A tranche in a Collateralized Loan Obligation (CLO) represents a segmented portion of the CLO's debt, each with distinct risk, return, and maturity profiles. These tranches allow investors to select exposure based on their risk tolerance and investment goals. Common tranches include senior, mezzanine, and equity, with senior tranches receiving priority in payment and lower risk, while equity tranches bear the highest risk but offer potential for greater returns. Data from CLO structures typically shows senior tranches rated AAA by agencies like S&P or Moody's, reflecting their priority in the capital structure and exposure to lower default risk. Mezzanine tranches are rated below investment grade, carrying moderate risk and offering higher yields. Equity tranches absorb first losses, do not have fixed payments, and are primarily held by investors seeking high returns through loan portfolio performance.

Table of Comparison

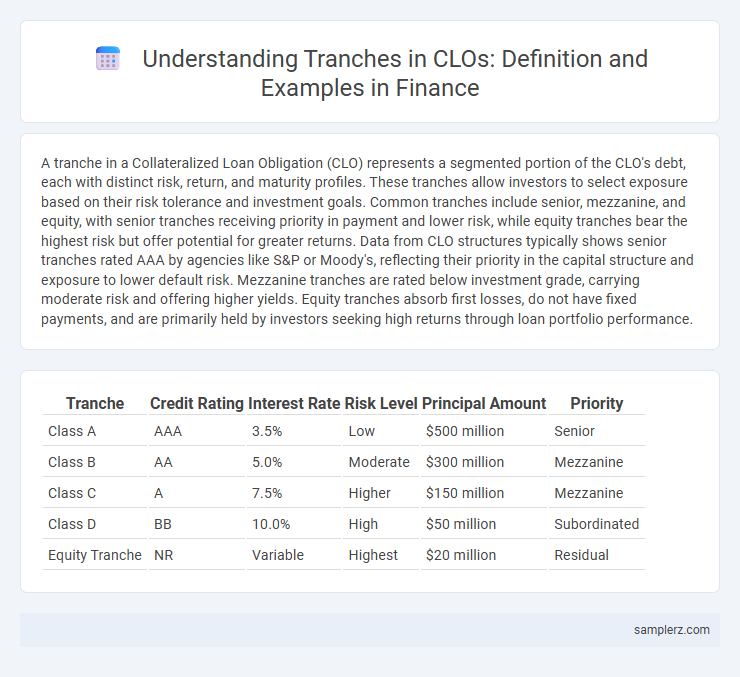

| Tranche | Credit Rating | Interest Rate | Risk Level | Principal Amount | Priority |

|---|---|---|---|---|---|

| Class A | AAA | 3.5% | Low | $500 million | Senior |

| Class B | AA | 5.0% | Moderate | $300 million | Mezzanine |

| Class C | A | 7.5% | Higher | $150 million | Mezzanine |

| Class D | BB | 10.0% | High | $50 million | Subordinated |

| Equity Tranche | NR | Variable | Highest | $20 million | Residual |

Understanding CLO Tranches: A Brief Overview

CLO tranches represent different layers of debt in a Collateralized Loan Obligation, each with varying risk and return profiles. Senior tranches typically have higher credit ratings and lower interest rates due to priority in repayment, while mezzanine and equity tranches absorb higher risk in exchange for greater potential yields. Understanding the structure and cash flow allocation of these tranches is crucial for assessing investment risks and returns in CLO markets.

Senior Tranche Example in CLO Structures

The senior tranche in a CLO structure typically holds the highest credit rating, often AAA, due to its priority claim on the underlying loan payments and lower risk exposure. This tranche receives scheduled interest and principal payments before any subordinate tranches, making it attractive to conservative investors such as pension funds and insurance companies. Its secured position ensures lower default risk, providing stable cash flow and capital preservation within the diversified credit portfolio.

