Greenmail in finance refers to the practice where a company repurchases its shares from a potential hostile bidder at a premium to prevent a takeover. An example occurred in 1984 when T. Boone Pickens accumulated a substantial stake in Mesa Petroleum and threatened a takeover. To avoid the acquisition, Mesa Petroleum paid Pickens a significant premium for his shares, exemplifying greenmail. This tactic allows the target company to retain control but often results in substantial costs detracting from shareholder value. Greenmail transactions typically involve a premium price on shares, creating a financial burden for the company. Such situations highlight the complex dynamics in hostile takeovers and defensive corporate strategies.

Table of Comparison

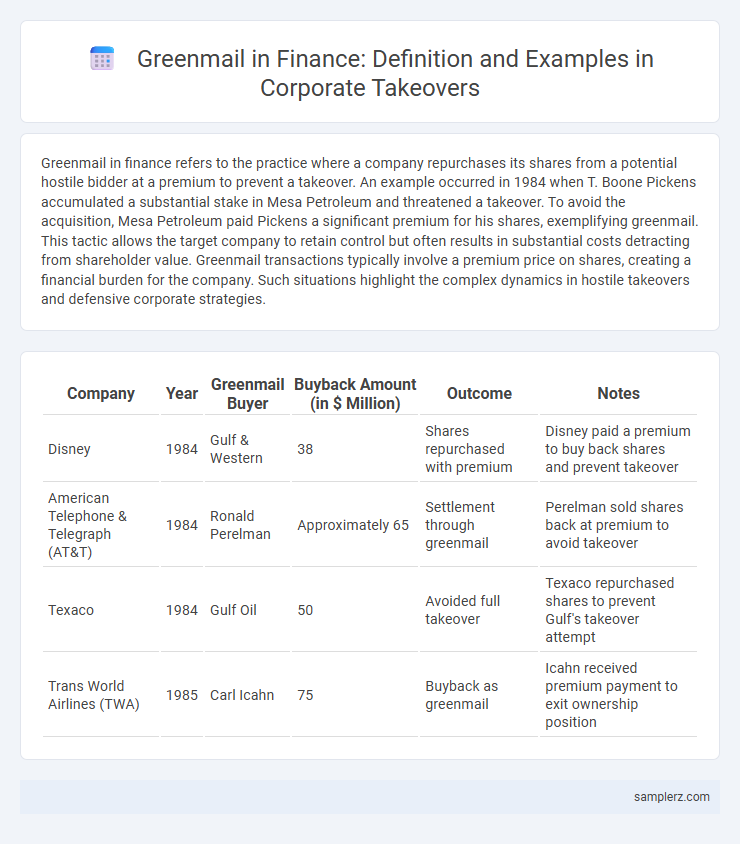

| Company | Year | Greenmail Buyer | Buyback Amount (in $ Million) | Outcome | Notes |

|---|---|---|---|---|---|

| Disney | 1984 | Gulf & Western | 38 | Shares repurchased with premium | Disney paid a premium to buy back shares and prevent takeover |

| American Telephone & Telegraph (AT&T) | 1984 | Ronald Perelman | Approximately 65 | Settlement through greenmail | Perelman sold shares back at premium to avoid takeover |

| Texaco | 1984 | Gulf Oil | 50 | Avoided full takeover | Texaco repurchased shares to prevent Gulf's takeover attempt |

| Trans World Airlines (TWA) | 1985 | Carl Icahn | 75 | Buyback as greenmail | Icahn received premium payment to exit ownership position |

Introduction to Greenmail in Corporate Takeovers

Greenmail occurs when a potential acquirer purchases a substantial stake in a target company and threatens a hostile takeover, prompting the target to repurchase the shares at a premium to thwart the bid. This practice exploits the leverage gained from the sizable equity position, compelling the target's management to pay a greenmail premium, often well above market value. Greenmail is a strategic defensive tactic in corporate takeovers that can deter hostile bidders while generating significant profits for the greenmailer.

Defining Greenmail: A Financial Overview

Greenmail refers to a corporate takeover strategy where a potential acquirer purchases a large block of a target company's shares and threatens a hostile takeover, prompting the target to buy back the shares at a premium to prevent the acquisition. This tactic exploits shareholder pressure and corporate vulnerabilities, often leading to significant financial costs for the target company. Greenmail profits arise from the premium paid above the market price, making it a controversial practice in mergers and acquisitions.

