In finance, a waterfall in cash flow refers to the hierarchical distribution of cash proceeds among various stakeholders based on predetermined priorities. For example, in a real estate investment, cash flow is first allocated to cover operating expenses and debt service; next, preferred equity investors receive their fixed returns; finally, any remaining cash is distributed to common equity holders. This structured approach ensures that senior claimants are paid before junior investors, minimizing risk for higher priority stakeholders. A typical cash flow waterfall includes multiple tiers, each representing a class of claims such as senior debt, mezzanine debt, preferred equity, and common equity. Data on inflows from rental income, sales, or refinancing events feed into the waterfall model to calculate precise distributions at each tier. Investors use this method to analyze expected returns and assess risk exposure based on the priority and timing of cash flow allocations.

Table of Comparison

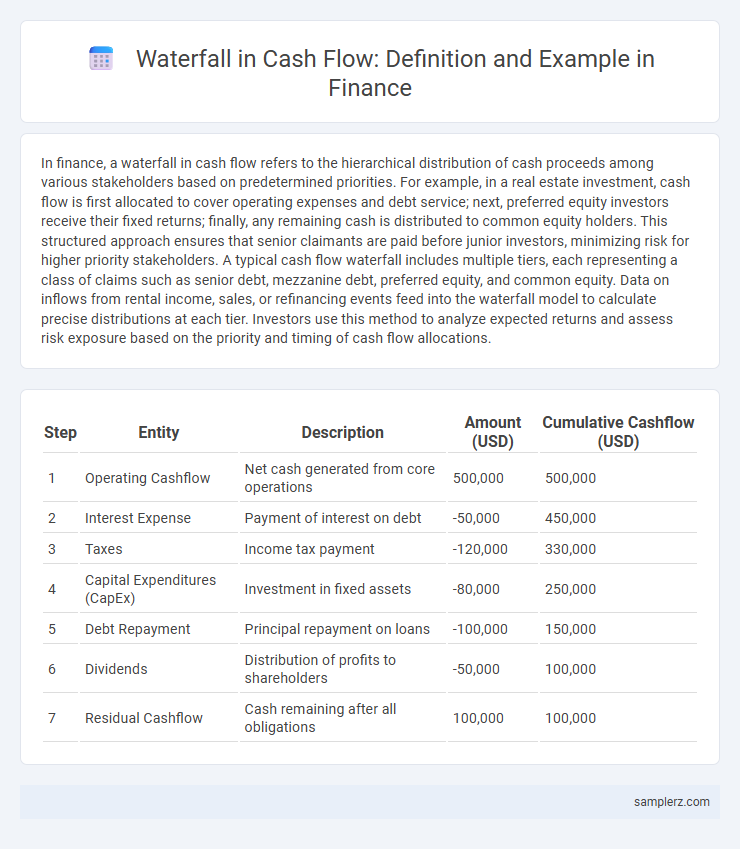

| Step | Entity | Description | Amount (USD) | Cumulative Cashflow (USD) |

|---|---|---|---|---|

| 1 | Operating Cashflow | Net cash generated from core operations | 500,000 | 500,000 |

| 2 | Interest Expense | Payment of interest on debt | -50,000 | 450,000 |

| 3 | Taxes | Income tax payment | -120,000 | 330,000 |

| 4 | Capital Expenditures (CapEx) | Investment in fixed assets | -80,000 | 250,000 |

| 5 | Debt Repayment | Principal repayment on loans | -100,000 | 150,000 |

| 6 | Dividends | Distribution of profits to shareholders | -50,000 | 100,000 |

| 7 | Residual Cashflow | Cash remaining after all obligations | 100,000 | 100,000 |

Introduction to Cashflow Waterfall Structures

Cashflow waterfall structures allocate incoming cashflows in a prioritized sequence, ensuring each stakeholder receives payments according to predefined rules. Typically used in project finance and structured lending, the waterfall starts with operating expenses, followed by senior debt service, and then subordinated debt or equity returns. This hierarchy effectively manages risk by controlling cash distribution and maintaining financial discipline throughout the loan lifecycle.

