The TED spread measures the difference between the interest rates on short-term U.S. government debt and interbank loans, reflecting credit risk in the banking sector. For example, during periods of financial stress, the TED spread can widen significantly as banks perceive higher default risk among their peers. In March 2008, the TED spread surged above 400 basis points amid the collapse of Lehman Brothers, signaling severe tension in the interbank lending market. A narrower TED spread indicates confidence and stability in financial markets, with banks willing to lend to each other at rates close to government securities. Typically, the TED spread averages around 20 to 50 basis points during normal market conditions. Monitoring this spread provides key insights into liquidity and risk in the interbank market, helping investors and policymakers assess the health of the financial system.

Table of Comparison

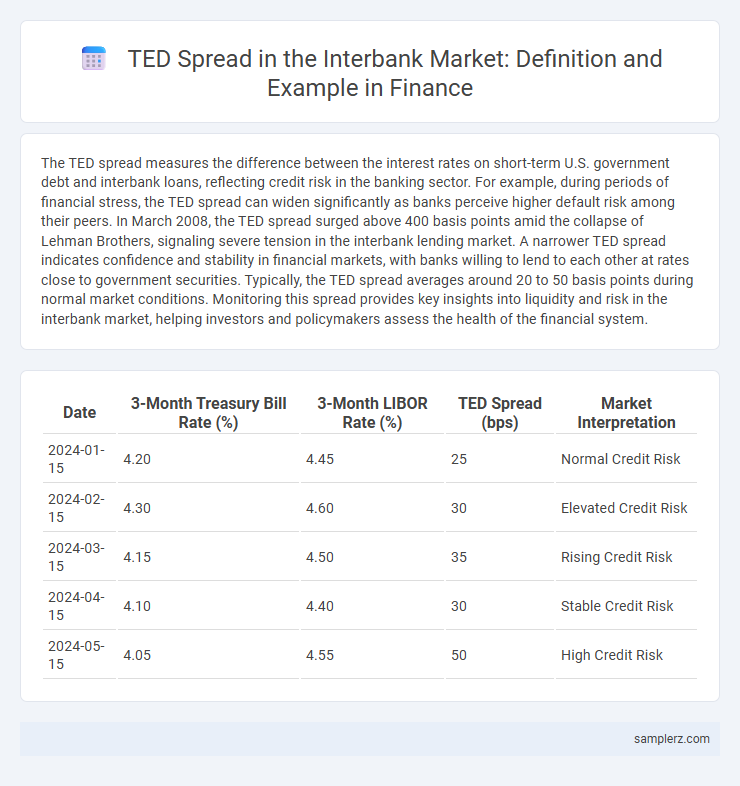

| Date | 3-Month Treasury Bill Rate (%) | 3-Month LIBOR Rate (%) | TED Spread (bps) | Market Interpretation |

|---|---|---|---|---|

| 2024-01-15 | 4.20 | 4.45 | 25 | Normal Credit Risk |

| 2024-02-15 | 4.30 | 4.60 | 30 | Elevated Credit Risk |

| 2024-03-15 | 4.15 | 4.50 | 35 | Rising Credit Risk |

| 2024-04-15 | 4.10 | 4.40 | 30 | Stable Credit Risk |

| 2024-05-15 | 4.05 | 4.55 | 50 | High Credit Risk |

Understanding the TED Spread: Definition and Significance

The TED spread measures the difference between the interest rates on short-term U.S. Treasury bills and interbank Eurodollar loans, serving as a key indicator of credit risk in the interbank market. A rising TED spread signals increasing perceived risk of bank default, reflecting reduced confidence among banks and higher borrowing costs. Financial analysts closely monitor this spread to assess liquidity conditions, market stress, and the overall health of the banking sector.

Historical Overview of TED Spread Movements

The TED spread, representing the difference between the interest rates on interbank loans and short-term U.S. government debt, historically surged during the 2008 financial crisis as banks perceived higher credit risk. Sharp increases in the TED spread signal tightening liquidity and growing distrust among financial institutions, evident during events like the 1998 LTCM collapse and the European debt crisis. Monitoring these fluctuations offers insights into market stress and credit conditions within the interbank lending environment.

