A STRIP in a treasury auction is a type of fixed-income security created by separating the principal and interest payments of a U.S. Treasury bond or note. Each interest payment and the principal payment become individual zero-coupon securities that can be sold separately, allowing investors to purchase discounted securities with no periodic interest. The U.S. Department of the Treasury facilitates this process through the Treasury Direct program, providing transparency and efficiency in the secondary market. Investors benefit from STRIPs by receiving a lump sum payment at maturity, making them attractive for long-term financial planning and tax-deferred growth. Treasury STRIPs have predictable cash flows and minimal default risk, backed by the full faith and credit of the U.S. government. Data from recent auctions indicate growing demand for STRIPs, reflecting shifts in investor strategies towards fixed maturity securities with specific future value targets.

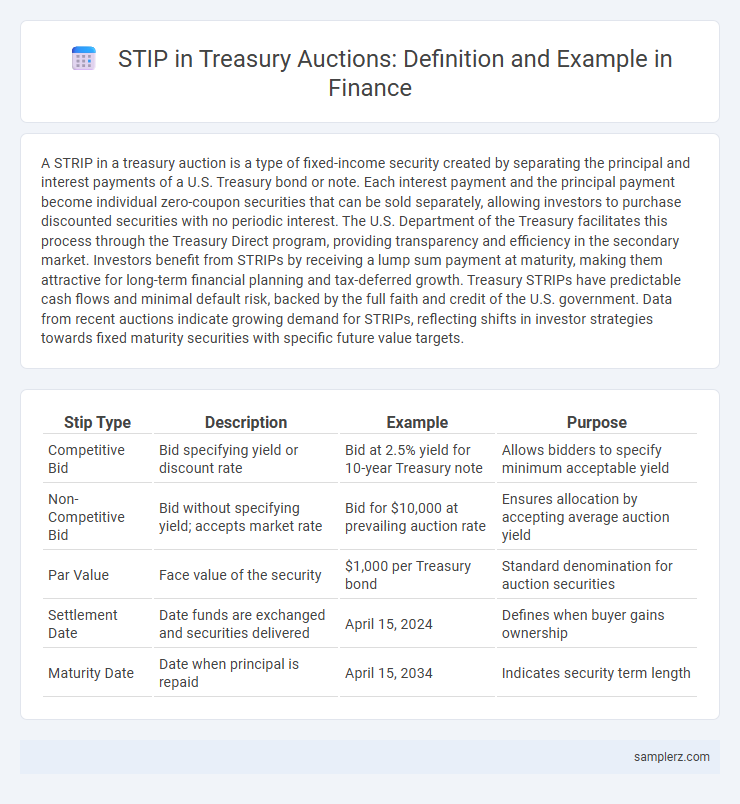

Table of Comparison

| Stip Type | Description | Example | Purpose |

|---|---|---|---|

| Competitive Bid | Bid specifying yield or discount rate | Bid at 2.5% yield for 10-year Treasury note | Allows bidders to specify minimum acceptable yield |

| Non-Competitive Bid | Bid without specifying yield; accepts market rate | Bid for $10,000 at prevailing auction rate | Ensures allocation by accepting average auction yield |

| Par Value | Face value of the security | $1,000 per Treasury bond | Standard denomination for auction securities |

| Settlement Date | Date funds are exchanged and securities delivered | April 15, 2024 | Defines when buyer gains ownership |

| Maturity Date | Date when principal is repaid | April 15, 2034 | Indicates security term length |

Understanding Stip in Treasury Auctions

A Separate Trading of Registered Interest and Principal of Securities (STRIPS) allows investors to hold Treasury securities as individual interest and principal components, trading them separately in treasury auctions. Understanding STIP in treasury auctions involves recognizing how these stripped securities provide specific cash flow timing and interest rate risk management benefits. Treasury auctions facilitate the issuance of these stripped securities, enabling precise investment strategies aligned with future financial obligations.