Historical Background and Emergence of Greenmail

Greenmail emerged prominently in the 1980s as a corporate finance tactic during hostile takeovers, where an acquiring party purchases a substantial block of shares to threaten control and forces the target company to repurchase those shares at a premium. This practice gained notoriety as companies sought to thwart unwanted takeovers without initiating hostile takeover defenses, often paying substantial greenmail premiums to avoid operational disruptions. Regulatory responses and shareholder backlash during this period led to stricter disclosure requirements and limitations on greenmail transactions to protect corporate governance and shareholder interests.

Notorious Examples of Greenmail in Major Takeovers

Notorious examples of greenmail in major takeovers include the 1984 battle between T. Boone Pickens and Gulf Oil, where Pickens acquired a significant stake and then sold it back at a premium to avoid a takeover. Another case involved Carl Icahn's attempt to acquire companies like TWA, where he held a substantial share to force a buyback at a premium price. These instances highlight how greenmail tactics extract high premiums by threatening unwanted takeovers, ultimately benefiting the greenmailer at the expense of the target company's shareholders.

High-Profile Greenmail Case: The T. Boone Pickens Saga

The T. Boone Pickens saga exemplifies a high-profile greenmail case where Pickens acquired a substantial stake in Mesa Petroleum, threatening a takeover to force the company to buy back shares at a premium. This strategic move allowed Pickens to secure a significant financial gain while deterring an unwanted acquisition attempt. The case remains a prominent example of greenmail tactics in corporate finance and takeover battles.

Greenmail vs. Other Takeover Defense Strategies

Greenmail involves a target company repurchasing its shares at a premium from a hostile bidder to prevent a takeover, often costing the company millions and benefiting the greenmailer. Unlike poison pills, which dilute shares to deter acquirers, and white knights, where a friendly third party acquires the company to block hostile bids, greenmail provides an immediate financial incentive to the greenmailer but can harm shareholder value. Share buybacks used in greenmail contrast with strategies like staggered boards or golden parachutes that focus on structural defenses rather than direct financial settlements.

Financial Impact of Greenmail on Companies and Shareholders

Greenmail imposes significant financial burdens on companies, often forcing them to repurchase shares at a premium above market value, which can deplete cash reserves and reduce funds available for growth or debt reduction. Shareholders may experience diluted value as resources are diverted to buy out greenmailers rather than investing in the business or paying dividends. This practice can also lead to increased volatility in stock prices and damage investor confidence, ultimately impacting the company's market valuation.

Regulatory Responses to Greenmail Practices

Regulatory responses to greenmail practices in takeover situations include the implementation of anti-greenmail provisions in corporate charters and securities laws designed to discourage hostile buyouts funded by a greenmailer's share repurchase at a premium. The Securities and Exchange Commission (SEC) enforces disclosure requirements that increase transparency around share repurchases linked to greenmail, deterring opportunistic behaviors by potential acquirers. Furthermore, some jurisdictions have introduced specific taxes or penalties on greenmail profits to reduce incentives for shareholders to engage in such practices during hostile takeovers.

Lessons Learned from Greenmail Incidents in Finance

Greenmail incidents in finance reveal critical lessons about corporate governance and shareholder rights, emphasizing the need for robust anti-greenmail provisions to protect companies from hostile takeovers. Regulators and firms have learned the importance of transparent disclosure and strategic defensive measures, such as poison pills and shareholder rights plans, to deter opportunistic greenmailers. Effective implementation of these policies ensures long-term shareholder value preservation and mitigates the risk of costly buyouts driven by greenmail threats.

The Future of Greenmail and Corporate Takeovers

Greenmail, once a popular tactic in corporate takeovers where an investor buys a significant stake to force a company to repurchase shares at a premium, is becoming less prevalent due to stricter regulatory frameworks and enhanced shareholder protections. Emerging trends indicate that companies are adopting advanced defense mechanisms, including poison pills and staggered board structures, to deter greenmail-driven buyouts. The future of greenmail will likely see a decline as sustainable investing and governance reforms prioritize long-term value creation over opportunistic financial maneuvers.

example of greenmail in takeover Infographic

samplerz.com

samplerz.com