Calculating the TED Spread: Step-by-Step Explanation

The TED spread is calculated by subtracting the yield on three-month U.S. Treasury bills from the three-month London Interbank Offered Rate (LIBOR), reflecting the credit risk in the interbank lending market. For example, if the 3-month LIBOR stands at 1.75% and the 3-month T-bill yield is 0.50%, the TED spread equals 1.25 basis points. This measure is crucial for assessing liquidity conditions and the perceived risk between banks in the financial market.

Key Factors Influencing the TED Spread in Interbank Markets

The TED spread, calculated as the difference between the interest rates on interbank loans (LIBOR) and short-term U.S. Treasury bills, reflects credit risk and liquidity in the interbank market. Key factors influencing the TED spread include changes in market liquidity, shifts in investor risk sentiment, and central bank monetary policy adjustments. Elevated TED spreads signal increased perceived default risk among banks and tightening financial conditions in the interbank market.

Real-World Examples of TED Spread Fluctuations

The TED spread, which measures the difference between the interest rates on interbank loans and short-term U.S. government debt, surged from historically low levels near 10 basis points to over 450 basis points during the 2008 financial crisis, reflecting heightened counterparty risk. In March 2020, amid the COVID-19 pandemic, the TED spread spiked sharply, signaling extreme liquidity stress and credit risk concerns in the interbank lending market. These fluctuations demonstrate the TED spread's role as a critical indicator of market confidence and systemic risk in the global financial system.

The TED Spread During the 2008 Financial Crisis

The TED spread, measuring the difference between the 3-month LIBOR and the 3-month U.S. Treasury bill rate, surged dramatically during the 2008 financial crisis, reaching peaks above 450 basis points. This spike reflected extreme credit risk and liquidity concerns within the interbank market as banks hesitated to lend to each other. The heightened TED spread served as a critical indicator of systemic stress and deteriorating trust among financial institutions during the crisis.

Implications of TED Spread Changes for Market Liquidity

The TED spread, defined as the difference between the interest rates on interbank loans and short-term U.S. government debt, serves as a key indicator of credit risk in the banking sector. An increasing TED spread signals rising fears of default and tightening liquidity conditions among banks, often leading to reduced interbank lending and higher borrowing costs. Conversely, a narrowing TED spread reflects improved trust and greater market liquidity, facilitating smoother capital flows within the financial system.

Comparing TED Spread Dynamics Across Major Economies

The TED spread, representing the difference between the 3-month LIBOR and US Treasury bill yields, exhibits varied dynamics across major economies such as the United States, Eurozone, and Japan. During financial stress periods like the 2008 crisis, the US TED spread surged dramatically, reflecting heightened interbank credit risk, while European counterparts showed similar but regionally influenced volatility patterns. Analyzing these spreads helps investors gauge global liquidity conditions and credit risk perceptions in key interbank markets.

TED Spread as a Predictor of Systemic Risk

The TED spread, calculated as the difference between the interest rates on short-term U.S. government debt (Treasury bills) and interbank loan rates (LIBOR), serves as a crucial indicator of credit risk in the banking sector. A widening TED spread signals increased lender caution and potential liquidity constraints, reflecting heightened systemic risk within the interbank market. Historical spikes in the TED spread during financial crises, such as the 2008 global recession, underscore its role as a predictive measure of banking sector distress and overall market instability.

Practical Applications of TED Spread Analysis for Investors

TED spread, calculated as the difference between the interest rates on interbank loans and short-term U.S. Treasury bills, serves as a critical indicator of credit risk in the interbank market. Investors utilize TED spread analysis to gauge market liquidity and potential stress by monitoring widening spreads that signal increased risk aversion among banks. This metric aids portfolio managers in adjusting asset allocations during periods of heightened financial uncertainty to mitigate exposure to credit defaults.

example of TED spread in interbank market Infographic

samplerz.com

samplerz.com