Bond duration measures the sensitivity of a bond's price to changes in interest rates, expressed in years. For example, a bond with a duration of 5 years indicates that its price would change approximately 5% for a 1% change in interest rates. This metric helps investors understand the potential price volatility and interest rate risk associated with fixed-income securities. Duration also assists in portfolio management by allowing investors to match the maturity of assets and liabilities, helping to mitigate risk. A 10-year Treasury bond typically has a duration close to 8 years, reflecting its longer time to maturity and interest payments. Investors use duration to evaluate bonds with varying coupons and maturities to optimize returns and manage interest rate exposure effectively.

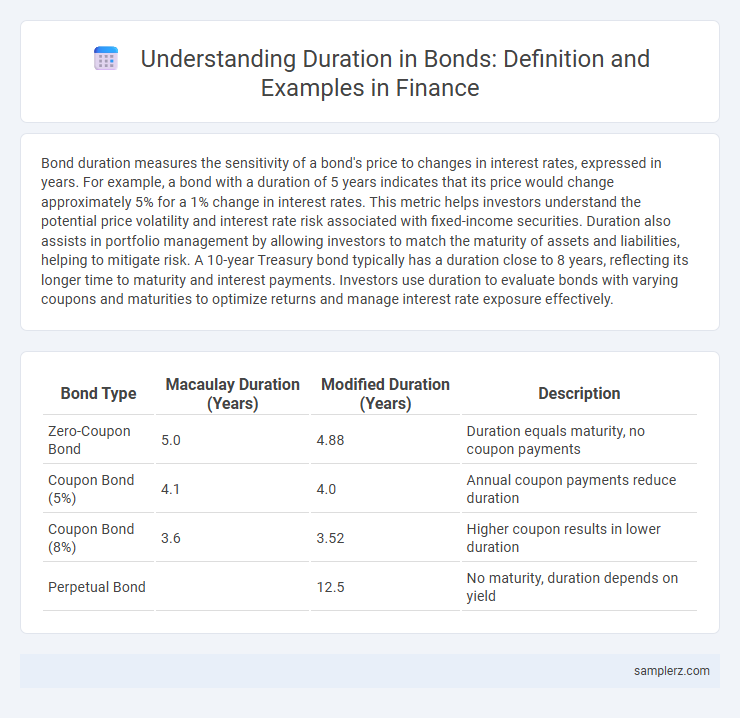

Table of Comparison

| Bond Type | Macaulay Duration (Years) | Modified Duration (Years) | Description |

|---|---|---|---|

| Zero-Coupon Bond | 5.0 | 4.88 | Duration equals maturity, no coupon payments |

| Coupon Bond (5%) | 4.1 | 4.0 | Annual coupon payments reduce duration |

| Coupon Bond (8%) | 3.6 | 3.52 | Higher coupon results in lower duration |

| Perpetual Bond | 12.5 | No maturity, duration depends on yield |

Introduction to Bond Duration

Bond duration measures the sensitivity of a bond's price to changes in interest rates, representing the weighted average time to receive all cash flows from the bond. For example, a 5-year bond with annual coupon payments and a 4% yield might have a Macaulay duration of approximately 4.5 years, indicating the effective maturity considering the bond's coupons and principal. Duration helps investors assess interest rate risk, guiding investment decisions in fixed-income portfolios.

Defining Duration in Bond Investments

Duration in bond investments measures the weighted average time it takes to receive the bond's cash flows, serving as a key indicator of interest rate risk exposure. A bond with a duration of 5 years implies that a 1% change in interest rates will approximately result in a 5% change in the bond's price. Investors use duration to assess sensitivity to interest rate fluctuations and to manage portfolio risk effectively.

Importance of Duration in Portfolio Management

Duration measures a bond's sensitivity to interest rate changes, quantifying potential price volatility. Investors use duration to balance risk and return, aligning bond maturities with investment horizons. Effective portfolio management relies on duration to mitigate interest rate risk and optimize asset allocation.

Types of Bond Duration Explained

Macaulay duration measures the weighted average time to receive a bond's cash flows, reflecting interest rate sensitivity and payment timing. Modified duration adjusts Macaulay duration for changes in yield, indicating the percentage price change for a 1% interest rate movement. Dollar duration calculates the dollar value change in a bond's price for a 1 basis point interest rate shift, helping investors assess risk in currency terms.

How to Calculate Macaulay Duration

Macaulay duration measures the weighted average time until a bond's cash flows are received, reflecting interest rate risk. To calculate it, multiply each cash flow's present value by the time until payment, sum these products, and then divide by the bond's total present value. This calculation helps investors assess bond price sensitivity to interest rate changes and compare bonds with different maturities and coupon rates.

Modified Duration: A Practical Approach

Modified Duration measures a bond's price sensitivity to interest rate changes, calculated by adjusting Macaulay Duration by the bond's yield to maturity. For example, a bond with a Macaulay Duration of 5 years and a yield of 4% has a Modified Duration of approximately 4.81, indicating its price will change by 4.81% for a 1% change in interest rates. This practical approach helps investors assess interest rate risk and manage bond portfolios effectively.

Real-Life Examples of Duration Calculation

A 10-year U.S. Treasury bond with a 3% annual coupon rate and a current yield of 2.5% typically exhibits a Macaulay duration of approximately 8.5 years, reflecting the weighted average time to receive the bond's cash flows. In practice, calculating duration for a corporate bond with irregular coupon payments involves discounting each cash flow by the yield to maturity and summing the weighted present values, which guides investors in assessing interest rate risk exposure. The modified duration derived from this process quantifies the bond price sensitivity to a 1% change in interest rates, crucial for portfolio immunization strategies.

Impact of Duration on Interest Rate Risk

Duration measures a bond's sensitivity to interest rate changes, quantifying the percentage price change for a 1% shift in yields. For example, a bond with a duration of 5 years will experience approximately a 5% price decline if interest rates rise by 1%. This relationship highlights how longer duration bonds carry greater interest rate risk, affecting portfolio volatility and investment strategy.

Duration Strategies in Bond Investing

Duration strategies in bond investing focus on managing interest rate risk by adjusting the portfolio's weighted average time to maturity. Investors use short-duration bonds to reduce sensitivity to interest rate fluctuations and long-duration bonds to capitalize on expected declines in rates. Effective duration management enhances portfolio stability and optimizes returns in varying interest rate environments.

Common Mistakes When Using Duration

Investors often confuse duration with maturity, overlooking that duration measures a bond's sensitivity to interest rate changes rather than its time to repayment. Using duration without considering bond convexity may lead to inaccurate interest rate risk assessments, especially for bonds with embedded options. Misapplying Macaulay duration for price sensitivity instead of modified duration causes errors in estimating bond price volatility.

example of duration in bond Infographic

samplerz.com

samplerz.com