Mezzanine Tranche: Features and Real-World Example

The mezzanine tranche in a Collateralized Loan Obligation (CLO) typically carries moderate risk and offers higher yields than senior tranches, reflecting its subordinated position in the capital structure. It absorbs losses after senior tranches are impacted but before equity tranches, balancing risk with income potential for investors. A real-world example includes a mezzanine tranche rated BBB that provides investors with a coupon rate around 6-8%, demonstrating its role as a vital mid-level finance layer within CLO structures.

Equity Tranche: Risk and Reward Explained

The Equity Tranche in a Collateralized Loan Obligation (CLO) represents the highest risk layer, absorbing the first losses from defaults within the loan pool. Investors in this tranche benefit from potentially higher returns due to its subordinated position, but face significant downside risk if loan performance deteriorates. This tranche typically offers elevated yields as compensation for its exposure to default and prepayment variability compared to senior notes.

Case Study: Tranche Distribution in a Typical CLO

In a typical Collateralized Loan Obligation (CLO), tranches are distributed based on risk and return profiles, with senior tranches receiving priority in payments and lower risk exposure, followed by mezzanine and equity tranches absorbing higher risks and potentially higher returns. The senior tranche is often rated AAA, reflecting its secured status, while mezzanine tranches carry BBB to BB ratings, balancing risk and yield. Equity tranches, unrated and subordinate, provide residual cash flow after debt obligations are met, illustrating the layered risk distribution fundamental to CLO structuring.

Yield Profiles Across CLO Tranches

Collateralized Loan Obligations (CLO) feature multiple tranches with varying risk and yield profiles, ranging from senior AAA-rated tranches offering lower yields around 3-5% to equity tranches that can yield upwards of 15-20% due to higher credit risk. The senior tranches benefit from priority in repayment, resulting in stable but lower returns, while mezzanine and subordinate tranches carry increased default risk and provide higher yields to compensate investors. These differentiated yield profiles allow CLO investors to choose tranches aligned with their risk tolerance and investment objectives.

Credit Ratings: Impact on CLO Tranche Selection

Credit ratings play a crucial role in CLO tranche selection by determining the risk and return profile investors expect from each tranche. Senior tranches often receive high credit ratings such as AAA, reflecting their lower default risk and priority in cash flow distribution, while mezzanine and equity tranches carry lower ratings, indicating higher risk exposure. Understanding these ratings helps investors align their portfolio strategies with desired risk tolerance and expected yields within the structured finance framework.

Example of Cash Flow Waterfall Among Tranches

In a CLO, the cash flow waterfall prioritizes payments by allocating interest and principal sequentially across tranches based on seniority, ensuring that senior tranches receive full payments before subordinated tranches are paid. For example, Class A tranches, having the highest credit rating, are paid interest and principal first, followed by Class B and Class C tranches, which absorb losses and deferred interest in cases of asset underperformance. This structured sequence protects senior investors while exposing equity tranche holders to higher risk and potential reward.

Investor Perspectives: Choosing a CLO Tranche

Investors selecting a CLO tranche evaluate risk and return profiles, with senior tranches offering lower yields but higher credit quality, while mezzanine tranches provide higher yields at increased risk. Equity tranches absorb initial losses and thus appeal to investors seeking high return potential and can tolerate credit volatility. Understanding tranche seniority, payment priority, and default risk is crucial for aligning investment goals with the CLO's capital structure.

Key Risks Illustrated Through CLO Tranche Examples

A mezzanine tranche in a CLO typically carries higher credit risk due to its subordinate position to senior tranches, exposing investors to default risk if underlying loans underperform. The equity tranche absorbs first losses, demonstrating high risk but offering higher yield potential, while the senior tranche has lower risk with priority in payment, yet faces interest rate and prepayment risks. These tranche structures exemplify how varying degrees of credit risk, market risk, and liquidity risk impact CLO investment profiles.

example of tranche in CLO Infographic

samplerz.com

samplerz.com