to 3.50%, its price typically falls, reflecting higher required returns and increased borrowing costs. Such movements are crucial for portfolio management, risk assessment, and interest rate sensitivity analysis in fixed-income investing.

Basis Points in Interest Rate Movements

A basis point represents 0.01% and is used to quantify changes in interest rates, where a 25 basis point increase means a 0.25% rise. For example, if the Federal Reserve raises the benchmark interest rate by 50 basis points, borrowing costs for loans and mortgages increase accordingly. Understanding basis points helps investors and analysts accurately gauge the impact of rate movements on bond yields and financial markets.

Comparing Basis Points Across Different Fixed-Income Instruments

A basis point represents 0.01% and is used to measure yield changes across fixed-income instruments such as Treasury bonds, corporate bonds, and municipal bonds. For instance, a 25 basis point increase in a 10-year Treasury yield reflects a 0.25% rise, while the same basis point movement in a high-yield corporate bond might indicate a different risk premium adjustment. Comparing basis points across these instruments helps investors assess relative yield shifts and credit risk variations efficiently.

Visualizing Yield Spreads in Basis Points

Yield spreads are commonly expressed in basis points, where one basis point equals 0.01%. For example, a yield spread of 150 basis points means a 1.50% difference between two bond yields, such as between corporate bonds and U.S. Treasuries. Visualizing these spreads on a graph clarifies risk premiums and market sentiment across different fixed-income securities.

Real-World Scenarios: Basis Point Increases and Decreases

A 25 basis point increase in Treasury yields often signals a tightening monetary policy, influencing mortgage rates and corporate bond yields. Conversely, a 50 basis point decrease in yield can stimulate borrowing and investment by reducing borrowing costs for businesses and consumers. These basis point movements critically impact portfolio valuations and risk assessments in fixed income markets.

The Significance of Basis Points for Investors

A basis point represents 0.01% and is crucial for accurately measuring changes in bond yields and interest rates, enabling investors to assess potential risks and returns. For example, a 50 basis point increase in a 5% bond yield raises the yield to 5.50%, significantly impacting bond prices and investment decisions. Understanding basis points helps investors compare financial products, monitor market trends, and manage portfolio performance effectively.

example of basis point in yield Infographic

samplerz.com

samplerz.com