Key Features of Stip in Treasury Bidding

Stip in treasury auction refers to the specific terms and conditions bidders must agree to, such as minimum bid amounts, bid increments, and maturity dates. Key features include price determination through competitive bidding, the requirement for bidders to specify yield or price, and rules governing bid acceptance, which ensure transparency and fair market-driven pricing. These stipulations enhance market efficiency by facilitating optimal capital allocation and reducing issuance costs for government securities.

How Stip Works During Treasury Auctions

During treasury auctions, a Stip (short for "stipulation") specifies certain conditions under which bids are accepted, such as minimum bid amounts or price limits, ensuring orderly and transparent allocation of government securities. Bidders submit competitive or non-competitive bids adhering to these stipulations, allowing the Treasury to determine the winning bids based on price and quantity criteria. This process helps set the prevailing yields on notes and bonds, reflecting market demand and influencing national borrowing costs.

Real-World Example of Stip in Action

In the 2020 U.S. Treasury auction, a State and Local Government Series (SLGS) investor used a standing tender instruction program (STIP) to automate bid placements for tax-exempt securities, ensuring compliance with IRS regulations. The STIP facilitated precise timing and pricing strategies, resulting in successful acquisition of targeted Treasury bills while maintaining portfolio liquidity. This real-world example highlights how STIP streamlines participation in complex auctions, minimizing manual errors and enhancing strategic execution for institutional investors.

Step-by-Step Stip Process in Treasury Auctions

In treasury auctions, the step-by-step Stip process begins with the announcement of the auction details, including the amount, maturity, and coupon rate. Investors submit their bids electronically, specifying the quantity and yield they are willing to accept. The Treasury then aggregates bids, ranks them by yield from lowest to highest, and allocates securities starting with the lowest yield until the offering amount is met, finalizing allocations and informing participants of their successful bids.

Comparing Stip With Standard Treasury Auction Methods

STIPs (Separate Trading of Registered Interest and Principal Securities) differ from standard treasury auction methods by allowing investors to buy and trade interest and principal components separately, enhancing liquidity and customization. Unlike traditional auctions where bids are placed on entire Treasury securities, STIPs enable more precise investment strategies by segmenting cash flows. This segmentation can lead to improved price discovery and tailored risk management for institutional investors in the treasury market.

Benefits of Using Stip in Treasury Auctions

STIP, or Short Term Investment Pool, in treasury auctions offers enhanced liquidity by allowing participants to quickly reinvest auction proceeds, reducing idle cash holdings. It provides improved yield optimization through pooled investments, leveraging scale to secure better interest rates on government securities. Utilizing STIP streamlines fund management, minimizing transaction costs and administrative burdens for institutional investors.

Stip Valuation: Calculation and Implications

STIP valuation in treasury auctions involves calculating the implied yield based on the discounted price of short-term treasury bills. The valuation method uses present value formulas reflecting the difference between face value and purchase price over the instrument's maturity, providing an accurate yield estimation. This calculation directly impacts investment decisions and portfolio risk assessments by indicating the cost of borrowing and prevailing market interest rates.

Potential Risks Associated with Stip in Treasury Auctions

Stipulated Investment Terms (STIP) in treasury auctions can introduce potential risks such as liquidity constraints, where rigid conditions limit investor flexibility to resell securities promptly. Price volatility may increase due to restrictive stipulations affecting bid participation and market depth. Counterparty risk emerges if stip terms complicate settlement processes, potentially disrupting standard auction outcomes.

Regulatory Considerations for Stip Use in Treasury Bids

Regulatory considerations for Stip use in treasury bids include compliance with SEC Rule 15c3-1, which mandates capital adequacy requirements for broker-dealers handling stipulated bids. Treasury auction participants must also adhere to Anti-Money Laundering (AML) regulations to ensure transparency and prevent illicit activities during bidding processes. Failure to comply with the Financial Industry Regulatory Authority (FINRA) guidelines can result in penalties and disqualification from future auctions.

example of stip in treasury auction Infographic

samplerz.com

samplerz.com