Key Components of a Cashflow Waterfall

A cashflow waterfall in finance typically includes key components such as operating cash inflows, debt service payments, reserve account contributions, and equity distributions. Operating cash inflows represent the initial cash generated from business activities, which are allocated first to cover senior debt obligations before moving down the priority ladder. Subsequent layers involve payments to subordinated debt holders, maintenance reserves, and finally residual cash is distributed to equity investors, ensuring a structured and prioritized allocation of cash resources.

Step-by-Step Example of a Cashflow Waterfall

A cashflow waterfall begins with allocating available cash to operating expenses, followed by debt service payments including interest and principal. Surplus cash flows next to preferred equity distributions, and after satisfying all senior obligations, residual cash is distributed to common equity holders. This hierarchical structure ensures prioritized cash allocation, reflecting contractual payment seniority in financial management.

Priority of Payments in Cashflow Waterfalls

Priority of payments in cashflow waterfalls ensures senior debt holders receive repayments before subordinated debt and equity investors, reducing risk for higher-priority creditors. Cashflow waterfalls allocate distributable cash sequentially, starting with operational expenses and interest on senior loans, followed by principal repayments, mezzanine debt servicing, and finally residual cash to equity holders. This structured hierarchy maintains financial discipline and creditor confidence through clear segmentation of payment tiers.

Types of Cashflow Waterfall Structures

Cashflow waterfall structures vary by type, including deal waterfall, operating waterfall, and hybrid waterfall models, each allocating cash based on contractual priorities and conditions. Deal waterfalls prioritize debt repayments and investor returns sequentially, while operating waterfalls distribute cash flow according to operational expenses and reserves before profits. Hybrid structures combine features from both, optimizing cash allocation for complex financial arrangements in private equity, real estate, and syndicated loans.

Waterfall Application in Project Finance

In project finance, a cash flow waterfall prioritizes the allocation of revenue by sequentially distributing funds to operating expenses, debt service, reserve accounts, and equity investors. This structured payment hierarchy ensures lender protections and compliance with financial covenants by allocating cash flow in predefined tranches. The waterfall mechanism optimizes risk management and financial stability throughout the project's lifecycle.

Waterfall Example in Real Estate Investment

In real estate investment, a cash flow waterfall example illustrates the sequential distribution of returns, starting with the return of the initial capital to investors, followed by preferred returns, and then proceeds split between limited and general partners based on agreed tiers. Common structures include hurdle rates at 8%, 12%, and 20%, where each tier adjusts the percentage of profit allocation, incentivizing the general partner's performance. This waterfall mechanism ensures transparency and aligns interests by systematically prioritizing capital return and rewarding value creation in property cash flow distributions.

Waterfall Mechanism in Private Equity Funds

The waterfall mechanism in private equity funds outlines the priority of cash flow distributions to investors, typically following a tiered structure that first returns capital contributions and preferred returns to limited partners before general partners receive carried interest. Common tiers include return of capital, preferred return hurdles, catch-up provisions, and residual splits, ensuring alignment between investor risk and reward. This structured cash flow allocation facilitates transparency and incentivizes general partners to maximize fund performance.

Benefits and Risks of Cashflow Waterfalls

Cashflow waterfalls provide a structured sequence for distributing cash inflows, ensuring prioritized payments to investors and stakeholders based on predefined tiers, which enhances financial transparency and predictability. The benefits include improved risk management through clearly defined payment hierarchies, maximizing returns for senior tranche holders while minimizing default risk exposure. However, risks involve potential liquidity constraints where lower-tier investors may face delays or reductions in payments during cash shortfalls, highlighting the importance of accurate cashflow forecasting and robust scenario analysis.

Best Practices for Designing Cashflow Waterfalls

Effective cashflow waterfalls prioritize clear tiered distributions, allocating cash sequentially from operating expenses to debt service, preferred returns, and equity repayments. Incorporating precise trigger points and contingencies ensures transparent cash allocation and minimizes disputes among stakeholders. Leveraging automated financial modeling tools enhances accuracy and facilitates real-time scenario analysis for optimized cashflow management.

example of waterfall in cashflow Infographic

samplerz.com

samplerz.com