Syndication in loan finance occurs when multiple lenders come together to fund a single borrower, spreading the risk among them. An example is a large corporation seeking a $500 million loan to finance a major acquisition, where a lead bank arranges the loan and invites other banks to participate. Each participating lender contributes a portion of the total loan amount, receiving interest payments proportional to their share. This structure benefits both borrower and lenders by enabling access to substantial capital while mitigating exposure to default risk. Syndicated loans are often used in sectors such as infrastructure, energy, and real estate, where project costs exceed the capacity of a single financial institution. Data on syndicated loans show increasing popularity in global markets due to their flexibility and efficient risk distribution.

Table of Comparison

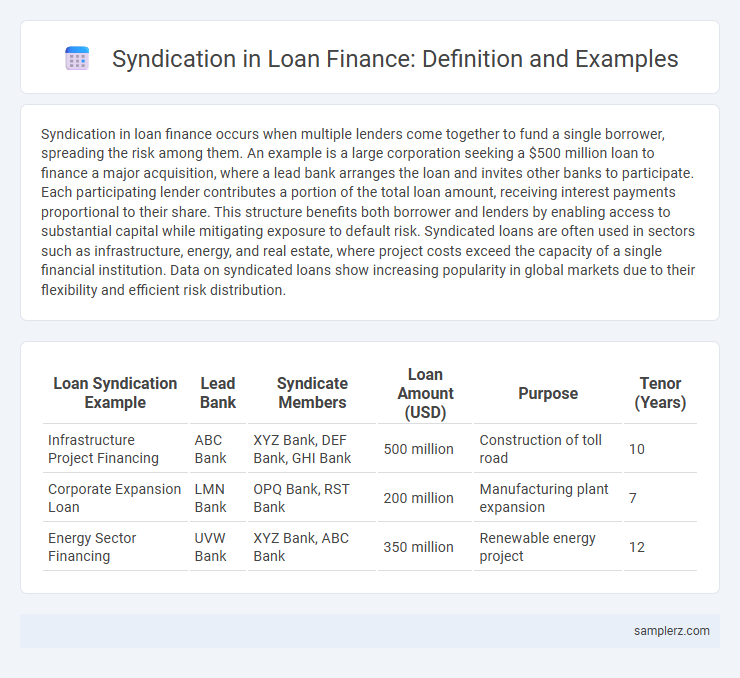

| Loan Syndication Example | Lead Bank | Syndicate Members | Loan Amount (USD) | Purpose | Tenor (Years) |

|---|---|---|---|---|---|

| Infrastructure Project Financing | ABC Bank | XYZ Bank, DEF Bank, GHI Bank | 500 million | Construction of toll road | 10 |

| Corporate Expansion Loan | LMN Bank | OPQ Bank, RST Bank | 200 million | Manufacturing plant expansion | 7 |

| Energy Sector Financing | UVW Bank | XYZ Bank, ABC Bank | 350 million | Renewable energy project | 12 |

Introduction to Syndicated Loans

Syndicated loans involve multiple lenders pooling resources to provide a large loan that a single lender cannot easily offer alone, commonly used in corporate and infrastructure financing. These loans distribute risk among banks or financial institutions while enabling borrowers to access substantial capital with more favorable terms. Key participants include lead arrangers, syndicate members, and borrowers, all coordinating to structure, fund, and manage the loan agreement efficiently.

Key Features of Loan Syndication

Loan syndication involves multiple lenders collaborating to provide a large loan to a single borrower, distributing the risk and capital requirement. Key features include shared credit risk among syndicate members, a lead arranger managing the loan process, and standardized loan documentation to ensure clarity and compliance. Syndicated loans often offer flexible repayment terms and access to larger funding amounts than individual banks typically provide.

How Syndicated Loans Work

Syndicated loans involve multiple lenders pooling resources to provide a large loan to a single borrower, typically a corporation or government entity, reducing individual risk exposure. The lead bank, known as the arranger, structures the loan, negotiates terms, and distributes portions to participant banks, each assuming a share of the credit risk and interest income. Borrowers benefit from increased capital access and diversified lender relationships, while lenders gain risk mitigation and potential fee revenue from loan servicing.

Major Players in Loan Syndication

Major players in loan syndication include lead arrangers, often large investment banks or financial institutions, who structure and underwrite the loan. Participating banks and institutional investors provide portions of the credit, sharing the risk and returns. Legal advisors and rating agencies also play critical roles by ensuring compliance and assessing credit quality, respectively.

Real-World Examples of Loan Syndication

JPMorgan Chase led a $15 billion syndicated loan for Amazon's acquisition of MGM Studios, mobilizing capital from over 20 global banks to share risk and provide liquidity. Another real-world example includes the $10 billion syndicated facility arranged by HSBC for Saudi Aramco's refinery expansion, involving multiple international lenders to diversify exposure. These syndications illustrate how large corporates leverage consortiums of financial institutions to secure substantial financing efficiently.

Syndication Process: Step-by-Step

The syndication process in loan financing begins with the lead arranger structuring the deal and inviting other banks to participate in the loan. Once interest is confirmed, due diligence and documentation are conducted collaboratively, ensuring all parties agree on terms and risk allocation. The final step involves executing the loan agreement and distributing funds while ongoing syndicate management monitors borrower compliance and financial performance.

Case Study: Corporate Loan Syndication

Corporate loan syndication involves multiple lenders pooling resources to provide large-scale financing to a single corporate borrower, mitigating individual risk exposure. A notable case is the $5 billion syndicated loan arranged in 2023 for a global energy company, where lead banks structured tranches to optimize interest rates and repayment schedules. This syndication facilitated the borrower's capital-intensive projects while distributing credit risk among twelve participating financial institutions.

Benefits and Risks of Syndicated Loans

Syndicated loans involve multiple lenders providing portions of a large loan to a single borrower, spreading the credit exposure among financial institutions. This structure offers benefits such as improved risk diversification, increased loan capacity, and enhanced access to capital for borrowers. However, risks include potential coordination challenges among lenders, slower decision-making processes, and the complexity of managing inter-lender agreements.

Syndicated Loan Structures Explained

Syndicated loans involve multiple lenders pooling resources to provide a large loan to a single borrower, often led by one or more lead arrangers who coordinate the process. Common syndicated loan structures include club deals, where a small group of lenders share equal risk, and fully underwritten deals, where one or more arrangers guarantee the entire loan amount before syndicating portions to other lenders. These structures optimize risk distribution and capital allocation, enabling borrowers to access substantial financing while lenders diversify exposure.

Syndicated Loan Market Trends

The syndicated loan market has experienced substantial growth, with global issuance surpassing $4 trillion in 2023, driven by increased demand from corporate borrowers seeking diversified funding sources. Major financial centers such as New York, London, and Hong Kong dominate syndication activities, while emerging markets are showing rising participation due to expanding infrastructure projects. Trends highlight a shift towards larger, multi-tranche deals incorporating sustainability-linked features to attract environmentally conscious investors.

example of syndication in loan Infographic

samplerz.com

samplerz.com